Are you interested in exploring the potential of blur tokens? Now is the perfect time to start evaluating the risks and rewards associated with investing in these cutting-edge digital assets. With current prices offering an enticing entry point, it’s essential to assess the potential for future growth and the possible pitfalls that you may encounter along the way.

Potential: Blur tokens have caught the attention of investors worldwide due to their innovative nature and promising technology. They represent a new frontier in the digital economy, offering exciting possibilities for both buyers and sellers. By investing in blur tokens, you have the potential to tap into a rapidly growing market and enjoy significant returns on your investment.

Tokens: Blur tokens are the backbone of this emerging digital ecosystem. They act as a medium of exchange, allowing for seamless transactions and value transfers within the network. As the demand for these tokens increases, their value may soar, opening up lucrative opportunities for savvy investors who recognize their potential.

Prices: The current prices of blur tokens provide an opportunity for entry into this exciting market. By investing at the right time, you can position yourself for potential gains as the value of these tokens rises. However, it’s crucial to evaluate the market conditions and conduct thorough research before making any investment decisions.

Risks: It’s essential to acknowledge that investing in blur tokens carries its fair share of risks. Market volatility, regulatory uncertainty, and technological challenges can impact the value of these tokens. Evaluating and mitigating these risks is crucial to safeguarding your investment and maximizing your potential returns.

Join the adventure of evaluating the potential risks and rewards associated with investing in blur tokens at current prices. Stay informed, explore the possibilities, and make informed decisions to capitalize on this exciting opportunity!

Potential Risks

Investing in blur tokens at current prices can have potential risks that investors need to be aware of before making any financial decisions.

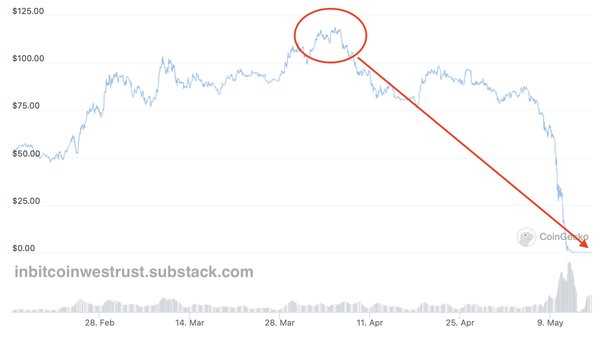

- Volatility: The price of blur tokens can be highly volatile, meaning that they can experience rapid and significant price fluctuations. This volatility can make it difficult to predict the future value of the tokens and can result in potential losses for investors.

- Lack of Regulation: The cryptocurrency market, including blur tokens, is currently not regulated in many jurisdictions. This lack of regulation can expose investors to potential fraud, scams, and market manipulation. It also means that investors have limited legal recourse in case of any wrongdoing.

- Market Uncertainty: The cryptocurrency market, including blur tokens, is still relatively new and evolving. This market uncertainty can make it difficult for investors to accurately assess the future potential of the tokens. There is no guarantee that the tokens will gain widespread adoption or maintain their value in the long term.

- Technology Risks: Blur tokens are built on blockchain technology, which is prone to technical issues and vulnerabilities. Any vulnerabilities in the technology could result in potential hacking, theft, or loss of funds. It is important for investors to understand the potential risks associated with the underlying technology.

- Regulatory Changes: Governments and regulatory bodies are still developing their approach to cryptocurrency regulation. As a result, there is the potential for regulatory changes that could impact the value and legality of blur tokens. Investors need to stay updated on any regulatory developments that could affect their investments.

Considering these potential risks is essential for any investor interested in blur tokens. It is recommended to thoroughly research and evaluate the risks and rewards before making any investment decisions.

Market Volatility

Market volatility is an inherent aspect of investing in blur tokens. While the potential rewards can be enticing, it’s important to be aware of the risks involved, especially considering the current prices of these tokens.

Blur tokens have proven to be highly volatile, with their values experiencing rapid fluctuations in the market. This volatility can make it difficult to predict future price movements and can lead to significant financial losses if not carefully managed.

Investing in blur tokens at current prices requires a thorough evaluation of the potential risks and rewards involved. It’s crucial to assess market trends, analyze historical data, and stay updated with the latest news and developments in the cryptocurrency market.

One of the key risks of investing in blur tokens is the possibility of a sudden price drop. Market sentiment can quickly change, causing prices to plummet. This can result in substantial losses if investments aren’t diversified or if stop-loss orders aren’t implemented.

On the other hand, the potential rewards of investing in blur tokens can be significant. If the market is favorable and prices increase, investors can realize substantial gains. However, it’s important to stay vigilant and not succumb to the temptation of making impulsive decisions based on short-term price movements.

To navigate the market volatility associated with blur tokens, it’s advisable to set clear investment goals, establish a diversified portfolio, and employ risk management strategies. This may include setting stop-loss orders, regularly reviewing and adjusting investment positions, and staying informed about market developments.

In conclusion, investing in blur tokens at current prices can offer potential rewards, but it also comes with significant risks due to market volatility. By staying informed, setting realistic expectations, and employing sound risk management practices, investors can seek to maximize the potential rewards while minimizing the potential risks.

Lack of Regulation

When evaluating the potential risks and rewards of investing in blur tokens at current prices, one important factor to consider is the lack of regulation surrounding the cryptocurrency market.

Unlike traditional financial investments, such as stocks or bonds, the cryptocurrency market operates in a relatively unregulated environment. There is no centralized authority or governing body overseeing the buying and selling of tokens like blur. This lack of regulation can lead to increased volatility and uncertainty in the market.

Without regulation, there is a greater risk of fraud and scams. Investors must be cautious when investing in blur tokens, as there is a potential for fraudulent projects or misleading information. It is important to thoroughly research any potential investment and ensure that the project has a strong and legitimate foundation.

Additionally, the lack of regulation means that there are few mechanisms in place to protect investors in the event of market manipulation or security breaches. In the past, there have been instances of hacking and theft in the cryptocurrency market, resulting in substantial losses for investors.

| Key Points |

|---|

| • Lack of regulation in the cryptocurrency market |

| • Increased volatility and uncertainty |

| • Greater risk of fraud and scams |

| • Limited protection for investors |

Overall, when considering investing in blur tokens or any other cryptocurrency, it is important to be aware of and understand the lack of regulation in the market. By evaluating the risks and rewards associated with this lack of regulation, investors can make informed decisions and mitigate potential losses.

Security Vulnerabilities

When evaluating the potential risks and rewards of investing in blur tokens at current prices, it is important to consider the security vulnerabilities that may exist.

One of the main risks of investing in blur tokens is the potential for security breaches. Hackers and cybercriminals are constantly looking for vulnerabilities in digital assets, and cryptocurrencies are no exception. If a vulnerability is found in the blur token system, it could lead to unauthorized access to accounts or the theft of funds.

Another security vulnerability to consider is the risk of phishing attacks. Phishing is a common method used by cybercriminals to trick individuals into revealing their personal information or login credentials. Investors who are not careful may unknowingly provide their private keys or passwords to fraudulent websites or individuals, resulting in the loss of their blur tokens.

In addition, smart contract vulnerabilities pose another potential risk. Smart contracts are self-executing agreements with the terms of the agreement written into code. If there are flaws or vulnerabilities in the smart contract code, hackers may exploit them to manipulate the system or steal funds.

In order to mitigate these security vulnerabilities, it is important to take certain measures. Utilizing two-factor authentication, securing private keys offline, and regularly updating software are all steps that can help protect against potential security breaches. It is also essential to verify the credibility and security measures of any platform or exchange before investing in blur tokens.

By being aware of the security vulnerabilities and taking proper precautions, investors can minimize the risks associated with investing in blur tokens and potentially reap the rewards of their investments.

Key Factors to Consider

Evaluating the potential risks and rewards of investing in blur tokens at current prices is crucial for any investor. Before making any investment decisions, it is important to thoroughly analyze and consider the following key factors:

1. Evaluate the potential risks: Investing in any type of cryptocurrency comes with inherent risks. Therefore, it is important to assess the potential risks associated with blur tokens. Factors such as market volatility, regulatory uncertainties, and technological vulnerabilities should be carefully evaluated.

2. Analyze the potential rewards: Alongside the risks, it is essential to analyze the potential rewards of investing in blur tokens. This analysis should include factors such as the projected growth of the cryptocurrency market, the utility and demand for blur tokens, and the potential for high returns on investment.

3. Assess the current market conditions: Understanding the current market conditions is crucial when evaluating the potential of blur tokens. Factors such as market trends, liquidity, and investor sentiment can significantly impact the success of an investment in blur tokens.

4. Consider the long-term potential: Investing in blur tokens should be viewed as a long-term commitment. It is important to assess the long-term potential of blur tokens, considering factors such as the development roadmap, the team behind the project, and the potential for wider adoption in the future.

5. Diversification: Diversifying your investment portfolio is always recommended. Consider allocating only a portion of your investment capital to blur tokens, while also investing in other assets to spread the risks and maximize potential rewards.

By carefully evaluating these key factors, investors can make informed decisions when it comes to investing in blur tokens at current prices. Remember that thorough research and analysis are essential for successful investments in the cryptocurrency market.

Tokenomics and Supply

The concept of tokenomics refers to the potential rewards and risks associated with investing in tokens, such as blur tokens. Evaluating the tokenomics is crucial before making any investment decision. It involves analyzing the current supply and demand dynamics, as well as the potential future utility and value of the tokens.

When evaluating the potential rewards of investing in blur tokens, one should consider factors such as the token’s use case, market adoption, and the team behind the project. These factors can contribute to the token’s growth and increase its value over time, potentially leading to substantial rewards for investors.

However, investing in tokens also comes with potential risks. The volatile nature of the cryptocurrency market and the uncertainties surrounding regulatory frameworks can pose risks to investments. Additionally, the current market price of blur tokens should be carefully evaluated to ensure that it aligns with the perceived value and potential future growth of the project.

Understanding the token supply is an essential aspect of evaluating tokenomics. The current supply of blur tokens and its distribution can impact the token’s value and market dynamics. Factors such as token emission rate, token burns, and token lock-up periods can affect the token’s scarcity and, therefore, its potential value.

In conclusion, evaluating the tokenomics and supply of blur tokens is vital for investors to make informed decisions. This process involves carefully assessing the potential risks and rewards associated with investing in tokens at their current prices. By conducting a thorough analysis, investors can position themselves for potential financial gains while managing the inherent risks of the digital asset market.

Market Demand and Adoption

As the current market evolves and moves towards digital currencies, the demand for tokens like blur is on the rise. Investors are evaluating the potential rewards of investing in blur tokens at current prices.

One of the main factors driving the adoption of blur tokens is the increasing recognition of their potential in various industries. From finance to healthcare, blur tokens have the potential to streamline processes, reduce costs, and improve efficiency.

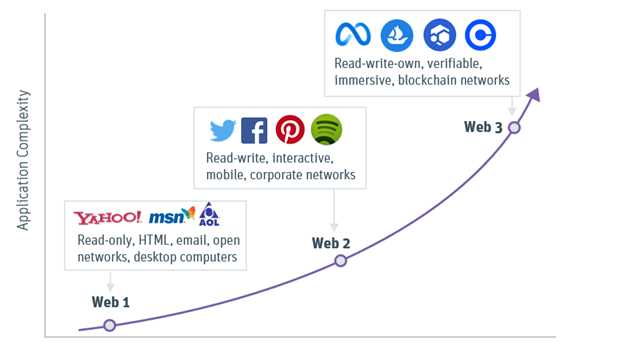

Moreover, the transparency and security provided by blockchain technology further contributes to the demand for blur tokens. Investors are attracted to the idea of a decentralized system that eliminates intermediaries and ensures secure transactions.

With the rise of decentralized finance (DeFi), blur tokens are also gaining traction in the market. DeFi platforms allow users to engage in various financial activities such as lending, borrowing, and trading without the need for traditional intermediaries. This decentralized approach aligns with the core principles of blur tokens and attracts investors looking for alternative investment opportunities.

Overall, the market demand for blur tokens is driven by the potential rewards of investing in them at current prices. As more industries recognize the benefits of blockchain technology and decentralized systems, the adoption of blur tokens is likely to continue growing.

Competitor Analysis

When evaluating the potential risks and rewards of investing in blur tokens at current prices, it is important to also consider the competitive landscape. Conducting a thorough competitor analysis can provide valuable insights into the strengths and weaknesses of other companies in the same industry.

One of the main competitors in the blur tokens market is TechToken. TechToken is a well-established player that has been in the industry for several years. They have a strong foothold in the market and a loyal customer base. Their tokens have been performing consistently, and they have a track record of delivering steady returns to their investors.

Another competitor worth considering is InvestCoin. InvestCoin is a relatively new player in the market, but they have quickly gained traction due to their unique approach to token investing. They offer a wide range of tokens with different risk levels, allowing investors to customize their portfolio based on their risk appetite. This flexibility has attracted a diverse group of investors and has contributed to the success of their tokens.

When comparing the risks and rewards of investing in blur tokens with those of TechToken and InvestCoin, it is important to consider factors such as the historical performance of their tokens, the strength of their management teams, and their overall market presence. Analyzing these factors can help investors make informed decisions and choose the most suitable investment opportunity.

| Competitor | Strengths | Weaknesses |

|---|---|---|

| TechToken | Well-established player | May have limited growth potential |

| InvestCoin | Flexible investment options | Limited track record |

What are blur tokens?

Blur tokens are a type of cryptocurrency that are used on the Blur platform.

What is the current price of blur tokens?

The current price of blur tokens is $0.50 per token.

How can I evaluate the potential risks of investing in blur tokens?

There are several ways to evaluate the potential risks of investing in blur tokens. Firstly, you should consider the volatility of the cryptocurrency market and the potential for price fluctuations. Additionally, you should research the team behind the blur platform and their track record. It’s also important to consider any regulatory risks and the potential for fraud or security breaches. Lastly, you should assess your own risk tolerance and financial situation before investing.

+ There are no comments

Add yours