In the era of new technology and the digital age, traditional forms of money are no longer the only means of conducting financial transactions. The rise of digital currencies, such as Bitcoin, has presented us with a new frontier of possibilities and challenges. While these digital currencies offer convenience, speed, and the potential for financial liberation, they also come with inherent risks that must be addressed.

Cybersecurity is one of the foremost concerns when it comes to digital currencies. With the advent of online transactions, the risk of cyber attacks and hacking has increased significantly. The blurred nature of digital currencies makes them an attractive target for cybercriminals, who seek to exploit weaknesses in the system for personal gain. The decentralized nature of some digital currencies further complicates matters, as there is no central authority to oversee transactions and provide security.

As with any emerging technology, it is crucial to understand and address the risks associated with digital currencies. The challenge lies in finding a balance between the benefits of digital currencies and the need for robust cybersecurity measures. Governments, financial institutions, and individuals alike must take proactive steps to protect themselves against potential threats. This can range from implementing encryption techniques and multi-factor authentication to educating users about best practices for securely storing and transacting digital currencies.

Addressing the risks and challenges of digital currencies requires collaboration and innovation. Industry leaders, cybersecurity experts, and policymakers must work together to develop comprehensive frameworks that safeguard the integrity and security of digital currencies. This includes the establishment of regulatory frameworks, international standards, and guidelines that promote responsible use and protect users from fraud and cyber attacks.

Conclusion

The world of digital currencies presents an exciting opportunity for the future of finance. However, it is essential to recognize and mitigate the risks and challenges that come with this emerging technology. By prioritizing cybersecurity measures and fostering collaboration, we can ensure that the benefits of digital currencies are realized while minimizing the vulnerabilities. Together, we can navigate the blurred landscape of digital currencies and create a secure and prosperous financial future.

Understanding the Risks of Blur Money

Blur money refers to the digital currencies that are designed to provide a higher level of privacy and anonymity. While they offer various benefits, such as faster transactions and lower fees, they also come with unique risks that need to be understood and addressed. In this section, we will explore the cybersecurity risks associated with blur money and the challenges in addressing them.

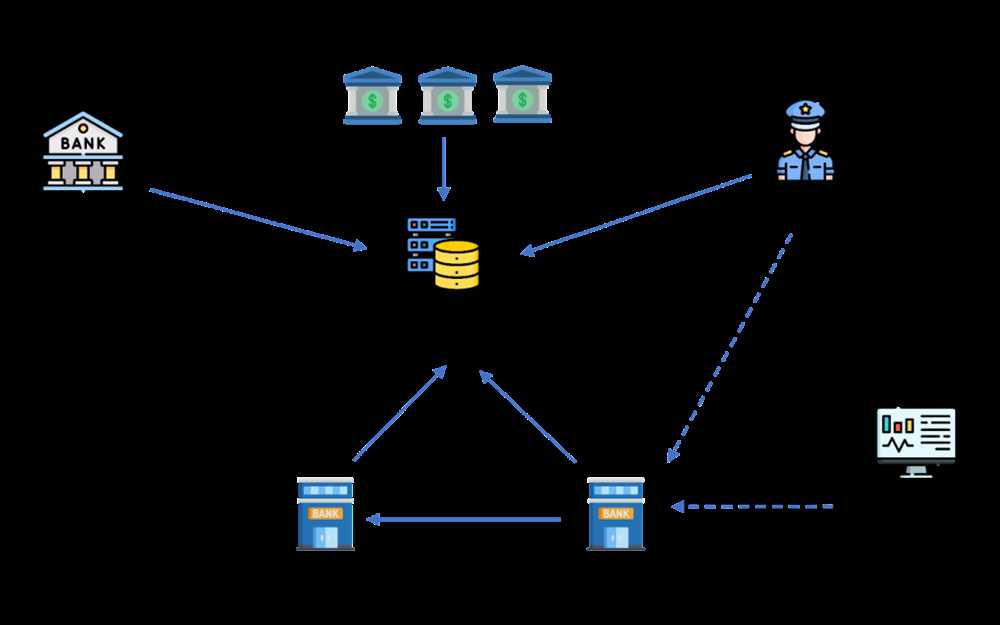

One of the main risks of blur money is the potential for illegal activities. Due to the heightened privacy and anonymity features, it can be easier for criminals to engage in activities such as money laundering, tax evasion, and the financing of illegal activities. This poses a challenge for law enforcement agencies and regulators who need to find ways to detect and prevent such activities while still respecting individuals’ privacy rights.

Another risk is the potential for financial fraud. The use of blur money can make it more difficult to trace transactions and identify the parties involved, increasing the risk of scams and fraudulent schemes. This highlights the need for robust cybersecurity measures to protect users and ensure the integrity of the digital currency ecosystem.

Cybersecurity threats also pose significant risks to blur money. As with any digital system, there is a risk of hacking, data breaches, and theft. Cybercriminals may target digital wallets, exchanges, or other platforms that facilitate the use of blur money to steal funds or sensitive personal information. Implementing strong cybersecurity measures, such as encryption and multi-factor authentication, is crucial to mitigate these risks.

Furthermore, the decentralized nature of many blur money systems can present challenges in terms of governance and regulation. The absence of a central authority makes it harder to enforce security standards, detect suspicious activities, and respond to emerging threats. This calls for collaboration between industry stakeholders, regulators, and cybersecurity experts to develop effective frameworks and protocols.

In conclusion, while blur money offers various benefits, it also comes with unique cybersecurity risks. Understanding these risks is essential for individuals, businesses, and governments to address them effectively. By implementing strong cybersecurity measures, fostering collaboration, and striking a balance between privacy and security concerns, we can mitigate the challenges posed by blur money and ensure its safe and responsible use.

The Growing Popularity of Digital Currencies

The world of finance is rapidly evolving, and one of the most prominent developments in recent years has been the rise of digital currencies. These innovative forms of money are addressing many of the challenges and risks associated with traditional currencies.

One of the primary advantages of digital currencies is the ability to blur the lines between different financial systems. Unlike traditional currencies that are tied to specific countries or regions, digital currencies are borderless and can be used globally. This means people can transact with anyone, anywhere in the world, without the need for intermediaries or costly currency conversions.

Cybersecurity is another critical aspect that digital currencies are addressing. With traditional currencies, there are always risks of theft, fraud, and counterfeit. However, digital currencies utilize advanced encryption and blockchain technology, making them highly secure and difficult to tamper with. This provides users with peace of mind that their money is safe and protected.

Furthermore, digital currencies offer greater financial inclusivity. In many parts of the world, individuals do not have access to traditional banking services, making it difficult for them to participate fully in the global economy. Digital currencies provide an alternative and allow these individuals to create a financial identity, access financial services, and participate in economic activities.

The growing popularity of digital currencies is evident by the increasing number of merchants, businesses, and even governments accepting them as a form of payment. This mainstream acceptance is fueling the adoption of digital currencies, and more individuals are embracing this new way of managing their money.

However, despite their advantages, digital currencies also come with their own set of risks and challenges. As with any emerging technology, there are concerns about regulation, security vulnerabilities, and the potential for illegal activities. It is essential for individuals, businesses, and governments to stay informed about these risks and work together to create a safe and regulated environment for the use of digital currencies.

In conclusion, digital currencies are becoming increasingly popular, as they address many of the challenges and risks associated with traditional currencies. They provide greater financial inclusivity, enhance cybersecurity, and allow for borderless transactions. However, it is important to approach the use of digital currencies with caution and be aware of the potential risks and challenges they bring.

The Advantages of Digital Currencies

Digital currencies offer numerous advantages in terms of flexibility and convenience. Unlike traditional forms of money, digital currencies aren’t bound by geographical limitations and can be used seamlessly across borders. This eliminates the challenges associated with exchanging currencies and makes international transactions much easier.

Cybersecurity is a major concern in the digital world, and digital currencies address this issue in unique ways. One of the advantages of digital currencies is that they are built on blockchain technology, which provides a high level of security. Transactions made with digital currencies are encrypted and verified by a network of computers, making it difficult for hackers to tamper with the system.

Another advantage of digital currencies is that they offer a certain level of anonymity. While transactions made with digital currencies are recorded on a public ledger, the identities of the individuals involved are anonymous. This can be beneficial for individuals who value their privacy or want to protect their financial information.

When it comes to financial risks, digital currencies offer some protection. Traditional forms of money can be vulnerable to inflation, economic crises, and government regulations. Digital currencies, on the other hand, operate independently of any central authority and are not affected by economic fluctuations. This makes them more resistant to financial risks and provides users with a sense of stability.

Finally, digital currencies can be a cost-effective alternative to traditional banking systems. The use of digital currencies eliminates the need for intermediaries, such as banks, which can charge high fees for transactions. This can result in lower transaction costs and more affordable financial services.

In conclusion, digital currencies provide advantages in terms of flexibility, cybersecurity, anonymity, financial risks, and cost-effectiveness. As technology continues to advance and the world becomes more connected, digital currencies have the potential to revolutionize the way we use and think about money. However, it is important to address the challenges and risks associated with digital currencies to ensure their widespread adoption in a safe and secure manner.

The Rise of Anonymous Transactions

The advent of digital currencies has brought about significant changes in the way we think about money and financial transactions. One of the most notable developments in this field is the rise of anonymous transactions.

Traditional currencies rely on a centralized authority to regulate and record transactions. However, digital currencies, such as Bitcoin and other cryptocurrencies, provide a level of anonymity and privacy that is unprecedented in the world of finance.

This anonymity presents both benefits and challenges. On one hand, it allows individuals to conduct transactions without revealing their identity or personal information. This can be particularly useful for individuals who value privacy or live in countries with oppressive governments.

On the other hand, this anonymity makes it difficult for authorities to track, regulate, and prevent illicit activities such as money laundering, terrorist financing, and fraud. The blurred lines between legitimate and illegitimate transactions pose a significant challenge for cybersecurity and law enforcement agencies.

Addressing the risks and challenges of anonymous transactions requires a multi-faceted approach. It involves developing innovative cybersecurity measures to detect and prevent illegal activities in the digital currency space. It also requires enhancing international cooperation and regulatory frameworks to ensure that digital currencies are not used as tools for criminal activities.

The rise of anonymous transactions in digital currencies has undoubtedly changed the financial landscape. It offers individuals newfound freedom and privacy, but it also raises concerns about security and compliance. Striking the right balance will be crucial as we navigate the challenges and opportunities in this evolving field.

The Dark Side of Digital Currencies

Digital currencies have brought about significant advancements in the world of finance, making transactions faster and more convenient. However, along with these benefits come risks and challenges, particularly in the realm of cybersecurity and money laundering.

One of the main challenges is how easily digital currencies can be manipulated and blurred. The very nature of digital currencies, being decentralized and lacking a central authority, makes them vulnerable to hacking and fraud. Cybercriminals can exploit weaknesses in the system and access individuals’ wallets, stealing their digital funds.

Money laundering is another dark side of digital currencies. Due to the anonymity provided by these currencies, it becomes easier for criminals to launder their ill-gotten gains. They can blur the trail of transactions, making it difficult for law enforcement agencies to trace the money back to its illegal origins.

Furthermore, the lack of regulation in the digital currency market poses challenges to law enforcement and financial institutions. With no central authority overseeing these currencies, it becomes harder to detect and prevent illicit activities. The challenge lies in developing effective regulatory frameworks that balance innovation and security.

In conclusion, while digital currencies have revolutionized the world of finance, they also come with their dark side. The risks, cybersecurity challenges, and potential for money laundering all need to be addressed to ensure the safe and secure use of these currencies.

Addressing Cybersecurity Challenges

Cybersecurity plays a vital role in the digital age, especially when it comes to the blurred lines of money and the rise of digital currencies. As the use of digital currencies becomes more prevalent, so do the challenges and risks associated with cybersecurity.

Addressing these challenges requires a multi-faceted approach. First and foremost, individuals and organizations must prioritize cybersecurity and make it an integral part of their digital currency operations. This includes investing in robust security systems and protocols to protect against cyber threats.

Furthermore, education and awareness are crucial in addressing cybersecurity challenges. It is important for users to understand the risks and vulnerabilities associated with digital currencies, and for organizations to provide comprehensive training to their employees.

Another key aspect of addressing cybersecurity challenges is collaboration. Governments, financial institutions, and the cybersecurity community must work together to share information, best practices, and strategies for combating cyber threats. This collaborative approach can help to identify and address vulnerabilities and prevent potentially devastating cyber attacks.

Emphasizing the importance of transparency and accountability is also essential. Digital currency platforms must establish clear and transparent processes to protect user data and funds. Regular audits and security assessments can help to identify any weaknesses or vulnerabilities, allowing for timely action to be taken.

Additionally, regulatory frameworks must be implemented to ensure the security and integrity of digital currency systems. These frameworks should address issues such as customer protection, anti-money laundering measures, and data privacy. By establishing clear rules and regulations, governments can create a safer environment for the use of digital currencies.

In conclusion, addressing the cybersecurity challenges associated with digital currencies requires a proactive and collaborative approach. It is crucial for individuals, organizations, and governments to prioritize cybersecurity and implement robust security measures. By doing so, we can help to mitigate the risks and ensure the safe and secure use of digital currencies in an increasingly digital world.

What is the importance of addressing cybersecurity risks in digital currencies?

Addressing cybersecurity risks in digital currencies is of utmost importance as these currencies are vulnerable to hacks and cybercrimes. Without proper security measures in place, users can become victims of identity theft, fraud, and financial losses. It is essential to address these risks to ensure the integrity and trustworthiness of digital currencies.

What are some of the challenges associated with digital currencies?

Some of the challenges associated with digital currencies include regulatory concerns, lack of privacy, volatility of prices, and the potential for money laundering and other illicit activities. Additionally, the complex nature of blockchain technology and the need for secure storage of digital assets pose significant challenges to the widespread adoption and use of digital currencies.

How can digital currencies be utilized for money laundering?

Digital currencies can be utilized for money laundering due to their decentralized nature and the relative anonymity they provide. Criminals can easily transfer funds across borders without leaving a trace, making it difficult for law enforcement agencies to track and trace illegal transactions. Additionally, the use of cryptocurrency mixers and tumblers can further obfuscate the source and destination of funds, making it challenging to detect and prevent money laundering activities.

What measures can be taken to enhance the cybersecurity of digital currencies?

Several measures can be taken to enhance the cybersecurity of digital currencies. These include implementing robust encryption algorithms, using multi-factor authentication for accessing digital wallets, conducting regular security audits, and educating users about best practices for online security. Additionally, collaboration between cryptocurrency exchanges, regulatory bodies, and cybersecurity firms can help in sharing threat intelligence and developing industry-wide security standards.

+ There are no comments

Add yours