In the ever-evolving world of cryptocurrency, market trends play a crucial role in determining the price movements of digital assets such as Bitcoin, Ethereum, and altcoins. However, it is not just market data and technical analysis that drive these trends. Investor sentiment, influenced by a wide range of factors including emotions, speculation, and risk perception, also plays a significant role.

Emotion-driven trading and speculation can cause volatility in the crypto market. Understanding the correlation between investor sentiment and price trends is vital for forecasting and making informed investment decisions. To uncover this link, extensive data analysis and sentiment analysis are required to gain insights into the collective behavior of market participants.

Investor sentiment analysis involves quantifying and analyzing the emotional indicators and opinions expressed by market participants in various sources such as social media, news articles, and forums. By examining relevant data, one can gain valuable insights into how market sentiment affects price trends.

The correlation between investor sentiment and blur crypto price trends can provide valuable information for traders and investors alike. By understanding the emotional aspects driving market behavior, it becomes possible to identify potential opportunities and manage risks more effectively.

While it is important to note that sentiment analysis alone may not guarantee accurate price forecasting or high-return investments, it can act as a supplementary tool for decision-making in an industry characterized by constant fluctuations and uncertainty. Exploring the link between investor sentiment and blur crypto price trends can provide valuable insights into the dynamic nature of the cryptocurrency market.

The Role of Investor Sentiment in Crypto Markets

Investor sentiment plays a crucial role in the dynamics of crypto markets. As the cryptocurrency market is highly driven by emotions and speculation, market sentiment can greatly impact the price volatility of digital assets like Bitcoin and altcoins.

Investors’ sentiment towards the crypto market is often influenced by various factors, including market trends, news, and personal investment goals. Understanding and analyzing investor sentiment can provide valuable insights into market behavior and assist in forecasting future price movements.

Data analysis techniques, such as sentiment analysis, are utilized to quantify and measure investor sentiment in the crypto market. Sentiment analysis involves extracting information and sentiment from textual data, such as social media posts, news articles, and online discussions.

By exploring the correlation between investor sentiment and crypto price trends, researchers can identify patterns and uncover potential links between market sentiment and price volatility. This analysis enables investors to better understand the role of sentiment in investment decisions and assess the risk-return trade-off associated with cryptocurrencies.

Technical analysis is another approach used to gauge investor sentiment in the crypto market. By analyzing price charts and trading volumes, investors can identify market trends and sentiment-driven behaviors, which can aid in making informed investment decisions.

The link between investor sentiment and crypto price trends is particularly relevant in the context of cryptocurrency trading and speculation. Emotional factors, such as fear, greed, and FOMO (fear of missing out), often drive the buying and selling decisions of investors, leading to increased market volatility.

Understanding investor sentiment and its impact on crypto markets can help market participants navigate through the blur of information and make more informed investment decisions. By keeping a pulse on investor sentiment, traders and investors can potentially capitalize on market opportunities and mitigate risks associated with the highly volatile crypto market.

In conclusion, investor sentiment plays a crucial role in the dynamics of crypto markets. The exploration and analysis of sentiment data provide insights into market trends, risk-return trade-offs, and the correlation between sentiment and price volatility. By understanding and considering investor sentiment, traders and investors can better navigate the complex world of cryptocurrencies and potentially improve their investment outcomes.

| Market Sentiment | Volatility | Data Analysis | Sentiment Analysis | Price | Exploring | Sentiment |

| Risk | Forecasting | Technical Analysis | Investor | Investment | Behavior | Blur |

| Analysis | Return | Crypto | Link | Correlation | Bitcoin | Emotion |

| Digital Assets | Trends | Cryptocurrency | Market | Trading | Speculation | Market Trends |

| Altcoins |

The Impact of Investor Sentiment on Price Fluctuations

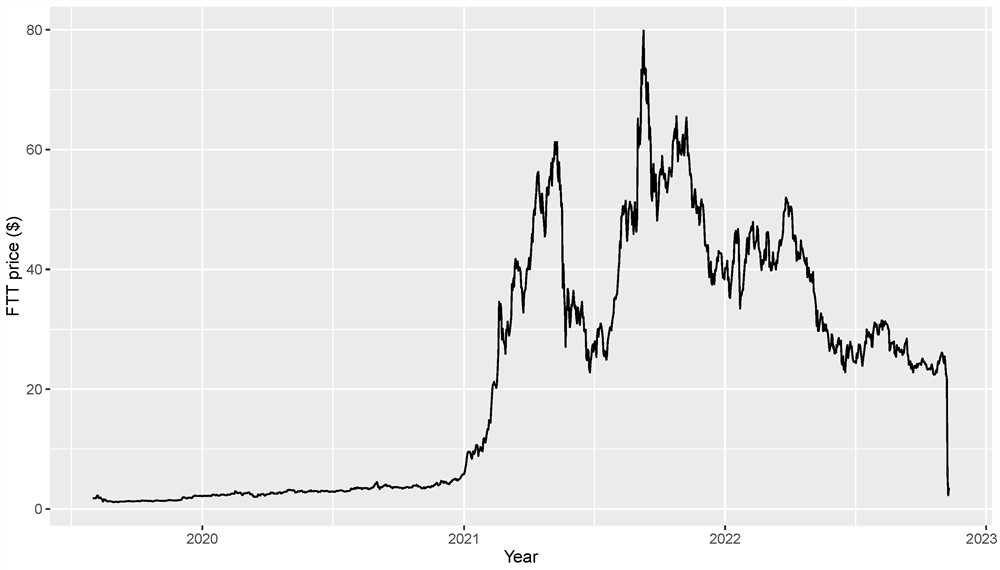

Investor sentiment plays a crucial role in the price fluctuations of digital assets, such as cryptocurrencies. The price of cryptocurrencies, like Bitcoin and altcoins, is influenced by a variety of factors, including market sentiment and investor behavior.

Exploring the link between investor sentiment and price trends is important for understanding the dynamics of the cryptocurrency market. Sentiment analysis, which involves quantifying and analyzing emotions expressed in news articles, social media posts, and other sources, can provide valuable insights into market trends and forecasting future price movements.

Investors’ sentiment can have a significant impact on price volatility, as emotions and speculation can drive irrational trading behavior. When investors are optimistic about the future of a particular cryptocurrency, they are more likely to buy, increasing demand and pushing up the price. Conversely, when sentiment is negative, investors may sell their holdings, leading to a decrease in price.

Market sentiment and price fluctuations are also closely related to risk and return. Higher sentiment can lead to increased speculation and a willingness to take on higher risks, pushing prices higher and potentially increasing returns. Conversely, when sentiment is low, investors may be more risk-averse and sell their holdings, leading to lower prices and potentially reducing returns.

Correlation between investor sentiment and price trends can also be observed through data analysis. By analyzing historical price data alongside sentiment data, researchers can identify patterns and relationships between market sentiment and cryptocurrency prices. This can help provide insights for developing trading strategies based on sentiment analysis and technical analysis.

Overall, investor sentiment plays a crucial role in price fluctuations in the cryptocurrency market. Understanding the impact of sentiment on market trends can provide valuable insights for investors and traders looking to make informed decisions. By combining sentiment analysis with other forms of data analysis, such as technical analysis, investors can gain a better understanding of market behavior and potentially improve their trading strategies.

| Key Words | Definition |

|---|---|

| Investor Sentiment | The overall attitude and emotions of investors towards a specific investment or market |

| Price Fluctuations | The changes in the price of an asset over time, which can be volatile and unpredictable |

| Market Sentiment | The general feeling or attitude of investors towards a particular market or asset |

| Sentiment Analysis | The process of analyzing and quantifying emotions and opinions expressed in text data |

| Volatility | The degree of variation in the price of an asset over a specific period of time |

| Investment | The act of allocating money or resources with the expectation of generating a profit |

| Market Trends | The general direction in which the market or the price of an asset is moving |

| Blur | Potential misspelling of “blue”, often used in reference to cryptocurrencies |

| Altcoins | Alternative cryptocurrencies to Bitcoin, such as Ethereum, Ripple, and Litecoin |

| Crypto | Shortened term for cryptocurrencies |

Previous Studies on Investor Sentiment and Crypto Price Trends

Several studies have investigated the relationship between investor sentiment and cryptocurrency price trends. These studies have explored the impact of investor sentiment on the behavior of prices for various altcoins, and have utilized sentiment analysis techniques to analyze the emotions and opinions of investors in the digital assets market.

One area of focus in these studies has been the link between investor sentiment and the risk associated with investing in cryptocurrencies. Researchers have found that high levels of positive sentiment can lead to increased price volatility, as investors may engage in speculative trading based on positive market sentiment.

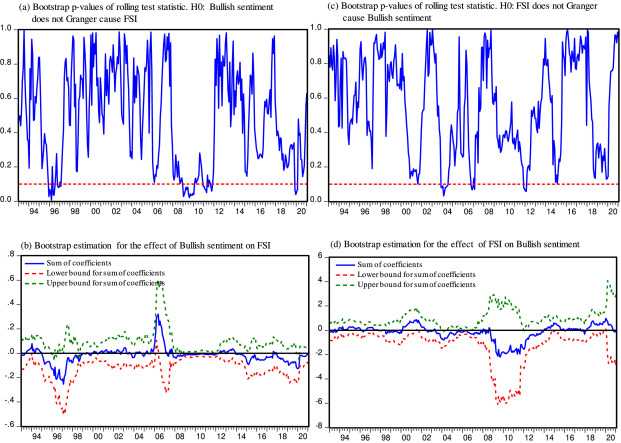

Another key finding has been the correlation between sentiment analysis and technical analysis in predicting price trends. Some studies have shown that sentiment analysis can provide valuable insights into market sentiment and help in making accurate predictions about future price movements.

A number of studies have also explored the role of investor sentiment in popular cryptocurrencies such as Bitcoin and Ethereum. These studies have found that market sentiment can play a significant role in influencing the price behavior of these cryptocurrencies, with positive sentiment often leading to increased investment and price growth.

In addition to exploring the relationship between investor sentiment and price trends, some studies have also investigated the impact of sentiment on investor behavior. For example, research has shown that investor sentiment can influence the decision-making process, with high levels of positive sentiment leading to increased investment and trading activity.

Overall, previous studies have highlighted the importance of investor sentiment in understanding and forecasting crypto price trends. By analyzing sentiment data and its correlation with price fluctuations, researchers can gain valuable insights into market trends and make more informed investment decisions.

Methods and Data Analysis

The analysis conducted in this study aimed to explore the link between investor sentiment and crypto price trends. To achieve this goal, various methods were utilized to collect and analyze data related to market sentiment and price movements of different digital assets, including cryptocurrencies like Bitcoin and Ethereum.

To gather data on investor sentiment, sentiment analysis techniques were employed. By analyzing social media posts, news articles, and other online sources, the sentiment of investors towards specific cryptocurrencies and the market as a whole was determined. This analysis helped uncover the emotions and opinions of investors, ranging from optimistic and positive sentiment to pessimistic and negative sentiment.

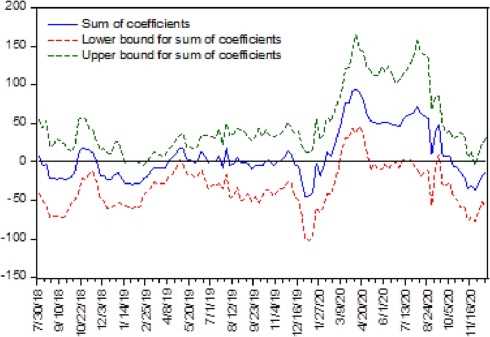

In addition to sentiment analysis, data on price trends and market volatility were collected to determine any correlations between investor sentiment and price movements. Historical price data for various cryptocurrencies were obtained, and statistical analysis techniques, such as regression and correlation analysis, were applied to identify any significant relationships.

Furthermore, trading data, including trading volumes and transaction details, were examined to understand the behavior of investors during different market sentiment conditions. This analysis helped identify patterns and trends in trading activity and provided insights into how sentiment influences trading decisions.

The collected data was then subjected to various analytical methods, such as time series analysis and forecasting techniques, to explore the impact of investor sentiment on the price behavior of cryptocurrencies. These methods allowed for the identification of potential factors that affect price volatility and risk in the crypto market.

Overall, this study aimed to provide a comprehensive analysis of the relationship between investor sentiment and crypto price trends. By exploring the link between sentiment and various aspects of cryptocurrency investment, including price movements, trading behavior, and market sentiment, this research contributes to a better understanding of the dynamics of the crypto market and enables more informed investment decisions.

Data Collection and Analysis Techniques

When it comes to exploring the link between investor sentiment and blur crypto price trends, data collection and analysis techniques play a crucial role in understanding the dynamics of the market. Effective data collection ensures that relevant information is gathered, while proper analysis techniques enable the extraction of meaningful insights.

One key aspect of data collection is the gathering of return and investment data from various sources. This includes analyzing historical price data of cryptocurrencies such as Bitcoin, Ethereum, and altcoins, along with their corresponding market trends. Speculation, volatility, and market sentiment can all be factors that influence the price of digital assets, and hence, collecting and analyzing relevant data is necessary to understand their impact.

Technical analysis is another technique utilized in data analysis. It involves studying historical price patterns, charts, and indicators to identify market trends and potential trading opportunities. By analyzing past price behavior, correlations between investor sentiment and market movements can be explored. Technical analysis methods can also be useful in forecasting potential price movements and market behavior.

Sentiment analysis is a technique that focuses on gauging the overall sentiment of investors towards cryptocurrencies. By analyzing social media posts, news articles, and online forums, sentiment analysis can provide insights into how investors perceive the market, which can have an impact on price trends. This technique can help identify the relationship between investor sentiment and price volatility.

Overall, exploring the link between investor sentiment and blur crypto price trends requires a multi-faceted approach to data collection and analysis. By utilizing techniques such as technical analysis and sentiment analysis, it becomes possible to gain a deeper understanding of market dynamics and identify the risks and opportunities associated with investing in cryptocurrencies.

| Data Collection Techniques | Analysis Techniques |

|---|---|

| – Gathering return and investment data | – Technical analysis |

| – Analyzing historical price data | – Sentiment analysis |

| – Examining market trends | – Correlation analysis |

| – Monitoring volatility | – Price forecasting |

| – Analyzing investor behavior | – Market sentiment analysis |

Correlation Analysis between Investor Sentiment and Crypto Price Trends

Exploring the relationship between investor sentiment and crypto price trends is crucial for understanding the dynamics of the digital assets market. Sentiment analysis, which involves the examination of emotions, attitudes, and opinions expressed by investors, can provide valuable insights into market sentiment and help predict cryptocurrency price movements.

Investors in the cryptocurrency market are often guided by speculation, due to the high volatility and risk associated with these assets. Their sentiment plays a significant role in shaping market trends and determining the direction of price movements. Understanding and analyzing investor sentiment can therefore be a powerful tool in forecasting the future price changes of cryptocurrencies like Ethereum and Bitcoin.

Data analysis is essential in evaluating sentiment as it involves collecting and analyzing large volumes of textual data from various sources such as social media platforms, news articles, forums, and trading platforms. By analyzing the sentiment expressed in these texts, researchers can gain insights into the overall sentiment of the market and investors towards specific cryptocurrencies.

Correlating sentiment analysis with crypto price trends allows for a deeper understanding of how investor behavior impacts the market. By examining the relationship between sentiment and price movements, it is possible to identify patterns and trends that can be used to improve investment strategies.

Market sentiment is influenced by a wide range of factors, including news events, regulatory developments, technological advancements, and market speculation. By identifying and analyzing these factors, it becomes possible to assess and understand investor sentiment and its impact on market trends.

Investor sentiment is not limited to established cryptocurrencies like Bitcoin and Ethereum but also extends to altcoins and other digital assets. By incorporating sentiment analysis into technical analysis and other forecasting models, traders and investors can gain a comprehensive understanding of market sentiment and make more informed investment decisions.

In conclusion, correlation analysis between investor sentiment and crypto price trends is crucial for understanding the relationship between sentiment and market trends. By considering sentiment alongside other factors, such as technical analysis and market sentiment, investors can gain a deeper understanding of the market and improve their risk management and investment strategies.

What is investor sentiment and how does it affect cryptocurrency price trends?

Investor sentiment refers to the overall attitude and emotions of investors towards a particular asset or market. In the context of cryptocurrency, investor sentiment can greatly impact price trends. When investors are optimistic and have positive sentiment about the future prospects of a cryptocurrency, they are more willing to buy, which can drive up prices. On the other hand, when investors are pessimistic and have negative sentiment, they may be more inclined to sell, leading to price decreases.

Are there any indicators or tools that can be used to measure investor sentiment in the cryptocurrency market?

Yes, there are several indicators and tools that can be used to gauge investor sentiment in the cryptocurrency market. Some popular ones include sentiment analysis algorithms that analyze social media posts and news articles to determine the overall sentiment towards a particular cryptocurrency. Additionally, surveys and opinion polls can also be used to measure investor sentiment. Lastly, market sentiment indexes, such as the Crypto Fear & Greed Index, can provide an overall indication of investor sentiment in the market.

How can understanding investor sentiment help with making investment decisions in the crypto market?

Understanding investor sentiment can be crucial for making informed investment decisions in the crypto market. By analyzing the sentiment of the overall market or specific cryptocurrencies, investors can gain insights into whether the market is bullish or bearish. This information can help identify potential trends and opportunities. For example, if investor sentiment is overwhelmingly positive towards a cryptocurrency, it may be a signal to consider buying. However, if sentiment is negative, it may be a sign to exercise caution or consider selling.

+ There are no comments

Add yours