The rise of digital assets and the advent of cryptocurrency trading have created new opportunities and challenges for traders and investors. With the increasing popularity of Bitcoin, Ethereum, and other cryptocurrencies, the crypto market has become a hub for speculation and profit. However, one of the key factors that affect traders and investors in this volatile industry is the blurred pricing.

Cryptocurrency pricing is highly volatile, with frequent fluctuations in value. This volatility poses a significant risk to traders and investors who rely on stable pricing for making informed decisions. The constantly changing prices make it difficult to accurately gauge the performance of the digital assets and predict future trends.

Blur pricing not only affects trading strategies but also impacts the overall security of the crypto market. With blurry pricing, traders and investors may inadvertently expose themselves to potential losses due to incorrect valuation of their portfolios. Moreover, the lack of clear pricing can make it challenging for regulators to implement effective measures to ensure market stability and protect investors.

Furthermore, blur pricing undermines the decentralization and innovation that cryptocurrency and blockchain technology promise. The decentralized nature of cryptocurrencies aims to eliminate the need for intermediaries, such as banks or financial institutions. However, the lack of clarity in pricing creates a reliance on centralized exchanges, which contradicts the core principles of decentralization.

In conclusion, blur pricing in the crypto market significantly affects traders and investors by introducing heightened risk and uncertainty. It hampers the ability to accurately assess assets, makes it difficult to implement effective trading strategies, hinders the growth of decentralized finance, and poses challenges for regulators. As the cryptocurrency industry continues to evolve, finding solutions to the issue of blur pricing becomes crucial for the long-term success and stability of the market.

Understanding the impact of blur pricing on crypto trading

Bitcoin and Ethereum, along with other cryptocurrencies, have revolutionized the digital market, providing a new opportunity for traders and investors. However, this market is not without its challenges, and one of the major factors that affect crypto trading is blur pricing.

Blur pricing refers to the volatility and uncertainty in the cryptocurrency market. Traders and investors often struggle to determine the true value of assets due to the constantly changing market conditions. This makes it difficult to make informed decisions about buying or selling crypto assets.

One of the key effects of blur pricing is the increase in risk for traders. The high level of volatility in the market means that prices can fluctuate rapidly, leading to potential loss or profit. Traders need to be quick to react and adapt their strategies to the changing trends to minimize losses and maximize profits.

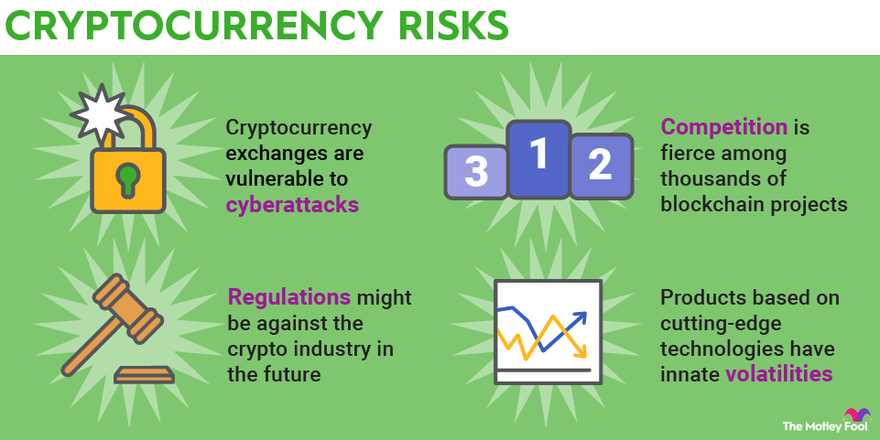

Another impact of blur pricing is the difficulty in accurately assessing the security of crypto assets. The decentralized nature of cryptocurrencies makes them susceptible to hacking and other security breaches. Traders need to carefully choose their trading platforms and exchanges to ensure the safety of their investments.

Regulation also plays a role in the impact of blur pricing on crypto trading. The lack of clear regulations and oversight in the cryptocurrency market further adds to the uncertainty and risk. Traders and investors must stay updated on the latest regulations and comply with them to avoid legal issues.

Moreover, blur pricing also affects the overall innovation and adoption of cryptocurrencies. The constant fluctuations in prices make it challenging for businesses to accept cryptocurrencies as a reliable mode of payment. The potential for loss due to volatility discourages traders and investors from embracing cryptocurrencies as a mainstream investment option.

Despite the challenges posed by blur pricing, it also presents opportunities for traders and investors. The volatility in the market allows for speculation and the chance to profit from short-term price movements. Traders who are adept at analyzing market trends and making quick decisions can take advantage of these opportunities to generate substantial returns.

In conclusion, blur pricing significantly impacts crypto trading by introducing volatility, risk, and uncertainty. It affects traders’ portfolios and their ability to accurately value and assess the security of crypto assets. However, it also brings opportunities for profit and presents a platform for innovation in the digital market. As the technology and regulation surrounding cryptocurrencies continue to evolve, traders and investors need to stay informed and adapt to the dynamic nature of the crypto market.

Increased market volatility

The blur pricing phenomenon in cryptocurrency trading and investing has led to increased market volatility. As traders and investors navigate through the ever-changing pricing landscape, the risk and potential for profit have become more pronounced.

The decentralization and innovative nature of cryptocurrency, such as Bitcoin and Ethereum, have attracted a wide range of investors, both experienced and novice. However, the introduction of blur pricing introduces a new level of uncertainty to the market.

Traders who rely on accurate and consistent pricing data to make informed decisions find it challenging to assess their risk and manage their portfolio effectively. The constant fluctuations in pricing due to blur pricing mechanisms make it difficult to determine the true value of an asset.

Moreover, price discrepancies can occur across various exchanges, further complicating the trading process. Traders may need to continuously monitor multiple platforms to find the best pricing opportunities, increasing the time and effort required for successful trading.

The increased market volatility resulting from blur pricing can also affect investors’ overall confidence in the cryptocurrency market. The lack of transparency and potential for manipulation can create doubts about the security and stability of digital assets.

Additionally, the introduction of more stringent regulation to address the challenges posed by blur pricing can further impact market volatility. While regulation aims to promote transparency and protect investors, it can also introduce additional uncertainty and risk.

In conclusion, the blur pricing phenomenon affects crypto traders and investors by increasing market volatility. Traders must navigate the dynamic pricing landscape, while investors must assess the risk and potential rewards associated with digital assets. The future of crypto finance relies on striking a balance between innovation, decentralization, and effective regulation to mitigate the negative impacts of blur pricing and ensure a stable and secure market.

Difficulty in accurately determining asset values

One of the challenges faced by crypto traders and investors is the difficulty in accurately determining the values of digital assets. The volatility in the cryptocurrency market makes it challenging for investors to assess the true value of assets and make informed investment decisions.

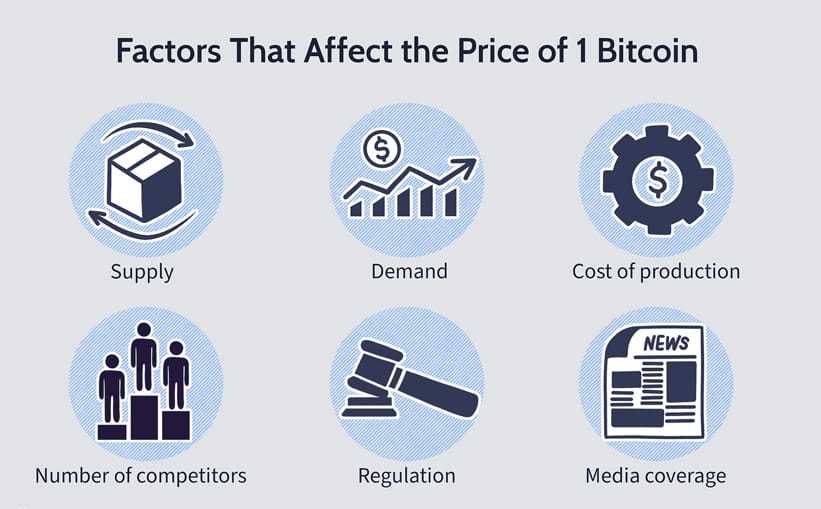

Unlike traditional finance, where asset values are relatively stable and can be easily determined through established valuation models, the digital asset market experiences high levels of volatility. This volatility is driven by factors such as market speculation, regulatory changes, and technological innovation, among others.

Trading in cryptocurrencies like Bitcoin and Ethereum can be highly profitable, but it is also accompanied by significant risks. The fast-paced nature of the market means that asset prices can fluctuate rapidly, leading to potential losses or missed investment opportunities.

The blur in pricing affects traders and investors by making it challenging to accurately assess the value of their portfolio. This can result in missed profit opportunities or trading at a disadvantageous price. Additionally, the lack of clear pricing data can also impact the security of trading on crypto exchanges.

Decentralization, one of the key features of cryptocurrencies, adds another layer of complexity to valuing digital assets. Unlike centralized markets, where pricing data is readily available and regulated, decentralized markets lack a central authority overseeing pricing. This poses challenges for traders and investors who rely on accurate and transparent pricing.

Overall, the difficulty in accurately determining asset values in the cryptocurrency market affects traders and investors by introducing increased risk and uncertainty to their investment strategies. To navigate this challenge, traders and investors need to stay updated on market trends, employ risk management strategies, and make informed decisions based on available information.

Increased trading risks and challenges

The blur pricing in the cryptocurrency market brings with it increased trading risks and challenges for investors and traders. The volatility of crypto assets, such as Bitcoin and Ethereum, can greatly affect the value of one’s portfolio. The constantly changing prices and the lack of regulation in the market make it difficult for traders to accurately predict market trends and make informed investment decisions.

With the blur pricing, traders face the risk of losing a significant portion of their investment due to sudden price drops or unexpected market movements. This makes it crucial for traders to carefully monitor the market and adjust their trading strategies according to the changing trends.

Additionally, the speculative nature of crypto trading and investing further adds to the challenges. The lack of traditional financial instruments and clarity in pricing make it harder for investors to determine the true value of cryptocurrencies. Speculation often drives prices, leading to potential market manipulation and further volatility.

Moreover, the decentralized nature of cryptocurrencies also brings unique challenges. While blockchain technology offers transparency and security, it also means that there is no central authority to regulate the market or protect traders from fraudulent activities. This lack of security raises concerns about the safety of investments and the overall integrity of the market.

In conclusion, the blur pricing in the cryptocurrency market introduces increased trading risks and challenges for both traders and investors. The constant volatility, speculative nature, and lack of regulation create uncertainties and make it difficult for individuals to navigate the market. It is important for traders and investors to stay informed, adapt to changing market conditions, and carefully manage their risks in order to maximize profit and minimize loss in this innovative and ever-evolving field of finance.

| Risks | Challenges | Affects |

|---|---|---|

| Volatility | Lack of regulation | Loss in investment |

| Speculation | Decentralization | Market manipulation |

| Security | Adapting to changing trends | Uncertainties |

The implications of blur pricing for crypto investors

Blur pricing is a phenomenon in the cryptocurrency market that is caused by the rapidly changing value of digital assets. This volatility can have a significant impact on crypto investors and their portfolios.

One of the main implications of blur pricing is the potential for significant profit or loss. The fast-paced nature of the crypto market means that prices can skyrocket or plummet in a short amount of time. This creates both opportunities and risks for investors. In some cases, investors can make substantial gains by capitalizing on quick price fluctuations. On the other hand, investors can also suffer significant losses if they buy or sell at the wrong time.

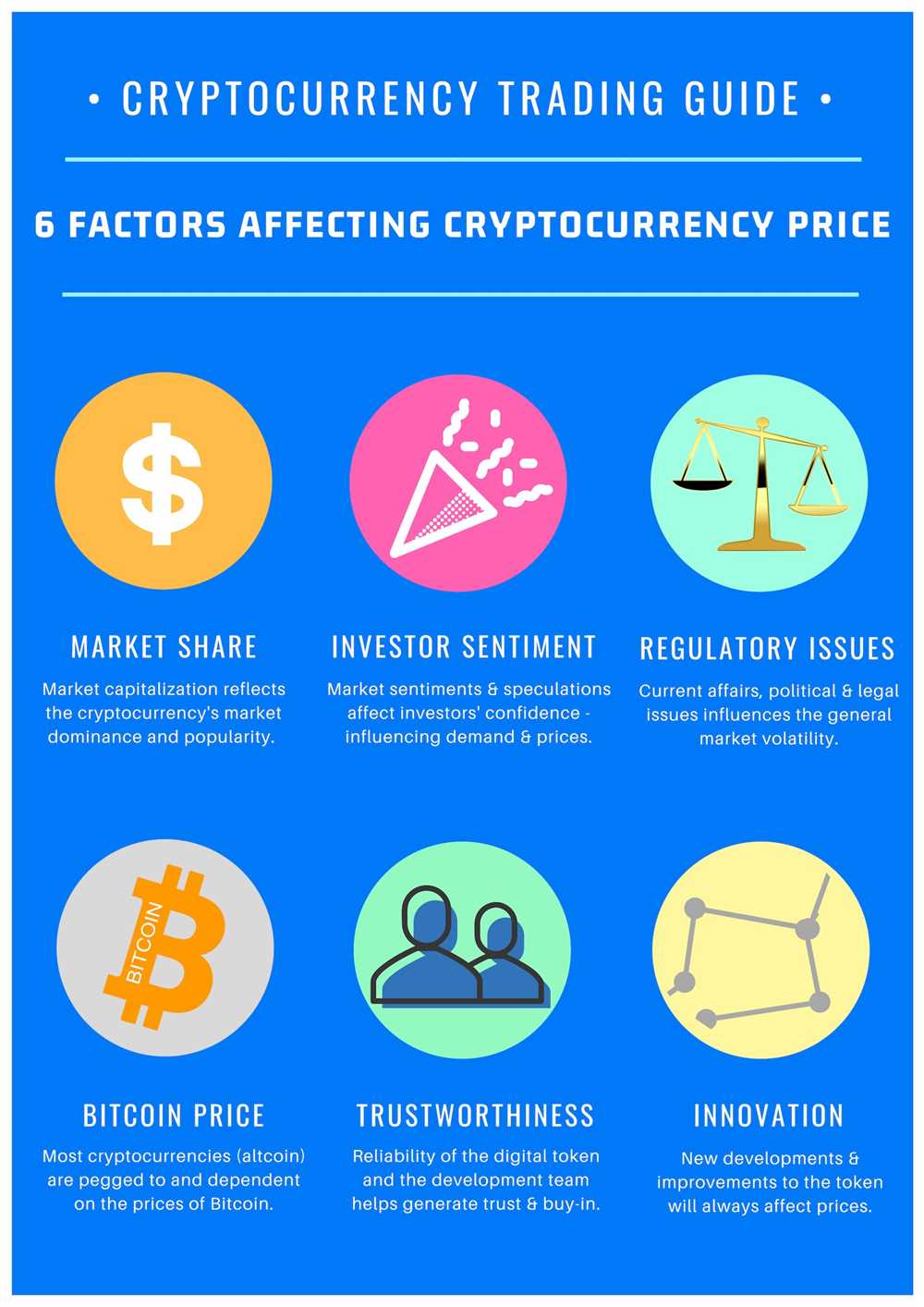

Blur pricing also affects the way investors perceive and approach investing in cryptocurrencies. The constant fluctuations in crypto prices make it difficult to determine a fair value for assets. This leads to increased speculation and can drive up the volatility of the market. As a result, investors may rely more on market trends and speculation rather than traditional valuation methods.

Furthermore, blur pricing has implications for the regulation and security of the crypto market. The rapid price changes can make it challenging for regulators to develop appropriate policies that protect investors and promote fair trading. Additionally, the volatility can attract malicious actors who seek to exploit the market’s uncertainty for personal gain.

Despite these challenges, blur pricing also presents opportunities for innovation and growth in the crypto space. The constant change in prices encourages the development of new technologies and trading strategies. Investors who can adapt to the fast pace of the market may find new ways to generate profits.

In conclusion, blur pricing affects crypto investors in various ways. It introduces a high level of risk and uncertainty, but also opens up opportunities for profit and innovation. Crypto traders and investors must carefully navigate the market’s volatility to protect their assets and make informed investment decisions.

Potential for increased investment losses

Blur pricing can have a significant impact on crypto traders and investors, potentially leading to increased investment losses. The volatile nature of cryptocurrencies combined with the uncertainty and lack of regulation in the market can create a breeding ground for speculation and increased risk.

The security of digital assets is a key concern for traders and investors. With the blurred pricing, it becomes difficult to accurately assess the value of cryptocurrencies and make informed investment decisions. This can result in traders and investors potentially overpaying for assets or entering into trades that may not be profitable.

The trend of blur pricing can also contribute to increased volatility in the market. When prices are unclear and there is a lack of transparency, it becomes harder to identify market trends and make accurate predictions. This can lead to heightened speculation and an increased potential for loss.

Additionally, the decentralized nature of cryptocurrencies and the innovation behind blockchain technology can make it challenging to regulate the market. This lack of regulation can create opportunities for manipulation and price manipulation, further increasing the potential for investment losses.

For example, a trader who wants to invest in Ethereum may find it difficult to accurately assess the current market price due to blur pricing. This can lead to the purchase of Ethereum at a higher price than its actual value, resulting in potential losses if the market price subsequently declines.

In summary, blur pricing affects crypto traders and investors by introducing uncertainty, increasing the potential for speculation, and making it more difficult to accurately assess the value of cryptocurrencies. This can result in increased investment losses and a higher level of risk in trading and investing in digital assets.

Greater reliance on technical and fundamental analysis

The increasing blur in cryptocurrency pricing has had a significant impact on traders and investors in the digital assets market. With the volatile nature of cryptocurrencies, it becomes crucial for traders and investors to rely more on technical and fundamental analysis when making financial decisions.

Finance and exchange operations are greatly affected by the blur in pricing. The unpredictable market trends of cryptocurrencies like Bitcoin and Ethereum make it challenging to determine their true value, leading to speculation and potential profit or loss. This has led traders and investors to adopt a more analytical approach in evaluating the pricing patterns of digital assets.

Technical analysis involves studying historical price movements, chart patterns, and other market indicators to identify trends and potential future price actions. Traders and investors rely on technical analysis to make informed decisions based on market data and historical price patterns. This method helps them identify potential entry and exit points, manage their portfolio, and mitigate risks.

On the other hand, fundamental analysis focuses on evaluating the underlying factors that may affect the value of cryptocurrencies. Factors such as the technology behind a specific cryptocurrency, its adoption rate, regulatory changes, and market demand are taken into consideration in fundamental analysis. This approach helps traders and investors assess the intrinsic value of digital assets and determine whether they are overvalued or undervalued in the market.

The blur in pricing has also created new opportunities for trading and investing in cryptocurrencies. Traders can take advantage of short-term price fluctuations and execute profitable trades based on technical and fundamental analysis. Additionally, investors can identify potentially undervalued digital assets and invest in them for long-term growth.

The reliance on technical and fundamental analysis is essential in navigating the blur in cryptocurrency pricing. It provides traders and investors with a more comprehensive understanding of the market dynamics, which helps them make informed decisions and minimize risks. Moreover, this analytical approach fosters a higher level of security in the trading and investing process, as it is based on data-driven insights rather than speculative strategies.

In conclusion, finance and exchange operations are significantly affected by the blur in cryptocurrency pricing. Traders and investors must rely more on technical and fundamental analysis to navigate the volatile market and make informed decisions. This analytical approach allows for better portfolio management, risk mitigation, and the identification of profitable trading opportunities. The reliance on analysis promotes a more secure and data-driven investment process, fostering innovation and decentralization in the crypto trading space.

Importance of risk management strategies

When it comes to investing in cryptocurrencies such as Bitcoin and Ethereum, having a solid risk management strategy is of utmost importance. The volatile and unpredictable nature of the cryptocurrency market requires investors and traders to be proactive and vigilant in managing their risks.

One of the main reasons why risk management strategies are crucial in the crypto market is the high level of market volatility. Prices of cryptocurrencies can fluctuate rapidly, leading to substantial gains or losses in a short period. Without a proper risk management plan, investors may find themselves exposed to significant financial risks.

Another factor that highlights the importance of risk management strategies in the crypto market is the presence of regulatory uncertainty and security concerns. The decentralized and relatively unregulated nature of cryptocurrencies can expose investors to fraud, hacking, and theft. By implementing risk management strategies, investors can mitigate the potential impact of these risks and protect their assets.

Risk management strategies also help investors to avoid speculation and emotional decision-making. The crypto market is often influenced by hype and speculation, leading to inflated prices. By setting clear profit and loss targets and sticking to them, investors can avoid getting caught up in market trends and make rational investment decisions.

Furthermore, risk management strategies can help investors diversify their portfolios and protect themselves from excessive exposure to a single asset. By spreading their investments across different cryptocurrencies, traders can reduce the impact of any negative price movements on their overall portfolio.

Finally, risk management strategies are essential for long-term investors who aim to capitalize on the potential growth of digital assets. By mitigating risks and protecting their capital, investors can stay in the market for the long haul and take advantage of technological innovation and market trends.

In conclusion, risk management strategies play a crucial role in the success of crypto traders and investors. The volatile and decentralized nature of the cryptocurrency market requires careful planning and proactive risk management. By implementing strategies that prioritize security, diversification, and rational decision-making, investors can navigate the blur pricing and uncertainty of the crypto market and maximize their chances of generating profit.

What is blur pricing?

Blur pricing refers to the practice of obscuring or hiding the true prices of cryptocurrencies on an exchange platform. This can be done by delaying price updates, manipulating order books, or using other tactics to create a false sense of market activity or liquidity. It can have a significant impact on crypto traders and investors by misleading them and potentially leading to poor decision-making.

How does blur pricing affect crypto traders?

Blur pricing can greatly affect crypto traders by making it difficult for them to accurately gauge the true market conditions. By distorting price information, traders may be misled into making poor trading decisions, such as buying or selling assets at suboptimal prices. Additionally, blur pricing can increase the risk of slippage, where trades are executed at prices different from what was expected.

+ There are no comments

Add yours