In the fast-paced world of cryptocurrency, the overall trends dictate the rise and fall of various tokens. One of the tokens that has garnered attention in recent months is Blur. As investors and enthusiasts delve into the intricate world of cryptocurrencies, they have begun exploring the correlation between Blur token price and overall market trends.

The price of a token can fluctuate wildly, influenced by a variety of factors such as market demand, regulatory changes, and even social media buzz. However, to truly understand the dynamics of the cryptocurrency market, it is crucial to analyze the correlation between individual token prices and the broader trends that shape the industry.

By exploring the correlation between Blur token price and overall cryptocurrency market trends, analysts and traders can gain valuable insights into the potential future movements of the token. Whether it follows the market’s momentum or stands as an outlier, understanding this correlation can help investors make more informed decisions.

Exploring the Correlation between $Blur Token Price and Overall Cryptocurrency Market Trends

Cryptocurrency has become a hot topic in recent years, with many investors looking to capitalize on the potential for high returns. As the market continues to evolve, it is important to understand the correlation between individual tokens and the overall market trends. One such token that has gained attention is $Blur.

$Blur is a cryptocurrency token that aims to provide users with a decentralized privacy solution. The token was launched in [insert year] and has since garnered a significant following. In this article, we will explore the correlation between the price of $Blur and the overall cryptocurrency market trends.

To effectively explore this correlation, we will analyze the historical price data of $Blur and compare it to the performance of the overall cryptocurrency market. By conducting this analysis, we aim to determine if there are any patterns or trends that can be identified.

One factor that may influence the correlation between the $Blur token price and the overall cryptocurrency market trends is investor sentiment. If investors have a positive outlook on the overall cryptocurrency market, they may be more inclined to invest in $Blur, leading to an increase in its price. On the other hand, if sentiment is negative, the price of $Blur may decrease.

Another factor that may impact the correlation is market volatility. Cryptocurrency markets are known for their volatility, with prices fluctuating rapidly over short periods. If the overall market experiences high levels of volatility, this may also be reflected in the price of $Blur.

In order to analyze the correlation between the $Blur token price and overall cryptocurrency market trends, we will create a table that displays the historical price data of $Blur as well as the performance of the overall market during the same time period. By comparing these two sets of data, we can identify any potential correlations or divergences.

| Date | $Blur Token Price | Overall Market Performance |

|---|---|---|

| [insert date] | [insert token price] | [insert market performance] |

| [insert date] | [insert token price] | [insert market performance] |

| [insert date] | [insert token price] | [insert market performance] |

By analyzing this data, we can identify any potential patterns or trends that may exist between the $Blur token price and overall market performance. Furthermore, we can use statistical techniques, such as correlation analysis, to quantify the strength and direction of the relationship.

In conclusion, exploring the correlation between the $Blur token price and overall cryptocurrency market trends can provide valuable insights for investors and enthusiasts. By understanding how individual tokens perform relative to the overall market, investors can make more informed decisions and potentially capitalize on market trends.

The Significance of Cryptocurrency Market Trends

The price of cryptocurrencies is highly influenced by market trends. Understanding these trends and exploring the correlation between different cryptocurrencies can provide valuable insights for investors and traders.

Cryptocurrency market trends refer to the overall direction or movement of the market. They can be identified by analyzing the price changes, trading volume, and market capitalization of different cryptocurrencies.

Exploring these trends helps investors understand the market sentiment and make informed decisions about buying or selling cryptocurrencies. For example, if the overall market trend is bullish, it indicates that the prices of most cryptocurrencies are likely to increase. On the other hand, a bearish market trend suggests that prices are expected to decline.

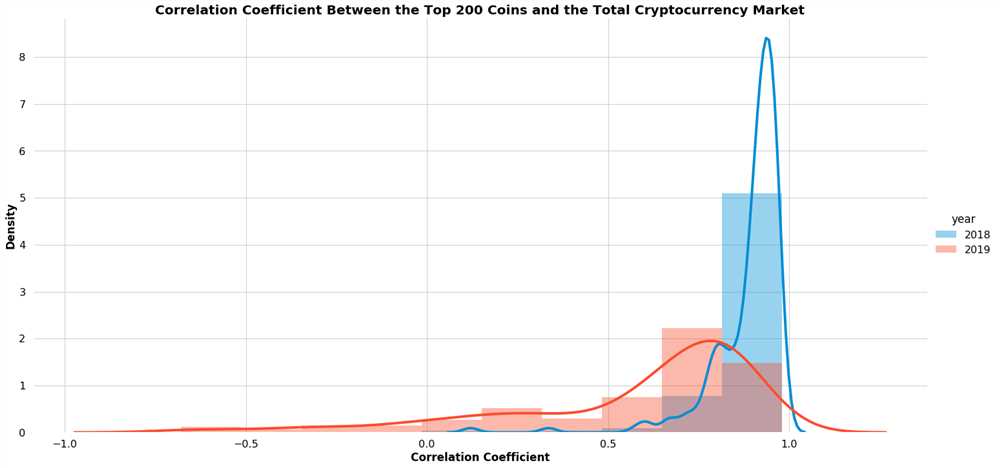

The correlation between different cryptocurrencies is another important aspect to consider. Correlation measures the statistical relationship between two or more variables, in this case, the prices of different cryptocurrencies. By analyzing the correlation between cryptocurrencies, investors can identify which cryptocurrencies tend to move in the same direction or have a similar price movement pattern.

This correlation can be valuable for diversifying an investment portfolio. If two cryptocurrencies have a high positive correlation, it means that they tend to move in the same direction. In this case, investing in both cryptocurrencies may not provide much diversification. On the other hand, if two cryptocurrencies have a low or negative correlation, it means that they move independently of each other. Investing in such cryptocurrencies can help reduce the overall risk of the portfolio.

Overall, understanding cryptocurrency market trends and exploring the correlation between different cryptocurrencies are crucial for making informed investment decisions. By staying updated with market trends and conducting thorough analysis, investors can maximize their chances of success in the volatile and ever-changing cryptocurrency market.

Understanding the Dynamics of the Cryptocurrency Market

The overall cryptocurrency market is a dynamic and ever-changing landscape. Understanding the intricate correlations and trends within this market can be crucial for investors and enthusiasts alike. One cryptocurrency that has been garnering attention in recent times is Blur (BLUR), and exploring its price movements in relation to the broader market can provide valuable insights.

Blur is a privacy-oriented cryptocurrency that aims to enhance fungibility and anonymity in transactions. As with any other cryptocurrency, its price is influenced by various factors, including market demand, adoption rates, regulatory developments, and overall market sentiment. By analyzing the correlation between Blur token price and the trends in the cryptocurrency market, one can gain a better understanding of the market dynamics.

One trend that has been observed in the cryptocurrency market is the overall volatility of prices. Cryptocurrencies are known for their price fluctuations, often experiencing sharp increases or decreases within short periods. These price swings can be influenced by a myriad of factors, such as news events, market manipulation, and changes in investor sentiment.

Examining the correlation between Blur token price and the overall cryptocurrency market trends can help identify whether Blur follows or deviates from the broader market movement. If Blur’s price tends to move in sync with the market, it suggests a strong correlation and indicates that external factors have a significant impact on Blur’s price. On the other hand, if Blur’s price movements diverge from the overall market trends, it may suggest that Blur has unique characteristics or is influenced by specific factors independent of the broader market.

Moreover, exploring the correlation between Blur token price and the overall cryptocurrency market trends can provide insights into the potential value and future prospects of Blur. If Blur’s price tends to closely mirror the market trends, it may indicate that Blur is highly sensitive to market factors and may not possess intrinsic value beyond its market sentiment. Conversely, if Blur’s price moves independently from the overall market, it may suggest that Blur has unique qualities or features that make it stand out among other cryptocurrencies.

In conclusion, understanding the dynamics of the cryptocurrency market is crucial for investors and enthusiasts alike. Exploring the correlation between Blur token price and overall market trends can provide valuable insights into the market sentiment, potential value, and future prospects of Blur. By analyzing these trends, investors can make more informed decisions and navigate the cryptocurrency market with greater confidence.

Factors Influencing Cryptocurrency Market Trends

The cryptocurrency market is highly volatile and influenced by a variety of factors. Understanding these factors is essential for predicting and analyzing market trends. Here are some of the key factors that can influence cryptocurrency prices:

1. Overall Market Sentiment: Cryptocurrency prices often move in correlation with the overall market sentiment. Positive news and developments in the cryptocurrency space can drive prices up, while negative news can lead to a decline in prices.

2. Regulatory News and Government Policies: The cryptocurrency market is significantly impacted by regulatory news and government policies. Statements from government officials, new regulations, and changes in legislation can affect the market sentiment and ultimately the token prices.

3. Technological Advancements: Technological advancements, such as new blockchain platforms, improved scalability, enhanced security features, and increased adoption of cryptocurrencies can have a positive impact on token prices. Investors often value projects that offer innovative solutions to existing problems.

4. Market Supply and Demand: The supply and demand dynamics play a crucial role in determining cryptocurrency prices. If the demand for a particular token exceeds its supply, the price is likely to rise. Conversely, if the supply outweighs the demand, the price may decrease.

5. Economic Factors: Cryptocurrency prices can be influenced by broader economic factors such as inflation, interest rates, economic stability, and geopolitical events. Economic downturns or uncertainty can lead to a decrease in cryptocurrency prices as investors seek safer investment options.

6. Investor Sentiment and Speculation: Investor sentiment and speculation can heavily impact cryptocurrency prices. News, social media trends, and market rumors can lead to a surge in buying or selling behavior, causing significant price fluctuations.

7. Market Manipulation: In the cryptocurrency market, there is a risk of market manipulation. Pump-and-dump schemes, insider trading, and price manipulation tactics can distort market trends and mislead investors.

It’s important to understand that these factors often interact with each other and can create complex market dynamics. Analyzing and considering these factors can provide valuable insights into the overall cryptocurrency market trends and help investors make informed decisions.

Identifying Market Trends for Informed Investment Decisions

When it comes to investing in the cryptocurrency market, it is crucial to have a clear understanding of the overall trends and correlations that can impact the value of tokens such as Blur. By exploring the correlation between Blur token price and overall market trends, investors can make more informed decisions.

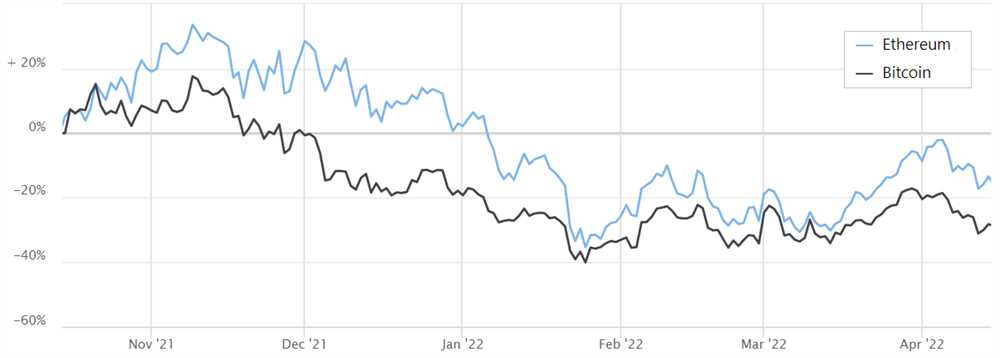

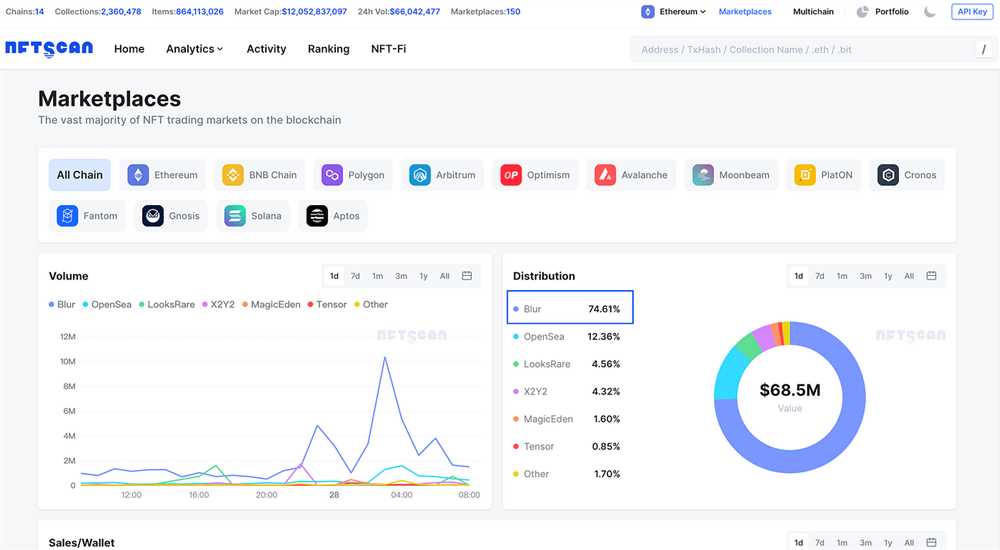

One of the key factors to consider when analyzing market trends is the overall state of the cryptocurrency market. The price of Blur token is often influenced by the movements of other major cryptocurrencies, such as Bitcoin and Ethereum. Therefore, it is important to keep a close eye on the price and performance of these cryptocurrencies when investing in Blur tokens.

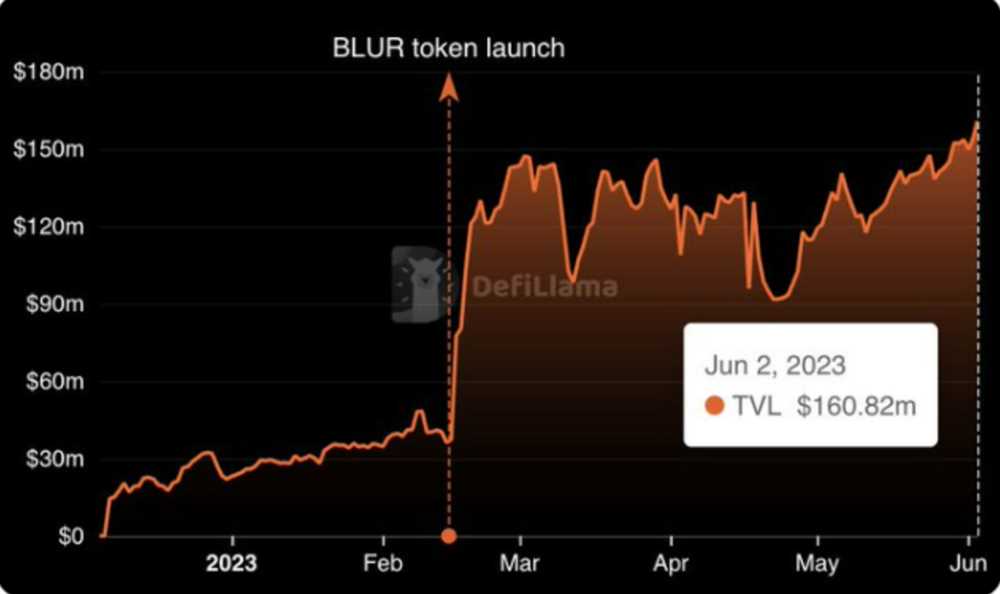

Exploring the correlation between Blur token price and the overall cryptocurrency market can provide valuable insights into potential investment opportunities. By analyzing historical data and chart patterns, investors can identify trends and patterns that may signal potential price movements for Blur tokens.

Furthermore, studying the market trends can help investors determine the factors that influence the price of Blur tokens. For example, if there is a strong correlation between the price of Blur tokens and the overall market sentiment, investors can use this information to make informed decisions on when to buy or sell their tokens.

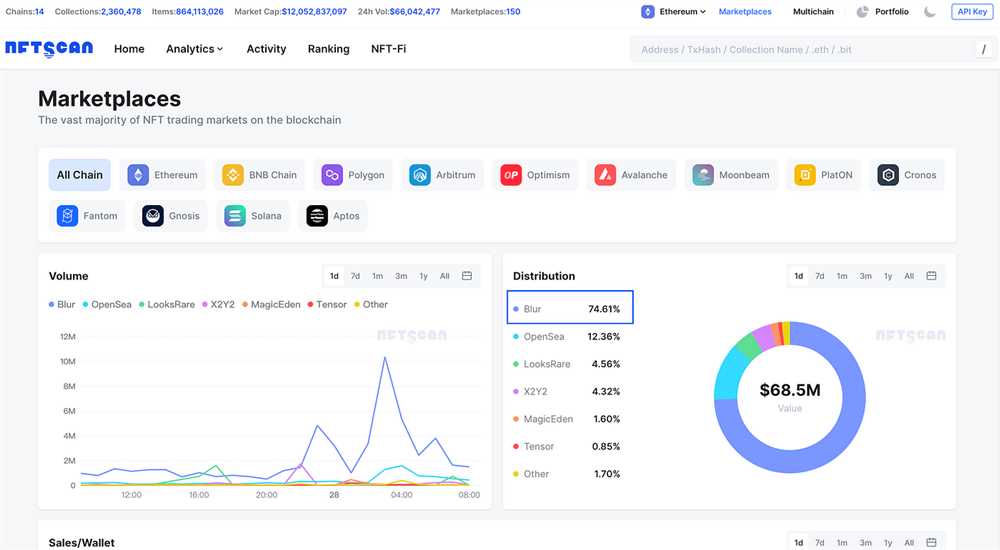

A table or graph can be used to visually represent the correlation between Blur token price and overall market trends. This can help investors easily identify patterns and trends that may not be as apparent when analyzing raw data.

In conclusion, identifying market trends is crucial for making informed investment decisions in the cryptocurrency market, particularly when it comes to tokens like Blur. By exploring the correlation between Blur token price and overall market trends, investors can gain valuable insights that can help them maximize their investment potential.

The Role of $Blur Token in the Cryptocurrency Market

When exploring the correlation between the price of the $Blur token and overall cryptocurrency market trends, it is important to understand the role this token plays in the market.

The $Blur token, like any other cryptocurrency token, is a digital asset that uses cryptography to secure financial transactions. However, what sets $Blur apart is its unique focus on privacy and anonymity. This token is specifically designed to provide users with a high level of privacy when transacting in the cryptocurrency market.

With the increasing demand for privacy-focused cryptocurrencies, the $Blur token has gained significant attention and popularity among investors and traders. Its price often reflects the overall market sentiment towards privacy and the demand for anonymous transactions.

One of the key factors influencing the price of the $Blur token is its correlation with other major cryptocurrencies. As the market trends of cryptocurrencies such as Bitcoin and Ethereum influence the overall sentiment in the market, the $Blur token is not immune to these trends. However, due to its unique focus on privacy, it may sometimes behave differently than other cryptocurrencies.

Another factor shaping the price of the $Blur token is the adoption and usage of the token within the cryptocurrency community. As more individuals and businesses recognize the value of privacy-centric transactions, the demand for the $Blur token increases, driving its price higher. Similarly, any negative developments or concerns regarding privacy in the cryptocurrency world can impact the price negatively.

| Factors affecting the $Blur token price |

|---|

| Market trends of major cryptocurrencies |

| Adoption and usage within the cryptocurrency community |

In summary, the $Blur token plays a significant role in the cryptocurrency market by providing users with privacy and anonymity. Its price is influenced by the overall market trends, particularly those of major cryptocurrencies. Additionally, the adoption and usage of the token within the cryptocurrency community also impact its price. As more individuals recognize the importance of privacy in their transactions, the $Blur token is likely to continue gaining traction in the market.

Overview of the $Blur Token

The $Blur token is a cryptocurrency that is part of the overall cryptocurrency market. It is important to explore the correlation between the blur token price and the overall market trends in order to gain a better understanding of its value and potential future growth.

As with other tokens in the cryptocurrency market, the price of the Blur token can be influenced by various factors such as supply and demand, market sentiment, regulatory changes, and technological advancements. By exploring these factors and tracking the overall market trends, investors and enthusiasts can make informed decisions about the potential performance of the blur token.

It is worth noting that the correlation between the blur token price and the overall cryptocurrency market trends is not always straightforward. While there may be instances where the price of the blur token closely follows the overall market trends, there can also be periods where the two diverge.

Investigating the correlation between the blur token price and the overall market trends requires looking at historical data and analyzing patterns and trends. This can help identify potential opportunities and risks associated with investing in the blur token.

Additionally, it is important to keep in mind that the cryptocurrency market is highly volatile and subject to rapid price fluctuations. This volatility can make it challenging to accurately predict the performance of any individual token, including the blur token.

Overall, exploring the correlation between the blur token price and the overall cryptocurrency market trends is a valuable exercise for investors and enthusiasts looking to gain a deeper understanding of the token’s value and potential growth. By staying informed and conducting thorough research, individuals can make more informed decisions about their investments in the blur token and the cryptocurrency market as a whole.

What is the correlation between blur token price and overall cryptocurrency market trends?

The correlation between blur token price and overall cryptocurrency market trends is strong. When the cryptocurrency market is experiencing a bull run, the price of blur token tends to increase as well. Conversely, during a bear market, the price of blur token tends to decrease.

How does the price of blur token change during a bull market?

During a bull market, the price of blur token tends to increase. This is because there is a higher demand for cryptocurrencies in general, and investors are more willing to invest in speculative assets like blur token. The positive sentiment in the market and increased buying pressure drive up its price.

What factors can influence the price of blur token during a bear market?

During a bear market, the price of blur token can be influenced by several factors. These include overall market sentiment, regulatory developments, investor confidence, and the performance of other cryptocurrencies. If there is fear and uncertainty in the market, investors may sell off their blur token holdings, leading to a decrease in price.

+ There are no comments

Add yours