Are you tired of the volatility in the cryptocurrency market? Looking for stable gains and a way to minimize risk? Look no further than Blur USDT.

Blur USDT is a stablecoin that provides the perfect solution for traders seeking a secure currency to invest in. Whether you’re a beginner or an experienced trader, Blur USDT offers a range of tools and features to help you maximize your profits.

With Blur USDT, you can easily analyze charts, identify trends, and make informed decisions. When the market takes a dip, you can take advantage of the opportunity to buy at a lower price and sell for a higher one. And with margin trading, you can amplify your gains by taking short or long positions.

Hodl no more! Blur USDT offers you the chance to actively manage your trading and income. With advanced indicators and strategies at your fingertips, you can stay ahead of the market and make calculated moves.

Don’t worry about a market recovery eating into your profits. With Blur USDT, you can trade with leverage, ensuring that even the smallest price movements can result in significant gains.

So why wait? Join the Blur USDT community today and start making profits with confidence.

Section 1: Understanding USDT and its Trading Potential

The charts of cryptocurrencies are often characterized by sharp price movements and high volatility. This can result in significant dips as well as substantial gains, making it an exciting but risky market to invest in. One way to mitigate this risk is by using stablecoins such as USDT.

USDT, also known as Tether, is a stablecoin that is pegged to the value of the US dollar. This means that its price remains relatively stable, providing traders with a reliable store of value. By using USDT, traders can easily manage their cryptocurrency portfolio and protect their funds during times of market volatility.

When trading USDT, it’s important to conduct thorough analysis and use various tools and indicators to identify potential entry and exit points. This can include technical analysis, fundamental analysis, and market sentiment analysis. By studying these factors, traders can make informed decisions and increase their chances of making profits.

One popular trading strategy when using USDT is called “blur trading”. This strategy involves quickly buying and selling USDT to take advantage of short-term price movements. Traders who use this strategy often employ leverage and margin trading to amplify their potential gains, but it’s important to note that this also increases the risk involved.

Another popular strategy is to hold USDT for the long term, also known as “hodling”. This allows traders to ride out market fluctuations in the hope of benefiting from future price appreciation. This strategy is particularly suitable for traders looking for a more stable and predictable income.

To maximize your trading profits with USDT, it’s important to stay updated on market trends, news, and events that can impact its value. Additionally, diversifying your portfolio by investing in a variety of cryptocurrencies can help spread the risk and increase your chances of making profits.

In summary, understanding USDT and its trading potential can help traders navigate the dynamic cryptocurrency market. By using stablecoins like USDT, traders can manage risk, protect their funds, and potentially profit from market fluctuations. Whether you choose to employ short-term blur trading or long-term hodling strategies, it’s essential to conduct thorough analysis and stay informed to make the most of your USDT trading endeavors.

Benefits of Using USDT in Trading

Using USDT (Tether) in trading provides several benefits and advantages for traders. Here are some of the key reasons why traders choose to use USDT:

| Stablecoin | USDT is a stablecoin that is pegged to the value of the U.S. dollar. This means that it maintains a stable value, making it less volatile than many other cryptocurrencies. Traders can confidently trade with USDT without worrying about significant price fluctuations. |

|---|---|

| Leverage and Margin Trading | Trading with USDT allows traders to access leverage and margin trading. This means that traders can borrow funds to increase their buying power and potentially amplify their gains. It provides an opportunity to engage in larger trades and capitalize on market movements. |

| Risk Management | By using USDT, traders can effectively manage their risk. They can set stop-loss orders and take-profit levels to limit potential losses and secure profits. USDT’s stable value makes it easier to implement risk management strategies, minimizing the impact of market fluctuations. |

| Market Analysis and Indicators | Traders can utilize various market analysis tools, technical indicators, and charts to make informed trading decisions when using USDT. These tools allow traders to analyze market trends, identify entry and exit points, and maximize potential profits. |

| Diversification and Recovery | USDT provides traders with an opportunity to diversify their portfolio. If the market experiences a dip or downtrend, holding USDT can act as a hedge, protecting traders from potential losses. Traders can also use USDT to buy other cryptocurrencies and benefit from their recovery. |

| Efficient Trading on Exchanges | USDT is widely accepted on various cryptocurrency exchanges. This allows traders to easily buy and sell USDT, providing liquidity and flexibility in trading. The availability of USDT trading pairs also enhances trading opportunities and increases potential profits. |

In conclusion, using USDT in trading offers several benefits, including stability, leverage, risk management, market analysis, diversification, and efficient trading on exchanges. Incorporating USDT into trading strategies can help traders maximize their profits and achieve their financial goals.

How USDT Trading Works

USDT Trading is a popular method of generating income in the cryptocurrency market. With the surge in the popularity of USDT, traders have been using it to make profits by taking advantage of its stability. Here is how USDT trading works:

- Exchange: To start USDT trading, you need to find a reliable cryptocurrency exchange that supports USDT pairs. Choose an exchange with a good reputation and high liquidity for smooth trading.

- Market Analysis: Before making a trade, it’s crucial to perform thorough market analysis. Study the charts, indicators, and market trends to identify potential entry and exit points.

- Strategies: Develop your trading strategies based on your risk tolerance and goals. Some popular strategies include long-term holding (HODL) or short-term trading to take advantage of price volatility.

- Buy and Sell: Once you have identified a favorable market condition, you can buy USDT when the price is low and sell it when the price goes up, making gains and profits.

- Risk Management: It’s essential to manage risk in USDT trading. Set stop-loss orders to limit potential losses and consider using leverage cautiously, as it can amplify both gains and losses.

- Recovery and Dip Analysis: Analyze the market during market dips and recoveries to identify potential opportunities for buying or selling USDT.

- Stablecoin advantage: USDT is a stablecoin, which means its value is pegged to a fiat currency like the US dollar. This stability provides traders with a reliable trading asset.

- Currency Pair Trading: USDT is frequently paired with other cryptocurrencies, allowing traders to diversify their investments and take advantage of different market movements.

- Invest with Caution: As with any investment, it’s crucial to invest with caution. Be mindful of the potential risks associated with trading USDT and only invest what you can afford to lose.

By understanding how USDT trading works and implementing effective strategies, you can maximize your profits and achieve success in the cryptocurrency market.

Strategies for Maximizing Profits with USDT Trading

If you want to maximize your profits with USDT trading, it is important to develop effective strategies and stay informed about the latest trends and market movements. Here are some key strategies to consider:

- HODL: HODL (hold on for dear life) is a popular strategy in the cryptocurrency world, and it can be applied to USDT trading as well. By holding onto your USDT during market volatility, you can potentially ride out any dips and capitalize on upward trends.

- Use Stop-Loss Orders: To manage risk, consider using stop-loss orders. These orders automatically sell a certain amount of your USDT if the price drops below a specified threshold, helping to limit potential losses.

- Utilize Technical Indicators: Technical indicators, such as moving averages or relative strength index (RSI), can provide valuable insights into market trends and help you make informed trading decisions. Use these indicators to identify potential entry and exit points for your USDT trades.

- Diversify Your Portfolio: It is important to diversify your USDT trading portfolio to minimize risk. Invest in a mix of different cryptocurrencies to spread out your investments and maximize the chances of making profitable trades.

- Stay Informed: Stay up to date with the latest news and developments in the cryptocurrency market. Follow reputable sources, monitor market charts, and conduct thorough analysis to identify potential opportunities for USDT trading.

- Manage Your Risk: Set a risk management strategy and stick to it. Determine your risk tolerance and the amount of USDT you are willing to invest in each trade. This will help you avoid making impulsive decisions and protect your capital.

- Consider Margin Trading: Margin trading allows you to magnify your potential gains by borrowing funds to trade with. However, it also increases the risk of substantial losses. Make sure you have a solid understanding of margin trading and its implications before using this strategy.

- Take Advantage of Market Recovery: During market downturns, there is often a recovery phase. Buying USDT during these dips can be a profitable strategy, as you can sell it once the market starts to recover, potentially making significant gains.

- Utilize Long and Short Positions: Consider taking both long and short positions to profit from both upward and downward movements in the market. This can help you generate income regardless of the market direction.

- Choose a Reliable Exchange: Select a reputable and secure exchange to ensure the safety of your USDT holdings. Look for exchanges with robust security measures and a user-friendly interface.

Remember, successful USDT trading requires patience, research, and a disciplined approach. By implementing these strategies and adapting them to your own investment style, you can increase your chances of maximizing your profits in the USDT market.

Section 2: Tips for Successful Blur USDT Trading

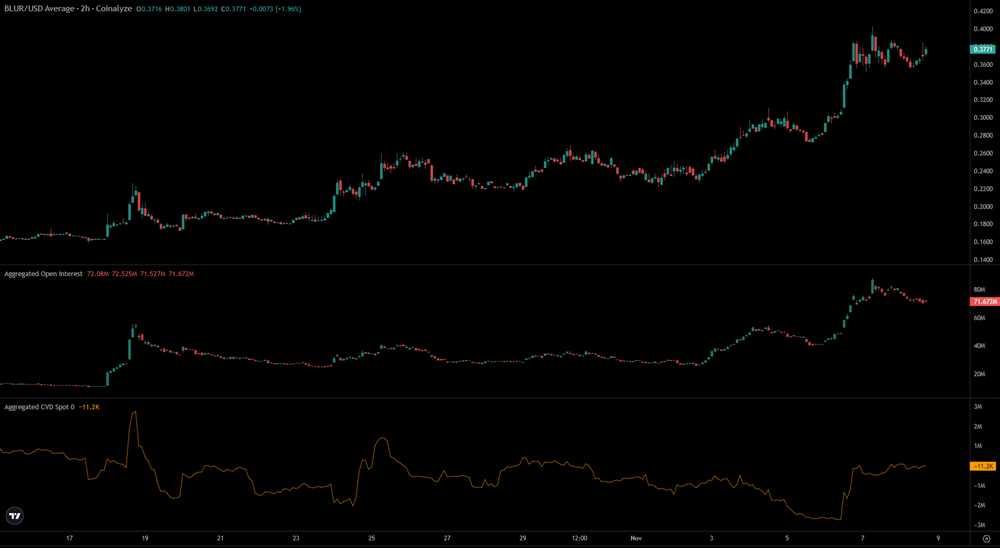

1. Proper Analysis: Before engaging in Blur USDT trading, it is essential to conduct thorough analysis of the market and exchange trends. Study the charts, indicators, and volatility to make informed decisions.

2. Set Clear Strategies: Define your trading strategies and stick to them. Determine when to buy and sell Blur using USDT and establish risk management techniques to mitigate potential losses.

3. Use Leverage Wisely: Leverage can amplify both gains and losses. Only use leverage if you understand its mechanics and can handle the associated risk.

4. Buy Dips: Take advantage of market dips to buy Blur at a lower price. This strategy can potentially lead to higher profits when the market recovers.

5. Utilize Stablecoin: Consider using USDT, a stablecoin, for Blur trading. It helps to minimize exposure to the volatility of cryptocurrencies and ensures a more stable trading experience.

6. Long-Term Investment: Hodl Blur for the long term to potentially benefit from its future growth. This strategy allows you to capitalize on the positive trajectory of Blur’s value over time.

7. Understand Currency Pair: Get familiar with the Blur/USDT currency pair and their respective market dynamics. Being knowledgeable about these currencies will enable you to make more informed trading decisions.

8. Income Gains: Trading Blur with USDT can generate regular income gains if managed effectively. Develop strategies that capitalize on market fluctuations to maximize your trading income.

9. Short Selling: Short selling Blur with USDT can be profitable when the market is experiencing a downtrend. This strategy allows you to benefit from the declining value of Blur.

10. Margin Trading: Consider utilizing margin trading for Blur with USDT. It provides opportunities to leverage your trading capital and potentially increase your profits.

11. Risk Management: Implement sound risk management techniques to protect your capital. Set stop-loss orders, diversify your portfolio, and avoid investing more than you can afford to lose.

12. Recovery Strategies: Have recovery strategies in place to handle unexpected market downturns. Stay calm and reassess your trading plans if you face losses, as the market can recover in the future.

13. Sell at Profitable Points: Identify favorable points to sell Blur with USDT and secure your profits. Utilize technical analysis and indicators to determine the optimal exit points.

In conclusion, successful Blur USDT trading requires diligent analysis, strategic planning, and risk management. By using these tips, you can enhance your trading experience and potentially increase your profits.

Researching and Analyzing Market Trends

Researching and analyzing market trends is essential for successful cryptocurrency trading. By keeping a close eye on market trends, traders can make informed decisions that maximize their gains and minimize their risks.

One important aspect of researching market trends is conducting thorough technical analysis. This involves studying price charts, identifying patterns, and interpreting various indicators to predict future price movements. Traders can use different strategies, such as buying the dip or shorting the recovery, to take advantage of market volatility for making profits.

Investors should also keep track of fundamental analysis factors that affect the value of cryptocurrencies. This can include news about regulatory changes, technological advancements, and general market sentiment. By staying informed about these factors, traders can make better decisions on when to buy or sell their assets.

Another crucial aspect of market research is understanding the role of different currency pairs. Traders can trade cryptocurrencies against stablecoins like USDT on various exchanges. They can also use leverage and margin trading to amplify their potential gains or losses. It’s important to manage the risk carefully and not to overextend oneself.

One popular strategy is hodling, which means holding onto a cryptocurrency for the long term. This strategy aims to capitalize on the potential for substantial gains over time, despite short-term price fluctuations. Traders should strategically choose the cryptocurrencies they invest in, based on their research and analysis.

Overall, successful trading requires constant research and analysis of market trends. By using a combination of technical and fundamental analysis, traders can make informed decisions to maximize their profits and minimize their risks.

Remember, the cryptocurrency market is highly volatile, and there are no guaranteed profits. However, with the right research, analysis, and risk management, traders can increase their chances of making substantial income from their investments.

So, whether you’re a beginner or an experienced trader, take the time to research and analyze the market trends before making any decisions. Stay updated with the latest news, follow the charts, and implement effective strategies to succeed in the exciting world of cryptocurrency trading.

Setting Realistic Trading Goals

When it comes to trading, it’s important to set realistic goals to ensure a successful and profitable trading experience. By having clear objectives, you can develop effective strategies and manage risks more efficiently. Here are some tips on setting realistic trading goals:

- Define your desired income: Determine how much money you would like to earn from your trading activities. This will help you focus on the right market opportunities and make informed decisions.

- Research the market: Stay informed about the latest trends, indicators, and news that may impact your trades. Conduct thorough analysis and utilize trading tools to identify potential opportunities.

- Set achievable targets: Avoid setting overly ambitious goals that may lead to disappointment. Instead, set attainable targets based on your knowledge, experience, and the current market conditions.

- Manage risk: Understand the risks involved in trading and establish risk management strategies. Use stop-loss orders, diversify your investments, and avoid excessive leverage to protect your capital.

- Choose the right trading exchange: Select a reliable and reputable exchange platform that offers the features and tools you need. Ensure that the platform supports the trading of stablecoins like USDT for added stability.

- Long-term vs. short-term: Decide whether you prefer long-term or short-term trading strategies. Long-term trading involves hodling positions for extended periods, while short-term trading focuses on capitalizing on market volatility.

- Buy low, sell high: Learn how to read charts, identify trends, and spot buying opportunities during market dips. Timing your trades effectively can help maximize your profits.

- Practice good risk management: Avoid making impulsive decisions based on emotions. Instead, make calculated trades based on thorough analysis and utilize risk management techniques to protect your capital.

- Track your progress: Regularly review and analyze your trading performance to identify areas for improvement. Keep track of your gains, losses, and overall profitability to measure your success.

- Continuous learning: Stay up to date with the latest trading strategies, techniques, and market developments. Learn from your past trades and seek opportunities to enhance your trading skills and knowledge.

By setting realistic trading goals and following sound strategies, you can increase your chances of making consistent profits and achieving long-term success in the trading market.

What is “Blur USDT Trading Tips for Making Profits”?

“Blur USDT Trading Tips for Making Profits” is a guidebook that provides tips and strategies for trading USDT cryptocurrency to earn profits.

Who is the author of “Blur USDT Trading Tips for Making Profits”?

The author of “Blur USDT Trading Tips for Making Profits” is not mentioned.

What kind of tips and strategies are included in “Blur USDT Trading Tips for Making Profits”?

“Blur USDT Trading Tips for Making Profits” includes various tips such as timing the market, setting stop-loss orders, analyzing trends, and managing risk to maximize profits while trading USDT.

Is “Blur USDT Trading Tips for Making Profits” suitable for beginners?

Yes, “Blur USDT Trading Tips for Making Profits” is suitable for beginners as it provides basic trading concepts and strategies that can help them understand and navigate the USDT market.

+ There are no comments

Add yours