Opensea, a leading online marketplace for digital collectibles and artworks, has brought about a significant impact on traditional art markets. This comparative study aims to analyze the influence of Opensea and its innovative technology on the art market and explore how it has revolutionized the way art is valued, bought, and sold.

Opensea operates on the principles of blockchain technology and tokenization. Its decentralized marketplace ensures transparency, accessibility, and disintermediation for both buyers and sellers. Through blockchain authentication, ownership of digital assets, such as NFTs (non-fungible tokens), can be easily verified and traced back to their original creators.

One of the key disruptions Opensea has brought is the revolution in the valuation of artworks. Traditional art markets often rely on subjective opinions and valuations, making it difficult for artists to determine the true worth of their creations. With Opensea, the value of digital art can be directly linked to its demand and popularity within the marketplace, allowing artists to receive fair compensation for their work.

Furthermore, Opensea’s technology has expanded the market for artists by attracting a broader base of buyers. The accessibility and convenience of purchasing digital art and collectibles through Opensea have attracted a new generation of art enthusiasts. This increased demand has led to higher investments in the digital art economy and provided artists with new opportunities for exposure and recognition.

However, the rise of Opensea and the booming market for digital art have also raised concerns regarding regulation and authenticity. As the marketplace primarily operates online, the risk of fraudulent listings and counterfeit artworks becomes a significant challenge. The industry will need to establish robust mechanisms to ensure the authentication of digital artworks and protect both buyers and artists from scams.

In conclusion, Opensea has undoubtedly had a profound impact on traditional art markets by introducing innovative technology and revolutionizing the way art is bought, sold, and valued. Its marketplace offers accessibility, transparency, and disintermediation, attracting a wider range of buyers and providing new opportunities for artists. However, as with any disruptive innovation, there are challenges to address, such as regulation and authentication, to ensure the long-term sustainability and growth of this digital art marketplace.

Changing Dynamics of the Art Market

The emergence of blockchain technology and the growth of platforms like Opensea have revolutionized the art market, bringing about significant changes in its dynamics. This comparative study aims to explore the impact of Opensea on traditional art markets, focusing on several key areas such as disintermediation, artists, artworks, marketplace, ownership, buyers, tokenization, and technology.

One of the most notable effects of Opensea on the art market is the disintermediation of the traditional art market. By leveraging blockchain technology, Opensea allows artists to directly connect with buyers, bypassing the need for intermediaries such as galleries or auction houses. This disintermediation has democratized the art market, giving artists greater control over their artworks and allowing them to reach a wider audience.

Furthermore, Opensea’s tokenization feature has enabled the digital ownership of art through non-fungible tokens (NFTs). NFTs represent unique digital assets and have transformed the way art is bought and sold. This innovation has opened up new opportunities for artists and collectors, expanding the accessibility of art beyond physical limitations.

Opensea’s impact on the art market has also brought about a shift in the perception of art as an investment. The digital nature of NFTs has made art a more liquid asset, attracting a new wave of investors. This increased demand has led to a surge in the value of digital collectibles, creating a potential alternative investment avenue for art enthusiasts.

Additionally, Opensea has introduced a new level of transparency and authentication to the art market. With every transaction recorded on the blockchain, the provenance and authenticity of artworks can be easily verified. This transparency enhances the credibility of the art market and protects buyers from fraudulent activities.

While Opensea and other blockchain-based platforms have disrupted the traditional art market, there are still challenges related to regulation and the integration of digital assets into the broader economy. However, the growth and success of Opensea signify that the art market is undergoing a profound transformation, driven by innovation and technology.

In conclusion, Opensea’s emergence has had a significant impact on the dynamics of the art market. Through disintermediation, tokenization, and technological innovation, Opensea has revolutionized the way art is bought, sold, and perceived. The comparative study of Opensea and traditional art markets provides valuable insights into the changing landscape of the art market and the potential future implications of blockchain technology on the art economy.

Understanding Opensea and Its Role

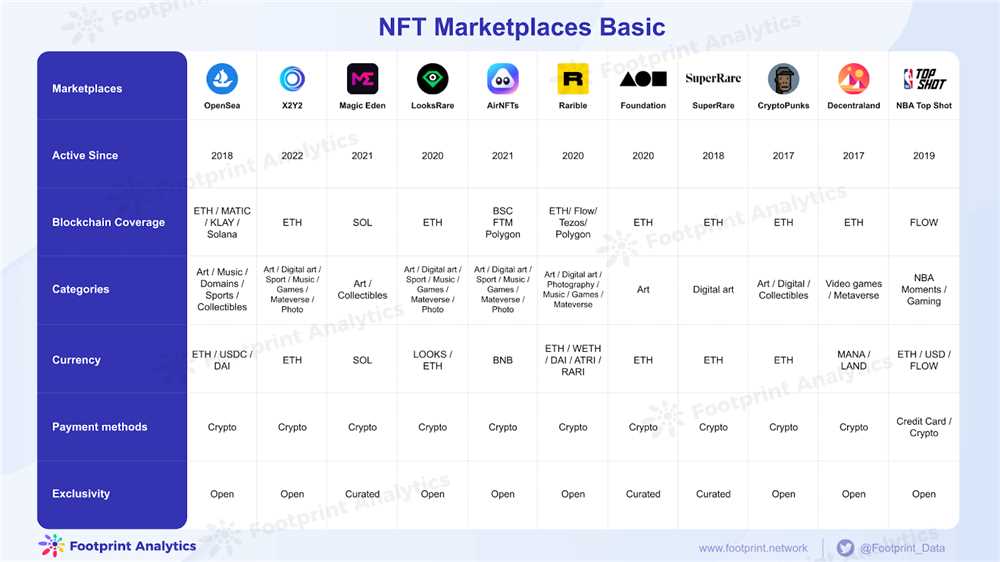

Opensea is a digital marketplace that has gained significant attention in recent years due to the rising popularity of non-fungible tokens (NFTs). It serves as a platform for sellers and buyers of various collectibles, including digital artworks and other unique items. Unlike traditional art markets, Opensea operates on the blockchain, utilizing the technology’s decentralized nature, transparency, and security to facilitate transactions.

Opensea’s introduction of NFTs has disrupted traditional art markets in several ways. Firstly, it has revolutionized the authentication and ownership of artworks. With blockchain technology, each artwork is tokenized, providing a unique digital fingerprint that verifies its authenticity and provenance. This level of transparency enhances trust between buyers and sellers, mitigating the risk of forgeries and fraud.

This comparative study explores the impact of Opensea on traditional art markets, focusing on the valuation and accessibility of artworks. Opensea has enabled a democratic and inclusive economy by removing barriers to entry for artists and buyers. Traditional art markets were often limited to a select group of artists and collectors, but Opensea has broadened the scope by offering an open and accessible platform for anyone to participate.

Opensea’s disintermediation of the art market has also disrupted the role of art galleries, dealers, and auction houses. By removing intermediaries, Opensea allows artists to directly connect with buyers and retain a larger portion of the sales proceeds. This innovation has empowered artists and shifted the balance of power in the art industry.

Furthermore, Opensea has introduced a new form of investment in the art market. Through the tokenization of artworks, buyers can invest in digital assets that have the potential for future appreciation. This represents a significant shift from traditional art markets, where physical artworks were often seen as illiquid and non-divisible assets.

However, the impact of Opensea on traditional art markets is not without challenges. The lack of regulation in the NFT space raises concerns about market manipulation, money laundering, and the protection of intellectual property rights. As Opensea continues to gain popularity, it is crucial to address these issues and establish a framework that safeguards both buyers and sellers.

In conclusion, Opensea and its role in the art market signify a transformative shift in the way art is bought, sold, and valued. The adoption of blockchain technology and the tokenization of artworks have revolutionized the industry, providing new opportunities for artists and buyers. While challenges remain, Opensea’s impact on traditional art markets is undeniable, and further research is needed to fully understand its long-term effects.

The Rise of Digital Art and NFTs

The art market has always been known for its traditional and established practices. However, in recent years, there has been an innovation and revolution in the way art is created, bought, and sold. This can be attributed to the rise of digital art and Non-Fungible Tokens (NFTs).

Digital art refers to artworks that are created using technology, such as digital painting or computer-generated graphics. NFTs, on the other hand, are unique digital tokens that represent ownership of a specific artwork or collectible. These tokens are built on blockchain technology, ensuring transparency and security in ownership and transactions.

The impact of digital art and NFTs on traditional art markets is significant. First and foremost, it has opened up a new marketplace for artists to showcase and sell their digital artworks. The tokenization of artworks allows for the creation of a digital economy where artists can monetize their creations directly, without the need for intermediaries such as galleries or auction houses.

Furthermore, NFTs have revolutionized the way art is valued. Traditionally, the value of an artwork is determined by factors such as the reputation of the artist, the rarity of the piece, and the demand in the market. With the introduction of NFTs, the valuation of digital art has become more transparent and reliable. Each NFT contains metadata that includes information about the artist, the artwork, and the ownership history, providing buyers with a comprehensive view of the artwork’s worth.

Additionally, digital art and NFTs have brought about a new level of accessibility. Unlike traditional art that is often confined to physical spaces, digital artworks can be easily shared and accessed online. This has expanded the reach of artists and allowed art enthusiasts from all over the world to discover and engage with their creations.

From an investment perspective, NFTs have provided a new opportunity for buyers to invest in art. The tokenization of artworks allows for fractional ownership, wherein buyers can own a percentage of an artwork by purchasing NFTs. This opens up the art market to a wider pool of buyers who may not have had the means or willingness to invest in traditional art.

However, with this disruption and innovation comes the need for regulation. The rapid growth of the digital art and NFT market has raised concerns about copyright infringement and fraudulent practices. Additionally, the ownership and transfer of digital assets on the blockchain raise questions about legal frameworks and jurisdiction. As the market continues to evolve and mature, it is crucial for regulations to be put in place to protect artists and buyers.

In conclusion, the rise of digital art and NFTs has had a profound impact on the traditional art market. With the disintermediation of galleries and auction houses, artists have gained more control over their artworks and the ability to directly engage with buyers. The transparency and accessibility provided by blockchain technology have also transformed the way art is valued and bought. However, as with any new technology, there are challenges and considerations that need to be addressed, particularly in terms of regulation and legal frameworks.

Exploring the Traditional Art Market

The traditional art market has been a cornerstone of the art world for centuries, providing a platform for artists to showcase their artworks and enabling buyers to invest in and collect valuable pieces. However, with the revolution of technology and the rise of digital markets, the traditional art market is facing new challenges and potential disruptions.

Comparative to the traditional art market, platforms like Opensea offer a unique opportunity for artists and buyers alike. Through tokenization, artists can digitally create and authenticate their artworks, providing a new form of ownership and collectibles. This tokenized ownership allows for greater transparency and valuation, as each artwork can be traced back to its original creator and history.

Buyers also benefit from the accessibility and transparency that technology brings. They can explore a wide range of artworks from different artists and make informed decisions based on the information available. Additionally, the blockchain technology used in platforms like Opensea ensures secure transactions and eliminates the need for intermediaries.

The impact of Opensea and similar digital markets on the traditional art market can be seen in several ways. Firstly, it has introduced a new way of buying and investing in art, which appeals to a new generation of art enthusiasts. Secondly, the disintermediation of the market has shifted the power dynamics between artists, sellers, and buyers, providing artists with more control over their artworks and pricing.

However, it is important to consider the potential challenges and regulations that come with the integration of blockchain technology and NFTs in the art market. Issues such as copyright infringement and the need for regulation to protect buyers and sellers are still being explored and addressed.

In conclusion, the traditional art market is experiencing a revolution with the advent of platforms like Opensea. The impact of this technology on the market is evident in the accessibility, transparency, and ownership of artworks. While challenges and regulations remain, the study of Opensea and its comparative impact on traditional art markets provides valuable insights into the future of the art economy.

Comparative Analysis: Opensea vs Traditional Art Markets

In the rapidly evolving landscape of the art world, Opensea has emerged as a disruptor, revolutionizing traditional art markets through the use of blockchain technology. This comparative analysis aims to examine the impact of Opensea on traditional art markets, focusing on various aspects such as tokenization, buyers and sellers, valuation, regulation, transparency, and accessibility.

Opensea, a leading marketplace for NFTs (non-fungible tokens), has changed the way artworks are bought and sold. Through tokenization, artists can create digital assets representing their artworks, which can then be traded on the Opensea platform. This tokenization process enables fractional ownership and allows for easy transfer and authentication of digital collectibles.

One of the key advantages of Opensea is the increased accessibility it provides to buyers and sellers. Traditional art markets are often restricted by geographical and financial barriers, limiting the reach of both artists and collectors. By leveraging the blockchain technology, Opensea opens up a global marketplace where anyone can participate in the art economy, regardless of their location or financial status. This level of accessibility has the potential to democratize the art market and empower emerging artists.

Another area where Opensea differs from traditional art markets is in the valuation of artworks. The decentralized nature of blockchain technology eliminates the need for intermediaries such as galleries and auction houses, reducing costs and increasing transparency. Additionally, the immutable nature of blockchain ensures the authenticity and provenance of artworks, addressing issues of forgery and fraud that plague the traditional art market.

However, the emergence of Opensea also raises concerns about regulation and the role of established institutions in the art world. As the platform operates outside the traditional regulatory frameworks, it faces challenges in terms of copyright infringement, taxation, and intellectual property rights. The lack of centralized regulation may pose risks for both artists and buyers, necessitating the development of new legal frameworks to protect all stakeholders.

| Opensea | Traditional Art Markets |

|---|---|

| Emphasizes disintermediation | Relies on intermediaries such as galleries and auction houses |

| Offers increased transparency | Transparency may vary depending on the market and participants |

| Accessible to global audience | Restricted by geographical and financial barriers |

| Facilitates fractional ownership | Ownership typically remains with a single individual or institution |

| Utilizes blockchain technology for authentication | Relies on traditional methods of authentication |

In conclusion, the comparative analysis between Opensea and traditional art markets highlights the disruptive potential of blockchain technology and the innovative use of NFTs. Opensea’s impact on the art market is evident through its emphasis on disintermediation, increased transparency, accessibility, and fractional ownership. However, challenges related to regulation and the need for new legal frameworks must be addressed to ensure the long-term success and sustainability of this digital art marketplace.

Economic Implications and Revenue Generation

The emergence of OpenSea, a decentralized marketplace for buying and selling digital artworks and collectibles through the use of non-fungible tokens (NFTs), has had a profound impact on the traditional art market. This comparative study aims to analyze the economic implications and revenue generation associated with this disruption.

One of the key economic implications of OpenSea and NFTs is the democratization and accessibility of the art market. Previously, traditional art markets were often limited to established galleries and collectors. However, with OpenSea, anyone with an internet connection can participate in the art market as both buyers and sellers. This increased accessibility has opened up new opportunities for artists who may not have had access to traditional markets, allowing them to showcase and monetize their artworks.

Furthermore, OpenSea’s use of blockchain technology and tokenization has introduced a new level of transparency in the art market. Every transaction on the platform is recorded on the blockchain, providing a permanent and verifiable record of ownership and authentication. This transparency and traceability have the potential to address issues of forgery and counterfeit artworks, enhancing trust and confidence among buyers and sellers.

Another significant economic implication is the disintermediation of the traditional art market. Through OpenSea, artists can directly connect with buyers, eliminating the need for intermediaries such as art galleries and auction houses. This direct interaction allows artists to retain a larger portion of the revenue generated from their sales, as they no longer have to pay hefty commissions to middlemen. Conversely, buyers can potentially acquire artworks at lower prices, as they are not subject to the markup imposed by intermediaries.

The revenue generation potential of OpenSea and NFTs cannot be understated. According to a recent report, the NFT market reached a valuation of $2.5 billion in the first half of 2021 alone, demonstrating the growing interest and investment in digital collectibles. Artists can monetize their artworks through the sale of NFTs, benefiting from increased demand and higher valuations. Additionally, OpenSea provides opportunities for artists to earn revenue through secondary sales, as they can receive royalties each time their NFT is resold.

| Pros | Cons |

|---|---|

| Increased accessibility for artists | Potential for market oversaturation |

| Elimination of intermediaries | Lack of regulation and potential for scams |

| Transparency and authentication | Environmental concerns related to energy consumption |

| Potential for higher revenue generation | Uncertain long-term value of NFTs |

In conclusion, OpenSea and NFTs have brought about a revolution in the traditional art market, disrupting the economy and introducing innovative ways of buying, selling, and valuing digital artworks. This comparative study highlights the economic implications of this disruption, including increased accessibility, disintermediation, transparency, and revenue generation potential. It is essential for artists, buyers, and regulators to navigate this changing landscape carefully, considering the opportunities and challenges associated with this transformative technology.

What is Opensea?

Opensea is a decentralized marketplace for non-fungible tokens (NFTs), where users can buy, sell, and trade digital assets.

How does Opensea impact traditional art markets?

Opensea has had a significant impact on traditional art markets by introducing a new way for artists to sell and monetize their work. It has allowed artists to reach a global audience and bypass intermediaries such as galleries or auction houses.

What are the advantages of using Opensea for artists?

Using Opensea provides artists with several advantages. Firstly, it allows them to retain full ownership of their work and set their own prices. Secondly, it provides a platform for artists to directly connect with buyers and build their own brand. Lastly, it offers a more accessible and inclusive market, allowing artists from all backgrounds to participate.

+ There are no comments

Add yours