When it comes to investing in cryptocurrencies, understanding the past performance and trends of a token’s price is crucial. By analyzing the historical data, investors can gain valuable insights into the market volatility, identify patterns, and make more informed decisions. In this article, we will conduct an investigation into the past movement of Blur token price and evaluate its predictability.

Our analysis will involve a thorough examination of statistical data, research graphs, and charts. By comparing the historical price fluctuations of Blur token with other relevant cryptocurrencies, we aim to identify any correlations and understand the factors affecting its growth or decline. This evaluation will enable us to make an accurate prediction of its future performance.

During our research, we will carefully examine the historical trends of Blur token price, focusing on both upward and downward movements. By identifying any patterns or trends in its past performance, we can better understand its predictability and determine if it is a good investment option. We will also take into account any external factors that might have influenced the token’s price fluctuations.

Finding the historical data

When it comes to analyzing the historical trend of Blur token price, thorough research and evaluation of statistics are crucial. By studying the past market movement, investors and analysts can gain valuable insights into potential future trends and accurately predict the token’s performance.

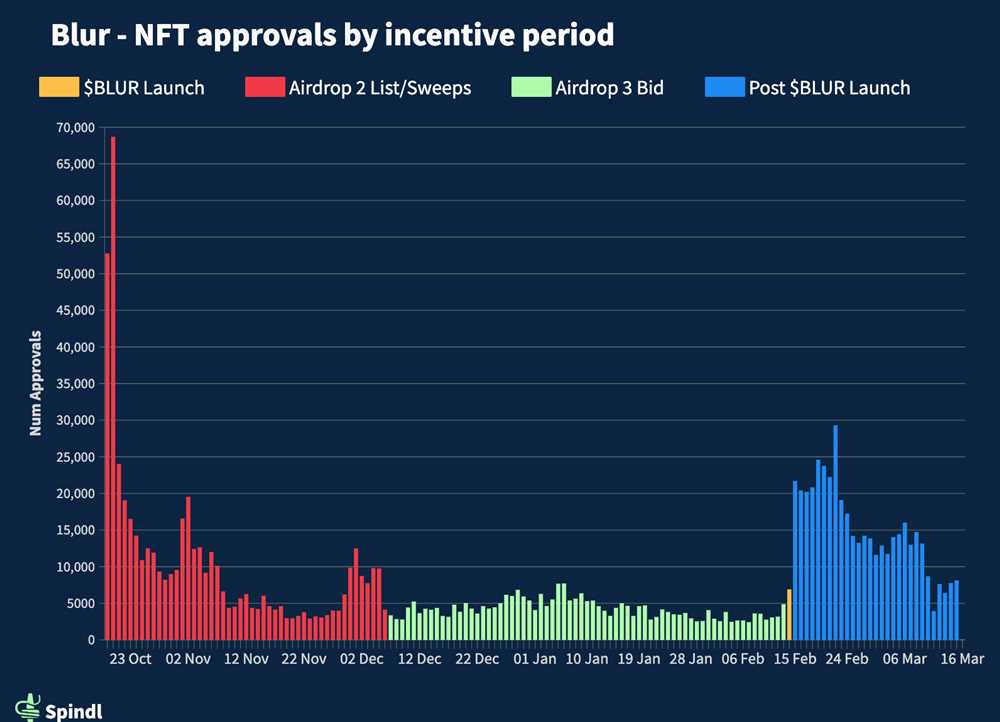

One of the primary methods used for analyzing historical data is through the use of charts and graphs. These visual representations allow for a clear comparison of the token’s price fluctuations over a specific period. By identifying patterns and trends in the data, analysts can make predictions and forecasts regarding the token’s future performance.

By investigating the correlation between various factors such as market volatility, price movement, and token supply, analysts can further understand the token’s growth potential and predictability. This correlation analysis helps in identifying the factors that influence the upward or downward movement of the token’s price.

To perform an in-depth analysis, it is essential to collect sufficient historical data that covers a significant time period. This data can be obtained from various sources such as cryptocurrency exchanges, financial websites, and specialized market analysis platforms. Once collected, the data can be organized and analyzed using statistical tools and techniques.

By analyzing the historical data, analysts can identify key trend patterns, such as the token’s performance during specific market conditions or events. These patterns can provide valuable insights into the token’s potential growth or decline in the future.

In conclusion, finding and analyzing historical data is crucial for understanding the trend and movement of Blur token’s price. Thorough research, statistical evaluation, and the use of charts and graphs are vital for making accurate predictions and forecasts regarding the token’s future performance.

Importance of analyzing historical trends

Blur token price is subject to constant fluctuation in the market. To understand its movement and predictability, it is crucial to analyze the historical trends of the token’s price. By conducting thorough research and evaluating past data, investors can identify patterns and correlations that can help them make informed decisions.

Analyzing historical trends involves the examination of price charts and graphs over a specific period. This investigation enables investors to identify trends in the upward or downward growth of the token’s price. By understanding how the token’s price has fluctuated in the past, investors can better anticipate its future movements and make accurate forecasts.

Moreover, analyzing historical trends helps in assessing the volatility of the token’s price. By observing the past fluctuations, investors can gain valuable insights into the token’s price range and its potential for rapid price swings. Such evaluation aids in managing risks and making sound investment decisions.

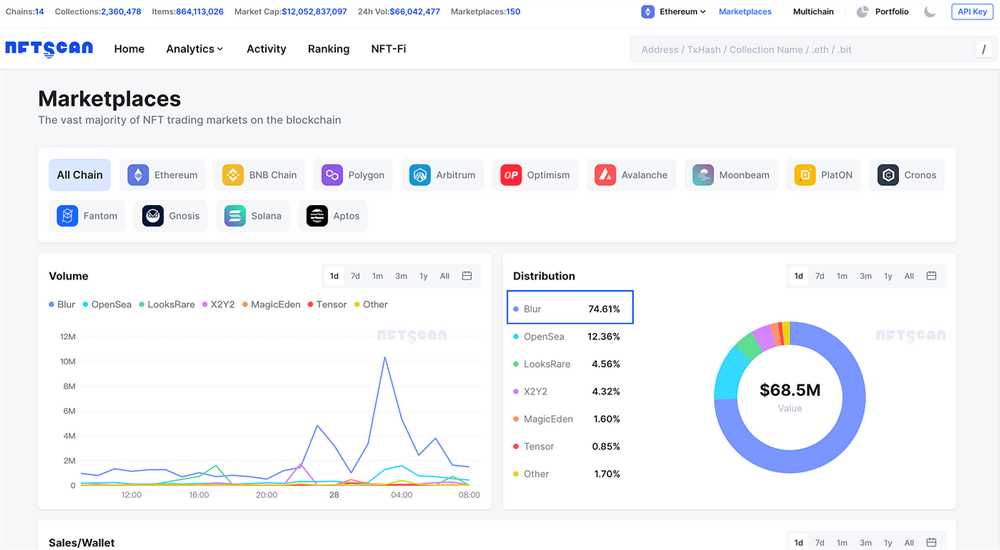

Additionally, analyzing historical trends allows for a comparison of the token’s performance with other similar assets. By studying the price movement of related tokens or assets, investors can gain a broader perspective on the market and make informed decisions based on this wider data set.

Overall, analyzing the historical trends of the Blur token price offers valuable information for investors. It helps in understanding the past market behavior, forecasting future trends, and making informed investment decisions. Through the analysis of historical data, investors can identify relevant patterns, correlations, and statistics that enable accurate prediction of future price movements.

Factors influencing price fluctuations

When analyzing the historical trend of Blur token price, it is important to consider the various factors that can influence its movement. By studying the statistics and performance of past trends, one can gain insight into the upward and downward fluctuations in price.

- Market research: Conducting thorough market research is essential when analyzing price trends. Studying charts, analyzing graphs, and investigating patterns can provide valuable information for price prediction and comparison.

- Growth and evaluation: Evaluating the growth potential of the Blur token can help in understanding its price movements. Factors such as technological advancements, partnerships, and user adoption can contribute to increased demand and subsequently higher token prices.

- Volatility and predictability: The historical data of Blur token price also reveals its level of volatility. Higher volatility indicates a greater fluctuation in price, making it important to consider when forecasting future price movements. Additionally, predictability can also be assessed by analyzing previous trends and assessing their reliability for future predictions.

- Market sentiment and news: The market sentiment towards Blur token can significantly impact its price. Positive news such as partnerships or developments can drive the price up, while negative news can cause a decline. Keeping track of market sentiment and news can, therefore, contribute to a better understanding of price movements.

Market demand and supply

When analyzing the historical trend of Blur token price, it is crucial to take into account the market demand and supply dynamics. By conducting a comprehensive analysis of these factors, it is possible to make accurate forecasts and predictions about the future movement of Blur token price.

The investigation of market demand involves evaluating the buying interest and the number of active participants in the market. By analyzing graphs and conducting research, it is possible to identify trends and patterns in the market that can provide valuable insights into the potential future performance of Blur token.

On the other hand, analyzing the market supply involves examining the availability of Blur tokens in the market and the rate at which new tokens are being introduced. This evaluation can be done by looking at statistics and past data to identify any trends or patterns in the token’s supply movement.

The correlation between market demand and supply can have a significant impact on the price of Blur token. For example, if the demand for Blur token is high and the supply is low, it could result in an upward trend in the token’s price. Conversely, if there is a decline in demand or an increase in supply, it may lead to a downward fluctuation in the token’s price.

By analyzing the historical data and evaluating market demand and supply, it is possible to gain insights into the predictability and volatility of Blur token price. This information can be used to make educated predictions about the future movement of the token’s price and to develop trading strategies based on these forecasts.

Overall, market demand and supply are crucial elements to consider when analyzing the historical trend of Blur token price. By conducting thorough research and analysis, it is possible to gain a deeper understanding of the market dynamics and make informed decisions about the token’s potential future performance.

Economic and political events

Volatility in the Blur token price can be influenced by economic and political events. These events can have a correlation with the investigation of historical trends, allowing for a better understanding of the downward or upward movement in price. Statistical analysis and the study of past data can help predict future price patterns, providing some level of predictability in the market. Graphs, charts, and statistical analysis can be used to evaluate performance and make predictions about the future growth or decline of the Blur token price.

Research and forecasting play a crucial role in analyzing the price trends of Blur token. Economic events such as changes in interest rates, inflation rates, and national policies can impact the price of the token. Political events such as elections, government stability, and geopolitical tensions can also affect market sentiment and create price fluctuations.

By comparing the historical data and analyzing the performance of Blur token in different economic and political situations, it is possible to identify patterns and make predictions about future price movements. This can help investors and traders make informed decisions based on the evaluation of price trends and market conditions.

Overall, the analysis of economic and political events is essential for understanding the factors influencing Blur token price. Through careful evaluation and investigation of past data, it is possible to gain insights into the token’s performance and make predictions about its future movement.

Technological advancements

Technological advancements have played a crucial role in the analysis and prediction of market trends for various assets, including cryptocurrency tokens like Blur. With the availability of vast amounts of data and advanced analytical tools, investors and analysts can now evaluate historical price movements and patterns to predict future trends.

Through the use of sophisticated algorithms and statistical models, it is now possible to identify patterns of upward or downward price movement in token prices. Historical data in the form of graphs, charts, and statistics can be used to compare past trends and evaluate the performance of Blur token.

The growth and volatility of cryptocurrency markets, including Blur, make it vital for investors to understand historical trends for effective decision-making. Detailed research and investigation into the fluctuation of token prices can provide valuable insights into future predictions.

By analyzing historical data, researchers can identify repeating patterns and assess the predictability of Blur token’s price trend. This evaluation can help investors make informed decisions on when to buy or sell, based on past trends and the forecasted direction of token prices.

Technological advancements have also facilitated the development of forecasting models that utilize historical data and statistical analysis to predict the future price movement of Blur tokens. These models take into account various factors such as market conditions, investor sentiment, and technological innovations.

Overall, technological advancements have significantly improved the accuracy and reliability of analyzing historical trends in the Blur token market. With access to vast amounts of data and advanced analytical tools, investors can make more informed decisions based on the past performance and future predictions of the token.

Methods for analyzing historical trends

When analyzing the historical trend of Blur token price, several methods can be employed to gain insights into the fluctuation and movement of the market. One of the primary methods is conducting a correlation analysis to identify any relationships between Blur token price and other variables such as market data or statistics.

Another method is the use of charts and graphs to visualize the historical price performance of Blur token. These visual representations can aid in the investigation of past trends and patterns, helping to identify potential predictability or predictability of future movement.

Furthermore, conducting a comparative analysis to evaluate the performance of Blur token in relation to other similar tokens or cryptocurrencies can provide valuable insights into its growth and decline. This analysis can help identify trends in price movement and assess the potential for future volatility.

Additionally, researchers can employ forecasting techniques to predict the future price of Blur token. By analyzing historical data and trends, statistical models can be developed to forecast potential price movements. These models can factor in variables such as market conditions, historical performance, and external influences to provide an estimate of future price trends.

In summary, analyzing the historical trends of Blur token price involves a comprehensive evaluation of past price data, correlation analysis, comparative evaluation, and forecasting techniques. By employing these methods, researchers can gain valuable insights into the factors influencing the price of Blur token and make informed decisions based on the trends and patterns identified.

What is Blur token?

Blur token is a cryptocurrency built on the Ethereum blockchain. It is designed to provide privacy and anonymity to its users, allowing them to make transactions without revealing their identity.

How has the Blur token price changed over time?

The Blur token price has experienced fluctuations over time. It initially started at a low price, but then saw significant growth as interest in privacy-focused cryptocurrencies increased. However, it is important to note that cryptocurrency prices are highly volatile and can be influenced by various factors.

+ There are no comments

Add yours