The rapid rise of cryptocurrency and blockchain technology has brought about a paradigm shift in the realm of financial transactions. This technological innovation has paved the way for decentralized systems that prioritize security and transparency. However, this decentralization comes at a price: the potential for blurred boundaries between privacy and compliance, raising important ethical implications.

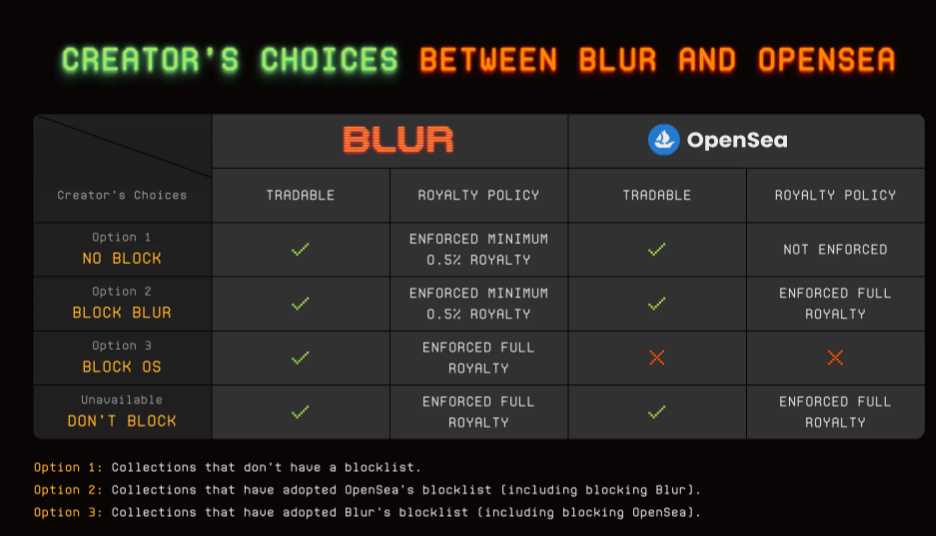

With the advent of cryptocurrency, individuals have gained more control over their financial assets, utilizing blockchain technology to ensure trust, protection, and integrity. The blurred line between privacy and compliance arises when balancing the need for anonymity and the demand for regulatory transparency. The decentralized nature of crypto transactions has raised concerns about accountability and surveillance, with governments and regulatory bodies struggling to enforce governance and regulation.

One of the key ethical considerations is the issue of privacy. While blockchain technology provides a high level of security, it also presents challenges for maintaining anonymity. On one hand, users may value the privacy and discreetness offered by cryptocurrencies, enjoying the freedom from government surveillance and intrusion. On the other hand, this same anonymity can facilitate illicit activities, such as money laundering and the funding of illegal operations.

Another ethical concern is the compliance aspect of cryptocurrency. The decentralized nature of crypto transactions makes it difficult for regulatory bodies to enforce transparency and ensure compliance with legal frameworks. This challenge hampers efforts to prevent financial crimes and protect the rights of individuals. Striking a balance between privacy and compliance becomes crucial in promoting a system that fosters innovation and growth while maintaining ethical standards.

To address these ethical implications, it is essential to establish a regulatory framework that provides a clear set of guidelines and rules for the use of cryptocurrencies. This framework should prioritize the protection of user data and financial transactions while ensuring transparency and accountability. Additionally, education and awareness programs should be implemented to help users understand the risks and responsibilities associated with cryptocurrency.

In conclusion, the rapid development of cryptocurrency and blockchain technology presents both opportunities and challenges. The blurred line between privacy and compliance raises important ethical implications that require careful consideration. Striking a balance between privacy and regulatory compliance is essential to harness the full potential of crypto technology while upholding ethical standards and protecting the rights of individuals.

The Challenges of Blurred Crypto

The rise of blockchain technology and the advent of cryptocurrencies have brought about numerous benefits, such as enhanced security, decentralization, and innovation. However, with these advancements come a series of challenges and ethical implications, particularly in the area of privacy and compliance.

One of the main challenges is the blurred line between privacy and compliance in the crypto space. While blockchain technology offers a high level of anonymity and protection for digital assets, it also raises concerns about regulatory compliance and accountability. The decentralized nature of cryptocurrencies makes it difficult for governments and regulatory bodies to enforce transparency and surveillance, leading to potential risks such as money laundering, terrorist financing, and fraud.

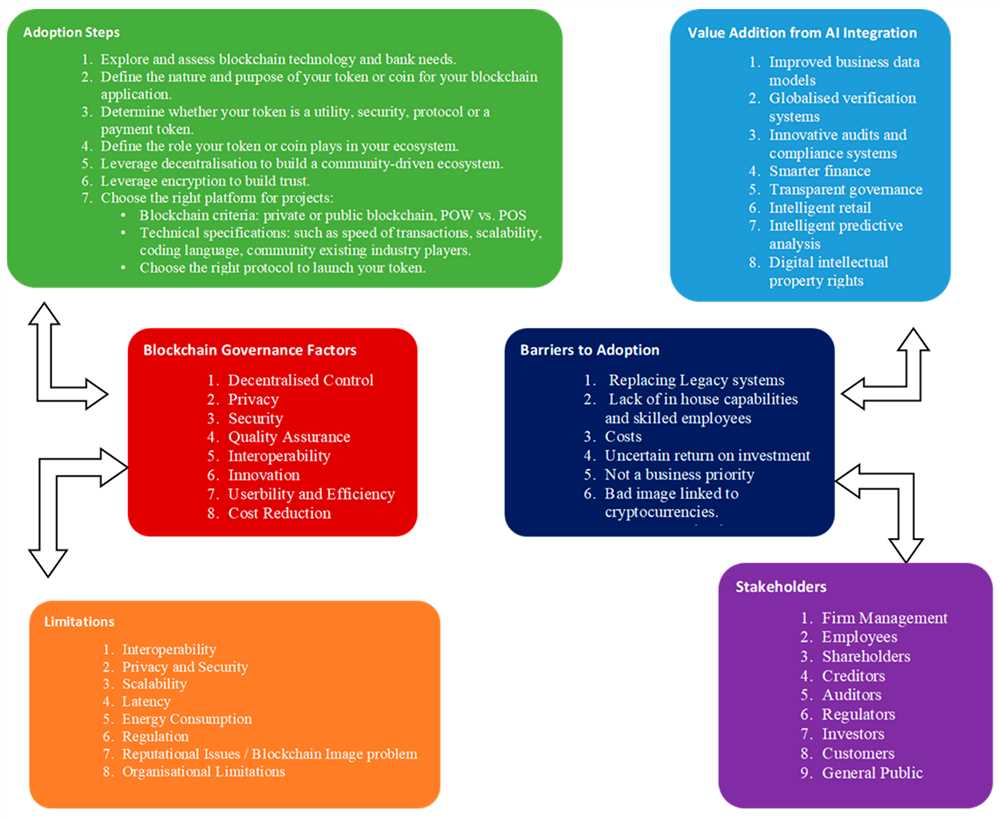

Another challenge is the lack of a clear regulatory framework for cryptocurrencies. As governments struggle to keep up with the rapid pace of innovation in the crypto industry, there is a need for comprehensive regulation that balances the rights of individuals with the need for financial integrity and consumer protection. This framework should address issues such as investor protection, anti-money laundering measures, taxation, and data privacy.

Additionally, the blurred nature of crypto poses challenges in terms of governance and accountability. Traditional financial systems have established mechanisms for dispute resolution, fraud prevention, and asset protection. However, the decentralized and pseudonymous nature of cryptocurrencies makes it challenging to hold individuals and organizations accountable for their actions. This lack of accountability can lead to potential abuses and the erosion of trust in the crypto ecosystem.

Furthermore, the implications of blurred crypto extend beyond the financial realm. As cryptocurrencies become more integrated into various aspects of society, including healthcare, voting systems, and intellectual property rights, the need for regulatory oversight and protection of data becomes even more critical. The potential for data breaches and privacy violations necessitates a comprehensive approach to ensure the integrity and security of digital transactions.

In conclusion, the blurred nature of crypto presents numerous challenges in terms of privacy, compliance, governance, and accountability. As the crypto industry continues to evolve, it is imperative to strike a balance between the benefits of innovation and the need for regulatory safeguards. By addressing these challenges head-on and collaboratively developing a framework that balances privacy, compliance, and responsibility, we can unlock the full potential of cryptocurrencies while ensuring the protection and trust of all participants.

Privacy Concerns in a Blurred Crypto Landscape

As the financial world continues to embrace the benefits of crypto and blockchain technology, new ethical implications are emerging. The blending of privacy and compliance has created a blurred landscape that raises concerns about the protection of personal data and individual rights.

Anonymity has long been one of the core principles of crypto, with users valuing the ability to conduct financial transactions without revealing their identities. However, as governments and regulatory bodies seek to establish frameworks for governance and accountability, the tension between privacy and transparency has become apparent.

Cryptocurrencies offer the potential for increased financial freedom and innovation, but they also present challenges in terms of privacy protection. The decentralized nature of blockchain technology, while providing security and integrity, also makes it difficult to implement traditional regulatory measures.

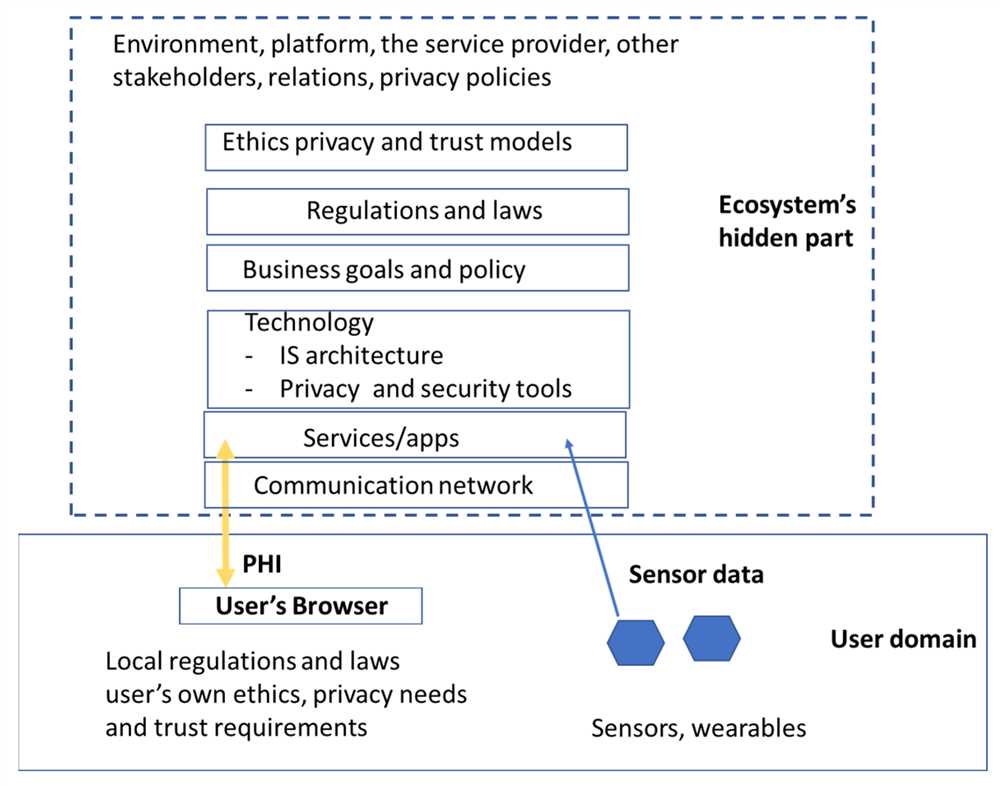

Privacy concerns arise when it comes to the storage and transmission of personal data within the crypto ecosystem. While blockchain technology ensures the immutability of transactions, it also means that once personal information is recorded, it cannot be easily removed or updated. This lack of control raises questions about the long-term privacy implications for users.

As the regulatory landscape evolves, striking the right balance between privacy and compliance is crucial. Effective regulation can ensure that individuals’ privacy rights are protected while still enabling the benefits of crypto innovation to flourish. It requires a delicate approach to avoid stifling technological advancements while addressing concerns about illicit activities and financial crimes.

Greater transparency and accountability are essential for building trust in the crypto world. While privacy remains an important aspect of financial transactions, there is a need for clearer guidelines and regulation to ensure that crypto assets are not used for illegal activities.

The blurred nature of the crypto landscape requires a collaborative effort between technology developers, regulators, and users to establish ethical standards. A transparent and accountable framework can help address privacy concerns while enabling the continued growth and adoption of cryptocurrency.

Ultimately, navigating the ethical implications of balancing privacy and compliance in the crypto realm requires a careful consideration of individual rights, data protection, and the trust of all stakeholders involved. By finding a middle ground between privacy and regulatory oversight, the crypto industry can strive towards a future that embraces both innovation and ethical responsibility.

Compliance Issues in the Face of Blurred Crypto

The rapid rise of cryptocurrency and blockchain technology has brought about a significant shift in the way financial assets are managed and transactions are conducted. While the innovation and potential of this digital technology are undeniable, its implications on compliance and regulatory frameworks cannot be ignored.

One of the key challenges in this blurred crypto landscape is the issue of accountability and compliance. With the anonymity and decentralization offered by cryptocurrencies, ensuring the protection of user data and rights becomes increasingly complex. The very nature of blockchain technology that underlies crypto transactions fosters transparency, but this also raises concerns around privacy and surveillance.

Regulatory bodies are grappling with the need to strike a delicate balance between innovation and security. In this context, compliance issues arise as traditional regulatory frameworks struggle to keep up with the evolving cryptocurrency landscape. The decentralized nature of crypto transactions makes it difficult for traditional governance and regulatory bodies to exert control and ensure the integrity of the system.

Furthermore, the blurred lines between privacy and compliance pose challenges in terms of ensuring data protection and transparency. While cryptocurrencies offer users anonymity, this can also create opportunities for illicit activities such as money laundering and tax evasion. Striking the right balance between privacy and transparency is crucial to maintaining trust in the crypto ecosystem.

Another compliance issue is the lack of standardized regulations for cryptocurrencies. Different countries and jurisdictions have varying levels of acceptance and regulatory frameworks for digital currencies, creating a fragmented landscape. This lack of regulatory clarity not only hinders compliance efforts but also leaves users vulnerable to scams and fraud.

Addressing compliance issues in the face of blurred crypto requires a multi-faceted approach. It involves the collaboration of regulatory bodies, industry stakeholders, and technology providers to develop robust frameworks that promote both innovation and security. Stricter regulation and enforcement mechanisms can help prevent misuse of cryptocurrencies while still allowing for their legitimate use.

In conclusion, the blurred crypto landscape presents numerous compliance and regulatory challenges. Balancing the ethical implications of privacy and compliance is crucial to establishing trust and ensuring the protection of user rights. As the technology continues to evolve, finding the right balance between innovation and security will be essential for the widespread adoption and acceptance of cryptocurrencies.

Achieving a Balance: Privacy and Compliance

In the era of blurred lines between privacy and compliance, achieving a balance is crucial. Regulation and data have become paramount in the financial world, but balancing these requirements with privacy is a delicate task. The rise of cryptocurrency and decentralization has further complicated the landscape, adding new dimensions to the already complex equation.

Financial institutions must navigate the blurred boundaries of privacy and compliance, ensuring both the security and regulatory requirements are met. Blockchain technology and digital assets offer unique advantages in terms of data integrity and anonymity, but they also pose challenges when it comes to accountability and trust.

On one hand, privacy rights and protection are essential for individuals and businesses alike in the digital age. Cryptocurrency provides a means for secure and private transactions, shielding sensitive information from unwarranted surveillance. This level of anonymity has its benefits, especially for those seeking to protect their financial activities.

On the other hand, compliance and governance must also be considered to maintain transparency and prevent illegal activities. Regulators are increasingly focused on ensuring that cryptocurrency transactions are conducted within the framework of existing laws and regulations. Balancing privacy and compliance means finding ways to adhere to these regulatory requirements while preserving the essence of decentralization and innovation.

One possible solution lies in adopting a hybrid approach that combines elements of privacy and compliance. This approach aims to strike a balance by implementing privacy-enhancing technologies that still allow for some level of oversight. By incorporating features that provide pseudonymity, traceability, or controlled access, financial institutions can comply with regulatory standards while ensuring that user privacy is protected.

Integrating privacy and compliance into the design of blockchain technology is crucial. Crypto assets can benefit from a system that enables self-regulation while also providing the necessary transparency required by regulatory bodies. By embedding privacy and compliance features directly into the technology infrastructure, financial institutions can streamline the process and enhance security.

The implications of finding the right balance between privacy and compliance are far-reaching. It ensures the protection of individuals’ rights and privacy, while also fostering trust in the cryptocurrency ecosystem. Striking this balance is essential for the continued growth and adoption of digital assets, providing a solid foundation for the future of financial transactions.

| Implications | Privacy | Compliance | Blockchain | Security |

|---|---|---|---|---|

| Protection of individuals’ rights | ✓ | |||

| Ensuring accountability and trust | ✓ | |||

| Preserving the essence of decentralization | ✓ | |||

| Fostering innovation and technology | ✓ |

Exploring Ethical Considerations in Privacy and Compliance

As the use of blockchain technology continues to expand, one of the key ethical considerations that arise is the balancing act between financial compliance and individual privacy. The decentralized nature of cryptocurrencies and the anonymity they offer have led to a blurred line between protecting personal data and adhering to regulatory frameworks.

On one hand, the adoption of cryptocurrencies and blockchain technology has brought greater transparency and trust to financial transactions. The immutability and integrity of data on the blockchain ensure that transactions are secure and cannot be altered. This innovation has the potential to revolutionize the way we handle digital assets and conduct business, allowing for greater efficiency and accountability.

However, this newfound transparency has also sparked concerns regarding privacy and surveillance. While blockchain technology ensures the security of transactions, it also makes them traceable and potentially visible to third parties. This balancing act between privacy and compliance becomes even more complex when considering regulatory governance and the potential for abuse of personal data.

One of the key implications is the need for a regulatory framework that can navigate these ethical considerations. As decentralized cryptocurrencies challenge traditional financial regulation, governments and regulatory bodies must adapt to ensure the protection of individual rights while still maintaining the necessary oversight and compliance. Striking the right balance will require careful consideration of privacy and security concerns, as well as an understanding of the implications of blurred lines between anonymity and compliance.

Additionally, there is a need for greater transparency and understanding among users of cryptocurrency regarding their rights and the potential risks associated with their data. Education and awareness are vital in ensuring that individuals understand the trade-offs involved in using cryptocurrencies and are empowered to make informed decisions about their privacy and security.

The ethical implications of the blurred line between privacy and compliance in cryptocurrency extend beyond financial transactions. The use of blockchain technology has the potential to revolutionize industries beyond finance, such as healthcare and supply chain management. As these technologies continue to innovate and evolve, addressing the ethical considerations of privacy, compliance, and trust will be crucial to ensuring the responsible and ethical implementation of blockchain technology.

| Ethical considerations | Implications |

|---|---|

| Anonymity | Protection of personal data and privacy |

| Regulatory governance | Ensuring compliance with applicable laws and regulations |

| Transparency | Building trust in financial transactions |

| Security | Preventing fraud and unauthorized access |

In conclusion, the ethical considerations surrounding the balancing act of privacy and compliance in the cryptocurrency world are complex and multifaceted. Striking the right balance between innovation and regulation is crucial in ensuring the responsible and ethical use of blockchain technology. Transparency, education, and a robust regulatory framework are all essential elements in navigating these ethical considerations and ensuring the protection of individual rights while harnessing the potential of cryptocurrencies.

Implementing Regulatory Measures for Balancing Privacy and Compliance

In today’s digital age, anonymity and privacy have become fundamental rights for individuals. At the same time, governments and regulatory bodies are focused on maintaining governance, ensuring financial integrity, and protecting user rights. This creates a delicate balancing act between privacy and compliance.

The emergence of technologies such as cryptocurrencies and blockchain has introduced a new layer of complexity to this issue. These technologies offer a high level of transparency and decentralization, making them attractive for users seeking privacy and trust. However, their potential implications for regulatory and compliance frameworks cannot be ignored.

To strike the right balance between privacy and compliance, regulatory measures need to be implemented. These measures should aim to ensure the protection of user data while providing the necessary accountability and transparency required by financial institutions and regulatory bodies.

One approach is to develop a regulatory framework specifically tailored to the unique characteristics of digital assets, including cryptocurrencies. This framework should address concerns such as anti-money laundering (AML) and know-your-customer (KYC) regulations, while also respecting users’ privacy rights.

Another important aspect is cooperation between the private sector and regulatory bodies. Open dialogue and collaboration can help create a better understanding of the technology and its potential implications. By working together, both parties can develop solutions that balance privacy and compliance effectively.

Furthermore, the implementation of advanced encryption and privacy-enhancing technologies can also help protect user data and maintain privacy. Such technologies can ensure that personal information is securely stored and transmitted, while still allowing for compliance with regulatory requirements.

Lastly, continuous monitoring and surveillance play a crucial role in maintaining a balance between privacy and compliance. Regulatory bodies can employ advanced analytical tools to detect suspicious activities and potential violations of privacy or compliance regulations. However, this surveillance should be conducted in a transparent and accountable manner, with strict adherence to privacy laws.

In conclusion, the blurred line between privacy and compliance in the digital age necessitates the implementation of regulatory measures. These measures should aim to provide the necessary protection for user assets while respecting privacy rights. By developing a regulatory framework tailored to the unique characteristics of digital assets, promoting cooperation between stakeholders, implementing privacy-enhancing technologies, and conducting surveillance responsibly, a balance can be achieved that ensures both privacy and compliance are maintained in the digital realm.

What are the ethical implications of blurred crypto balancing privacy and compliance?

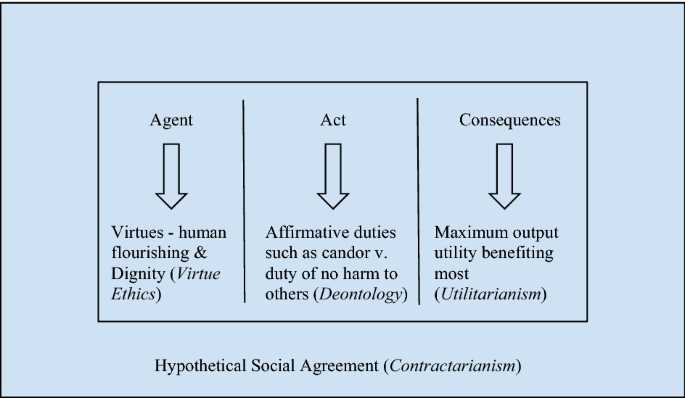

The ethical implications of blurred crypto balancing privacy and compliance are that it raises questions about the balance between individual privacy and regulatory compliance. It challenges the traditional notion of privacy and the ability of individuals to keep their financial transactions private. On one hand, privacy is a fundamental right and individuals should have the freedom to transact in a private and secure manner. On the other hand, compliance with regulations is essential for preventing illegal activities such as money laundering and terrorist financing. Finding the right balance between privacy and compliance is a complex ethical dilemma.

How does blurred crypto balancing privacy and compliance affect individual privacy?

Blurred crypto balancing privacy and compliance affects individual privacy by making it more difficult for individuals to keep their financial transactions private. Traditional financial systems have layers of regulations in place to ensure compliance, but cryptocurrencies, such as Bitcoin, often offer a higher level of privacy and anonymity. While this can be advantageous for individuals who value their privacy, it also creates challenges for regulators in preventing illegal activities. As a result, there is a push for stricter regulations and increased transparency in the crypto space, which can encroach on individual privacy.

Why is finding the right balance between privacy and compliance in crypto so challenging?

Finding the right balance between privacy and compliance in crypto is challenging because it involves navigating complex ethical and legal considerations. Privacy is considered a fundamental right and individuals should have the freedom to keep their financial transactions private. However, compliance with regulations is crucial for preventing illegal activities. Stricter regulations and increased transparency can encroach on individual privacy, but too much privacy can enable criminal activities. Balancing the interests of individuals, regulators, and society as a whole requires careful consideration of the ethical implications involved.

+ There are no comments

Add yours