Decentralized finance, or DeFi, is an emerging innovation that is reshaping the financial industry. It leverages blockchain technology to create a peer-to-peer marketplace where users can transact securely and without intermediaries. This decentralized system holds great promise for the future of finance.

However, as with any new technology, there are risks involved. The blurred boundaries of DeFi raise questions about privacy, security, and regulation. While the decentralized nature of this system provides opportunities for innovation and increased liquidity, it also poses challenges in terms of data protection and governance.

One of the main risks of decentralized finance is related to credit. In a decentralized system, anyone can participate in lending and borrowing without going through traditional financial institutions. While this opens up opportunities for individuals who are underserved by the traditional banking system, it also increases the risk of defaults and fraud.

Another risk in the DeFi space is the lack of regulation. The absence of centralized authorities and the autonomous nature of decentralized autonomous organizations (DAOs) make it difficult to enforce rules and protect investors. This regulatory uncertainty creates opportunities for bad actors to take advantage of unsuspecting users.

Despite these risks, decentralized finance offers numerous opportunities. By leveraging smart contracts and digital assets, DeFi protocols can enable new forms of financial transactions, such as decentralized exchanges and lending platforms. This innovation has the potential to reduce costs, increase accessibility, and empower individuals in the financial system.

The future of finance is being shaped by the power of blockchain technology and the emergence of decentralized finance. The boundaries between traditional finance and the crypto world are becoming increasingly blurred. While there are risks associated with this new paradigm, the opportunities for innovation and financial inclusion are vast. It is crucial for regulators and industry participants to work together to strike the right balance between fostering innovation and protecting users in this rapidly evolving space.

Understanding Decentralized Finance

Decentralized finance, also known as DeFi, is a rapidly emerging system that utilizes blockchain technology to create a decentralized financial marketplace. The boundaries of traditional finance are being blurred, as DeFi offers new opportunities for individuals to access liquidity and participate in the global economy.

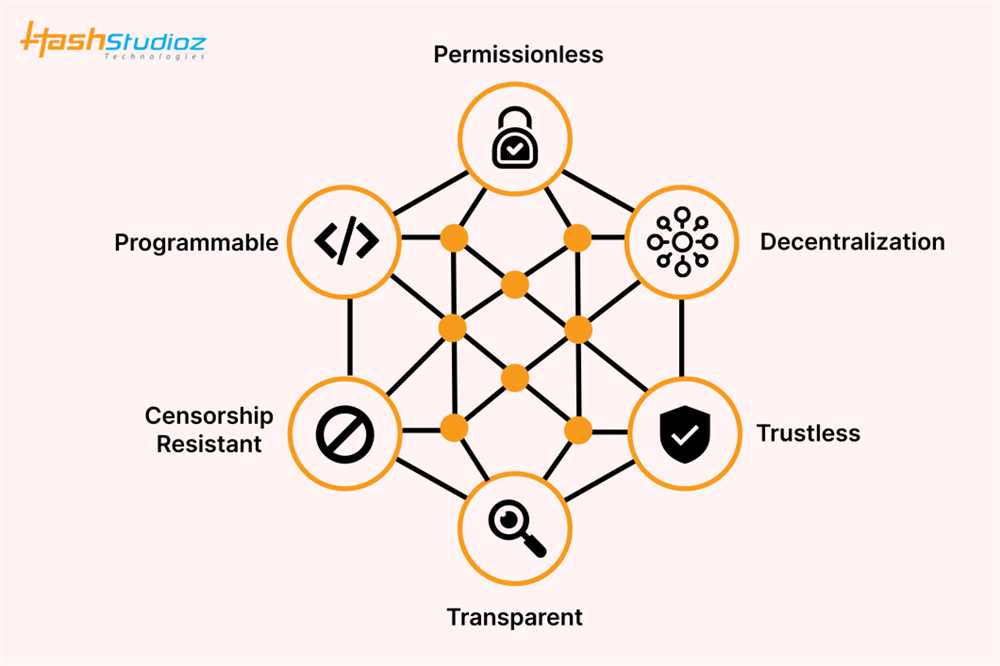

At its core, decentralized finance aims to remove intermediaries and enable peer-to-peer transactions through the use of smart contracts. This decentralized nature reduces reliance on centralized authorities and introduces a higher level of privacy and security.

One of the key innovations of DeFi is the ability to tokenize and trade digital assets, such as cryptocurrency, on decentralized exchanges. These exchanges operate on decentralized protocols, allowing users to trade directly with one another without the need for a traditional intermediary.

Decentralized finance also offers new ways to access credit and lending services. Through DeFi platforms, individuals can secure loans using their digital assets as collateral, without needing to go through a traditional banking system. This opens up opportunities for those who may not have access to traditional banking services.

However, it’s important to note that despite its potential benefits, decentralized finance also comes with risks. The lack of regulation and oversight means that there is a higher potential for fraud and scams. Additionally, the decentralized nature of DeFi means that there is limited recourse if something goes wrong, as there is no central authority to turn to.

Another challenge of decentralized finance is the management and protection of user data. While blockchain technology offers a high level of security for transactions, there are still concerns about the privacy and integrity of user information.

Decentralized finance also introduces the concept of decentralized autonomous organizations (DAOs), which are organizations that operate through smart contracts and are governed by the community. While this can lead to increased transparency and accountability, it also raises questions about decision-making and potential conflicts of interest.

In conclusion, decentralized finance represents a new and exciting frontier in the world of finance. It offers opportunities for individuals to access liquidity, trade digital assets, and access credit in a peer-to-peer manner. However, it also poses risks due to its decentralized nature and lack of regulation. As the boundaries between traditional finance and DeFi continue to blur, it is important for individuals to understand the risks and opportunities associated with this emerging technology.

Defining Decentralized Finance

Decentralized finance, also known as DeFi, is an emerging innovation in the world of finance that seeks to redefine traditional boundaries. It leverages the power of decentralized technologies such as blockchain, smart contracts, and decentralized autonomous organizations (DAOs) to create a system that is open, transparent, and accessible to all.

One of the main advantages of decentralized finance is the increased security it offers. By utilizing cryptographic techniques and peer-to-peer networks, decentralized finance provides a more secure environment for transactions and the storage of digital assets. This enhanced security is especially important in the realm of cryptocurrencies, where maintaining privacy and protecting data are paramount.

Decentralized finance also eliminates the need for intermediaries such as banks and financial institutions. Instead, it enables direct transactions between parties through decentralized exchanges, which utilize smart contracts to execute trades. This not only reduces transaction costs but also eliminates the need to rely on centralized authorities for credit approvals or verification.

Furthermore, decentralized finance allows for greater liquidity and accessibility. Anyone with an internet connection can participate in the DeFi marketplace, providing an opportunity for individuals who may not have access to traditional financial systems. Additionally, the use of decentralized protocols and platforms enables individuals to seamlessly trade, lend, and borrow digital assets, further expanding the possibilities for financial inclusion and innovation.

However, with the benefits of decentralized finance come certain risks and challenges. The regulatory landscape surrounding DeFi is still evolving, and there is a need to strike a balance between innovation and consumer protection. Issues such as fraud, market manipulation, and lack of transparency can arise in decentralized finance, requiring careful monitoring and regulation to ensure a fair and secure financial ecosystem.

In conclusion, decentralized finance represents a paradigm shift in the way we interact with the financial system. Through the use of emerging technologies and principles of decentralization, DeFi provides new opportunities for individuals to engage in secure, peer-to-peer transactions, and access financial services. While there are risks and challenges associated with this emerging field, the potential for innovation and financial empowerment outweighs the blurred boundaries and uncertainties that currently exist.

The Benefits of Decentralized Finance

Decentralized finance, or DeFi, offers a multitude of benefits that are reshaping the traditional financial system. By leveraging blockchain technology, DeFi provides enhanced security, decentralization, and transparency.

One of the key advantages of DeFi is its ability to eliminate the need for intermediaries. Traditionally, the financial system relies on centralized entities such as banks and exchanges to facilitate transactions. However, with decentralized finance, individuals can transact directly with each other through peer-to-peer protocols. This not only reduces the reliance on third parties but also increases the efficiency and speed of transactions.

In addition to peer-to-peer transactions, DeFi also enables the exploration of new credit opportunities. Through smart contracts, individuals can create and participate in decentralized lending and borrowing platforms. This opens up access to credit for individuals who may not have been able to obtain it through traditional channels. Furthermore, these platforms often offer competitive interest rates and flexible terms, creating a more inclusive and accessible financial marketplace.

Decentralized finance also promotes liquidity in the market. By allowing individuals to trade digital assets directly, DeFi eliminates the need for centralized exchanges. Individuals can trade cryptocurrencies and other digital assets seamlessly, without having to entrust their assets to third-party platforms. This not only reduces the risk of hacks and theft but also improves overall liquidity in the market.

With DeFi, innovation is flourishing. The emerging field of decentralized autonomous organizations (DAOs) allows for the creation of decentralized governance structures. These organizations operate based on predefined rules and are managed by token holders, providing a new way to govern and manage resources.

Furthermore, decentralized finance offers enhanced privacy. While blockchain technology provides transparency by recording all transactions on a public ledger, users have control over their personal data. Personal information is not required to be shared when participating in DeFi protocols, providing individuals with greater privacy and control over their financial activities.

However, it is worth noting that the blurred boundaries and lack of regulation in the DeFi space also present risks. Without proper regulation, there is a greater possibility of scams and fraud. Additionally, the decentralized nature of DeFi means that responsibility lies with the individual, and there may not be recourse in the event of loss or theft.

In conclusion, decentralized finance offers a range of benefits, including enhanced security, decentralization, liquidity, credit opportunities, innovation, and privacy. As the field continues to grow and evolve, it is important to carefully navigate the risks and opportunities that it presents.

The Challenges of Decentralized Finance

Decentralized finance, or DeFi, offers numerous opportunities in the world of finance. It has the potential to revolutionize the way data is stored and transactions are conducted by utilizing smart contracts and blockchain technology. However, it also presents several challenges and risks that must be addressed.

One of the main challenges of decentralized finance is the blurred boundaries between different systems. Crypto and digital assets can be easily transferred across peer-to-peer networks, making it difficult to define clear regulations and boundaries. This lack of regulation can lead to potential risks such as fraud and money laundering.

Another challenge is the issue of privacy and security. While blockchain technology provides transparency, it also poses challenges in protecting user privacy. Transactions conducted on a public blockchain are visible to everyone, raising concerns about the confidentiality of sensitive financial information.

Liquidity is another challenge for decentralized finance. In traditional finance, centralized exchanges provide liquidity by matching buyers and sellers. However, in DeFi, liquidity is often fragmented across different platforms, making it more challenging to ensure efficient trading and price discovery.

Furthermore, the emerging field of decentralized autonomous organizations (DAOs) presents its own set of challenges. DAOs are organizations that operate based on smart contracts and are governed by community voting. However, these organizations lack legal frameworks and governance structures, which can lead to challenges in decision-making and accountability.

Regulation is another challenge that decentralized finance must address. As DeFi becomes more popular, regulators are starting to pay attention and explore ways to regulate this market. Striking the balance between innovation and regulation is crucial to ensure the growth and stability of the DeFi ecosystem.

In conclusion, while decentralized finance presents numerous opportunities for innovation and financial inclusion, it also comes with its own set of challenges. The blurred boundaries, privacy concerns, fragmented liquidity, emerging DAOs, and regulatory issues are all hurdles that must be overcome for the full potential of DeFi to be realized.

Risks in Decentralized Finance

In the emerging world of decentralized finance (DeFi), there are both risks and opportunities for participants. While the technology behind decentralized finance, such as blockchain and smart contracts, has the potential to revolutionize the financial system, it also introduces new risks that need to be explored.

One of the key risks in decentralized finance is the lack of regulation. Unlike traditional finance, which is subject to government oversight, decentralized finance operates outside of the traditional regulatory framework. This lack of regulation can lead to potential issues with security, transparency, and investor protection.

Decentralized finance relies on decentralized autonomous organizations (DAOs), which are governed by smart contracts and protocols. While the use of DAOs allows for innovation and eliminates the need for intermediaries, it also introduces risks. The code that governs DAOs is not infallible and can contain bugs or vulnerabilities that can be exploited by malicious actors.

Another risk in decentralized finance is the volatility of cryptocurrencies. Digital assets, such as Bitcoin and Ethereum, are often used as the basis for decentralized finance activities. However, the value of these cryptocurrencies can be extremely volatile, leading to potential losses for participants in decentralized finance.

Liquidity is also a risk in decentralized finance. While decentralized exchanges (DEXs) provide a peer-to-peer marketplace for trading digital assets, the liquidity of these platforms can be limited. This can make it difficult for participants to enter or exit positions quickly, which can lead to potential losses or missed opportunities.

Privacy is another concern in decentralized finance. While the blockchain technology that underlies decentralized finance is often touted for its transparency, there are also potential privacy risks. Transactions on the blockchain are public and can be traced back to their origin, which can expose sensitive financial data.

Overall, the blurred boundaries of decentralized finance bring both risks and opportunities. Participants in decentralized finance must be aware of these risks and take appropriate measures to mitigate them. As the technology continues to evolve, it is important to explore and understand the risks associated with decentralized finance in order to fully leverage its potential.

Lack of Regulation and Oversight

The advent of decentralized finance (DeFi) has blurred the boundaries of traditional finance, creating a new marketplace that operates outside the confines of centralized institutions. This decentralization, powered by blockchain technology, has given rise to a plethora of opportunities and risks in the world of cryptocurrency.

One of the primary concerns in this emerging space is the lack of regulation and oversight. Unlike the traditional financial system, which is heavily regulated and monitored by governmental authorities, the DeFi ecosystem operates without a centralized authority overseeing its activities. While this decentralization brings inherent benefits such as increased transparency and liquidity, it also exposes participants to potential risks.

Decentralized autonomous organizations (DAOs), smart contracts, and peer-to-peer exchanges form the backbone of the DeFi universe. These protocols facilitate the seamless transfer of digital assets and the creation of decentralized financial products. However, the absence of regulatory oversight means that there is no central authority to ensure the security and reliability of these protocols.

Without clear regulations, participants in the DeFi space face risks related to security, privacy, and credit. The absence of a centralized system for verifying identities and conducting due diligence opens the door for potential fraud and hacking. Smart contracts, while designed to automate transactions and reduce reliance on intermediaries, can still be vulnerable to coding errors or malicious actors. Furthermore, the lack of regulatory scrutiny means that DeFi platforms may not adequately assess the creditworthiness of borrowers, potentially leading to higher default rates.

While the lack of regulation poses risks, it also presents opportunities for innovation and disruption. The DeFi space has introduced novel concepts such as automated market makers and yield farming, which have the potential to revolutionize traditional financial practices. DApps (decentralized applications) built on blockchain technology enable users to access financial services without intermediaries, increasing financial inclusivity and reducing transaction costs. DeFi also offers the potential for decentralized governance, allowing participants to have a direct say in the decision-making processes of the ecosystem.

In summary, the lack of regulation and oversight in the DeFi space creates both risks and opportunities. Participants must navigate the decentralized landscape with caution, understanding the potential security vulnerabilities and the lack of accountability. As DeFi continues to evolve, it is essential for regulators to explore ways to strike a balance between allowing innovation and ensuring the protection of participants and the stability of the broader financial system.

Vulnerabilities in Smart Contracts

Smart contracts are a critical component of the decentralized finance (DeFi) ecosystem, enabling a variety of innovative financial transactions and services. These self-executing contracts are written in code and automatically execute when predetermined conditions are met. They have gained popularity due to their potential to automate processes, reduce intermediaries, and increase efficiency in managing digital assets.

However, the emergence of smart contracts also brings potential vulnerabilities and risks to the financial system. As decentralized finance continues to explore the boundaries of technology, it is crucial to understand and address these vulnerabilities to ensure the security and integrity of DeFi platforms.

One of the main vulnerabilities in smart contracts is the risk of coding errors or bugs. Smart contracts are written by humans, and even small mistakes or oversights in the code can lead to significant security breaches. These vulnerabilities can be exploited by malicious actors to access, manipulate, or steal data, digital assets, or funds. In the emerging DeFi marketplace, where privacy and decentralization are key, these vulnerabilities pose a significant risk.

Moreover, the interconnected nature of DeFi protocols and the peer-to-peer nature of decentralized exchanges and platforms create additional risks. A vulnerability in one smart contract or protocol can have cascading effects on the entire ecosystem. This interconnectedness can also make it challenging to regulate and oversee the DeFi space, as traditional regulatory frameworks may not fully address the risks and complexities of decentralized finance.

Another vulnerability is the lack of transparency and auditability in some smart contracts. While the blockchain technology underlying DeFi provides a level of transparency, the actual smart contract code may not always be readily accessible or auditable. This lack of transparency can make it difficult to identify potential vulnerabilities or detect malicious activities, compromising the security and trust of the DeFi ecosystem.

To mitigate these vulnerabilities, the DeFi community must prioritize security measures, such as rigorous code audits, bug bounties, and continuous monitoring of smart contracts. Additionally, implementing standards and best practices for smart contract development can help minimize the risk of coding errors and ensure the overall security of the DeFi ecosystem.

Overall, while decentralized finance offers exciting opportunities for innovation and financial inclusion, it is crucial to acknowledge and address the risks and vulnerabilities in smart contracts. By embracing technology, transparency, and regulation, the DeFi community can build a more secure and resilient decentralized financial system.

Market Volatility and Risk Exposure

The emergence of decentralized finance (DeFi) and decentralized autonomous organizations (DAOs) has brought about significant innovation and opportunities in the world of finance. However, with this decentralization and the use of cryptocurrency, there comes a certain level of volatility and risk exposure that investors and participants must navigate.

Decentralization, one of the core principles of DeFi, presents both advantages and challenges when it comes to security and risk management. On one hand, decentralization removes the need for intermediaries and central authorities, allowing for greater transparency and trust in the system. This is achieved through the use of blockchain technology, smart contracts, and peer-to-peer exchanges.

However, the decentralized nature of DeFi also means that there is a lack of regulation and oversight, which can increase the risks associated with investing in digital assets. The boundaries between traditional finance and DeFi are blurred, making it difficult for regulators to keep up with the rapid advancements in the space.

Market volatility is a significant risk that participants in DeFi must contend with. The value of cryptocurrencies can fluctuate dramatically, which can lead to potential losses for individuals holding these assets. Additionally, the liquidity of DeFi protocols can vary widely, which can further impact the stability and reliability of the marketplace.

Risks related to data privacy and security are also prevalent in the DeFi space. As transactions are conducted on public blockchains, there is a risk that sensitive information could be exposed. Moreover, the use of smart contracts introduces the potential for bugs and vulnerabilities that could be exploited by malicious actors.

Despite these risks, the opportunities presented by DeFi are immense. The ability to access financial services and participate in a decentralized ecosystem opens up new avenues for individuals from all over the world. The elimination of intermediaries also leads to lower transaction costs and greater financial inclusivity.

Ultimately, exploring the risks and opportunities of DeFi requires a cautious and informed approach. Participants must educate themselves on the intricacies of the technology, understand the potential risks involved, and make informed decisions based on their risk tolerance and investment goals. In this rapidly evolving landscape, it is crucial for regulators to strike the right balance between fostering innovation and ensuring investor protection.

What is decentralized finance (DeFi)?

Decentralized finance (DeFi) refers to a financial system that operates on blockchain technology and eliminates the need for intermediaries. It allows users to engage in various financial activities, such as lending, borrowing, and trading, without relying on traditional financial institutions.

What are the risks associated with decentralized finance?

There are several risks associated with decentralized finance. One of the main risks is the smart contract risk – if there are any vulnerabilities in the smart contracts, users’ funds could be at risk. Another risk is the regulatory risk, as the regulatory framework for DeFi is still evolving and there is uncertainty regarding how it will be regulated. Additionally, there is a risk of market volatility, as the value of cryptocurrencies can be highly volatile.

What are the advantages of decentralized finance?

Decentralized finance offers several advantages. One of the main advantages is that it provides financial services to people who are unbanked or underbanked, as all you need is a smartphone and internet access to participate in DeFi. It also eliminates the need for intermediaries, reducing costs and increasing efficiency. Moreover, decentralized finance enables greater financial privacy and control over assets.

How can decentralized finance revolutionize the financial industry?

Decentralized finance has the potential to revolutionize the financial industry by democratizing access to financial services. It can provide financial services to people who have been traditionally excluded from the traditional financial system. It also has the potential to disrupt traditional financial intermediaries, as it eliminates the need for middlemen. Additionally, decentralized finance can increase financial transparency and reduce the risk of fraud.

+ There are no comments

Add yours