When it comes to investing in the cryptocurrency market, understanding the various technical indicators that influence price is essential. These indicators provide valuable insights into the market trends and can help traders make informed decisions. One such indicator is the Moving Average Convergence Divergence (MACD) algorithm, which is widely used for trend analysis.

The MACD indicator, along with other oscillators and trendlines, helps traders identify patterns in price data. By analyzing these patterns, traders can determine the strength of a trend and the potential for a reversal. This information is crucial for effective trading and maximizing returns.

Another important indicator is the Relative Strength Index (RSI), which measures the momentum of a cryptocurrency’s price. The RSI is used to identify overbought and oversold conditions, which can help traders anticipate potential price movements. By understanding the RSI, traders can take advantage of market volatility and optimize their trading strategies.

In addition to the MACD and RSI, there are several other technical indicators that can influence the price of Blur, a popular cryptocurrency. These include moving averages, support and resistance levels, and various chart patterns. Each of these indicators provides unique insights into the market and can be used in combination to make better trading decisions.

Decoding these technical indicators requires a thorough understanding of their underlying principles and the ability to analyze market data effectively. Traders who are able to interpret these indicators accurately can gain a significant advantage in the cryptocurrency market. By staying informed and keeping up with the latest trends, traders can navigate the volatile crypto market with confidence.

The Importance of Technical Indicators in Analyzing Crypto Prices

When it comes to investing in cryptocurrencies, understanding the market trends and price movements is crucial. This is where technical indicators play a significant role. These indicators can provide valuable insights into the volatility, patterns, and strength of a cryptocurrency’s price.

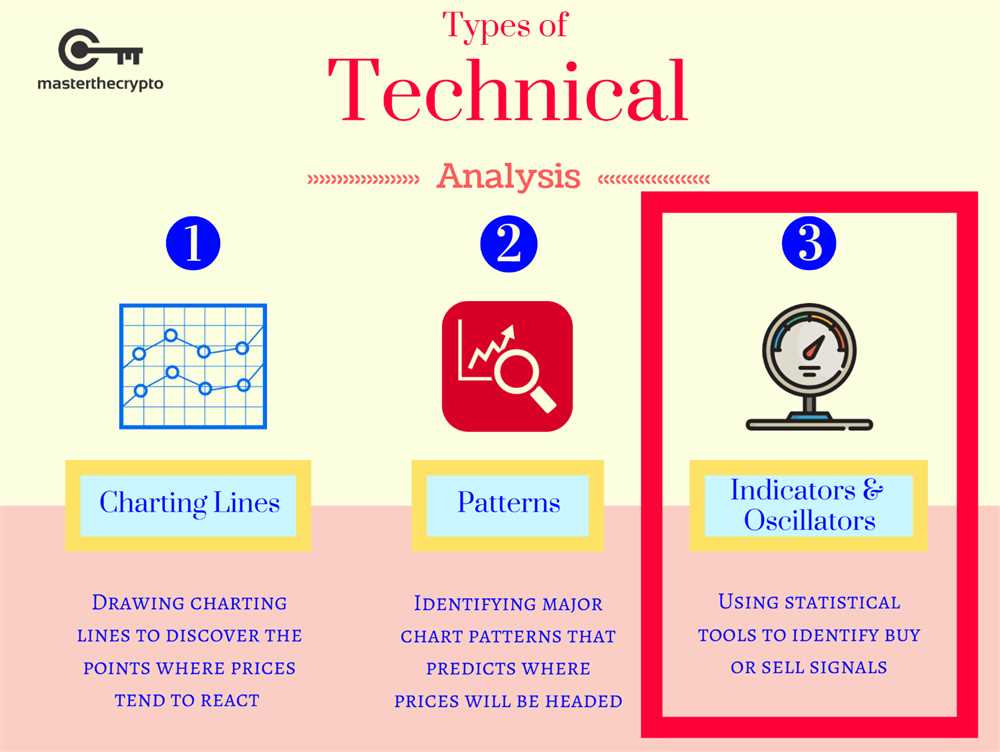

Technical indicators are mathematical calculations based on historical price, volume, or both. They are used to identify trends, support and resistance levels, and potential entry or exit points. By decoding the data using these indicators, investors can make more informed decisions about buying or selling cryptocurrencies.

One commonly used technical indicator is the moving averages. Moving averages help identify the current trend by smoothing out price fluctuations over a specified period. By plotting moving average lines on a chart, investors can spot upward or downward trends and potential trend reversals.

Another useful indicator is the relative strength index (RSI). The RSI measures the speed and change of price movements and indicates whether a cryptocurrency is overbought or oversold. This information can help investors determine when a cryptocurrency is likely to experience a price correction or rebound.

Furthermore, oscillators like the MACD (Moving Average Convergence Divergence) can be helpful in analyzing momentum and trend reversals. The MACD uses two moving averages to identify potential buying or selling opportunities. By comparing the MACD line and signal line, investors can gauge the strength of a trend or momentum shift.

Technical indicators also assist in identifying key support and resistance levels. Support levels are price levels where the demand for a cryptocurrency outweighs the supply, causing prices to bounce back up. Conversely, resistance levels are price levels where the supply outweighs the demand, causing prices to reverse and head lower. By recognizing these levels, investors can set appropriate stop-loss and take-profit orders.

Ultimately, technical indicators provide valuable information that influences cryptocurrency prices. By utilizing these indicators and analyzing the data, investors can gain a deeper understanding of the market and make more informed investment decisions. However, it’s important to remember that technical indicators are not foolproof and should be used in conjunction with other analysis methods to reduce risks and maximize returns.

Understanding Market Trends

Investing in the cryptocurrency market can be a challenging task, especially with the constantly changing and volatile nature of prices. To make informed decisions, traders and investors rely on technical indicators to analyze market trends and predict future price movements.

Technical indicators are mathematical calculations based on historical price data that can help reveal patterns and trends in the market. They can be classified into several categories, including moving averages, oscillators, and momentum indicators.

Moving averages are commonly used to smooth out price fluctuations and identify the overall trend of a cryptocurrency. They are calculated by averaging the prices over a certain period, and the resulting line can act as support or resistance levels, indicating potential entry or exit points for traders.

Oscillators, on the other hand, measure the strength and momentum of a trend. They are used to identify overbought or oversold conditions, which can signal a potential reversal or continuation of a trend. Examples of oscillators include the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD).

Momentum indicators, as the name suggests, help traders understand the speed and strength of a price movement. They can indicate whether a trend is accelerating or losing momentum, which can be valuable information for making trading decisions.

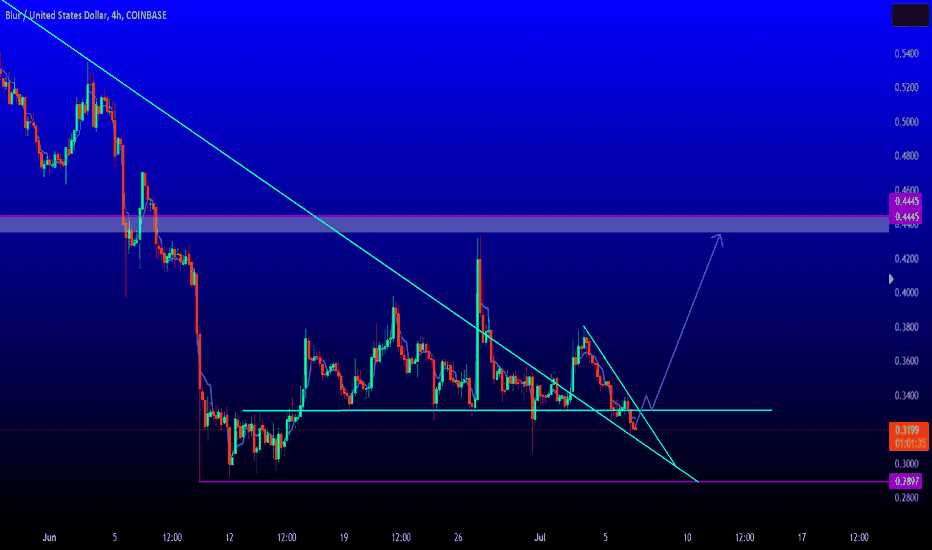

To make sense of these technical indicators, traders often rely on charts to visualize the data. Trendlines, for example, are drawn on charts to connect a series of higher lows or lower highs, indicating an uptrend or downtrend, respectively.

In addition to trendlines, traders also look for chart patterns, such as triangles, flags, and head and shoulders, which can provide insights into future price movements based on historical price patterns.

Understanding market trends is crucial for successful cryptocurrency trading. By decoding the technical indicators and analyzing the data, traders can identify support and resistance levels, predict price movements, and make informed trading decisions. However, it is important to remember that no indicator or analysis method can guarantee accurate predictions, as the market is influenced by various factors and can be subject to unexpected volatility.

Analyzing Trading Volume

Trading volume analysis is an essential part of technical analysis for understanding market trends and making informed decisions. It helps investors and traders gauge the momentum and strength of a cryptocurrency’s price movements.

One of the primary tools used for volume analysis is the Volume Moving Average (VMA), which is a variation of the simple moving average that focuses exclusively on trading volume. By calculating the average volume over a specific period, it becomes easier to identify points of significant buying or selling activity.

Another important indicator is the Volume Weighted Average Price (VWAP), which calculates the average price a security has traded at, factoring in both price and volume. The VWAP is commonly used to identify possible areas of support and resistance and can provide valuable insights, especially when combined with other technical indicators and chart patterns.

Decoding volume patterns is crucial for understanding the underlying trends in the market. For instance, a significant increase in trading volume during a price surge suggests strong buying interest and can indicate a potential upward trend. Conversely, a decrease in volume coupled with a price decline might suggest weakening interest and a possible downward trend.

Other indicators like the Money Flow Index (MFI) and the On-Balance Volume (OBV) can also be used to analyze trading volume. The MFI measures the rate at which money is flowing into or out of a particular cryptocurrency, reflecting the strength of buying or selling pressure. The OBV, on the other hand, calculates volume based on whether prices close higher or lower than the previous day.

By using volume analysis alongside other technical indicators and oscillators, such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), investors can gain a deeper understanding of the market and make more informed trading decisions.

In conclusion, analyzing trading volume is essential for understanding market trends and identifying potential buying or selling opportunities. By decoding volume patterns, investors can effectively assess the strength and momentum of a cryptocurrency’s price movements and make informed investing and trading decisions based on data-driven analysis.

Identifying Support and Resistance Levels

Support and resistance levels play a crucial role in understanding the price movements in the cryptocurrency market. These levels are determined by analyzing various technical indicators and patterns in the market data.

Support refers to the price level where the buying strength outweighs the selling pressure. It acts as a floor for the price, preventing it from falling further. Traders often look for support levels to identify potential buying opportunities.

Resistance, on the other hand, is the price level where selling pressure surpasses buying strength, acting as a ceiling for the price. It prevents the price from rising further. Traders frequently analyze resistance levels to identify potential selling opportunities.

There are several indicators and tools that traders use to identify support and resistance levels, such as trendlines, moving averages, and Fibonacci retracement levels. These tools help in decoding the price patterns and determining the strength of support and resistance levels.

Trendlines are lines drawn across the price chart to connect the highs or lows of the price movement. They provide visual representation of the trend and can act as potential support or resistance levels.

Moving averages are calculated by averaging the closing prices over a specific period and are plotted on the price chart. Traders often consider moving averages as support or resistance levels.

Fibonacci retracement levels are based on the Fibonacci sequence, which is a mathematical pattern. Traders use these levels to identify potential support and resistance levels based on the percentage retracement of the previous price movement.

In addition to these tools, traders also use indicators such as the MACD (Moving Average Convergence Divergence) and momentum oscillators to identify support and resistance levels. These indicators provide insights into the strength of the trend and the potential reversal points.

By decoding the technical analysis of support and resistance levels, traders can make informed decisions about their investments in the cryptocurrency market. Understanding these levels helps traders identify potential entry or exit points and gauge the volatility of the market.

Popular Technical Indicators Used in Crypto Trading

Decoding the technical indicators that influence the blur crypto price is essential for successful investing in the volatile cryptocurrency market. These indicators provide valuable insights into the momentum, trends, and strength of price movements, helping traders make informed decisions.

1. Moving Averages: Moving averages are widely used indicators that smooth out price data to identify trends. The two most common moving averages are the simple moving average (SMA) and the exponential moving average (EMA). Traders often look for crossovers and divergences between moving averages to predict price reversals or confirm trends.

2. Oscillators: Oscillators, such as the relative strength index (RSI) and the stochastic oscillator, measure the speed and magnitude of price changes. These indicators help identify overbought and oversold conditions in the market, indicating potential trend reversals.

3. Trendlines: Trendlines are drawn on charts to connect the higher lows or lower highs, forming support and resistance levels. Traders use trendlines to identify the direction of the market and potential price breakouts or breakdowns.

4. MACD (Moving Average Convergence Divergence): MACD is a popular trend-following momentum indicator that shows the relationship between two moving averages of a cryptocurrency’s price. It helps traders identify potential buy or sell signals when the MACD line crosses above or below the signal line.

5. Fibonacci Retracement: Fibonacci retracement levels are horizontal lines drawn on a chart to indicate potential areas of support and resistance based on the Fibonacci sequence. Traders use these levels to identify potential price reversals or areas to enter or exit positions.

These are just a few of the many technical indicators available for analyzing cryptocurrency price data. Traders often combine multiple indicators to gain a comprehensive view of the market and make informed trading decisions.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a technical indicator that measures the data momentum of a cryptocurrency’s price movements. It is used to identify overbought and oversold conditions in the market.

RSI is calculated using the average gains and average losses over a specified period of time. It is typically displayed as an oscillator that fluctuates between 0 and 100. A reading above 70 indicates that the cryptocurrency is overbought and a correction may be imminent, while a reading below 30 indicates that the cryptocurrency is oversold and a potential rebound may occur.

RSI is often used in combination with other technical indicators, such as moving averages, trendlines, and the Moving Average Convergence Divergence (MACD), to provide a more comprehensive analysis of the market. By decoding the RSI data and interpreting its signals, investors can gain insights into the strength and direction of price trends, as well as potential support and resistance levels.

One of the advantages of using RSI is that it helps investors avoid making emotionally driven trading decisions. The index provides objective and quantifiable signals that can be used to inform investment decisions and execute trading strategies.

| Strength | RSI Reading | Interpretation |

|---|---|---|

| Strong Uptrend | Above 70 | Potential overbought condition |

| Weak Uptrend | Between 50 and 70 | Price may continue upward momentum |

| Consolidation | Between 30 and 50 | Price may remain range-bound |

| Weak Downtrend | Between 30 and 50 | Price may continue downward momentum |

| Strong Downtrend | Below 30 | Potential oversold condition |

It’s important to note that RSI is just one tool among many in the technical analysis of cryptocurrencies. It should be used in conjunction with other indicators and patterns to make informed investing decisions. By understanding and decoding the RSI, traders can gain valuable insights into the market’s volatility and identify potential entry and exit points.

What are technical indicators and how do they affect crypto prices?

Technical indicators are mathematical calculations based on historical price, volume, or volatility data of a cryptocurrency. They are used by traders and investors to analyze and predict future price movements. These indicators can have a significant impact on crypto prices as they are widely followed by market participants, influencing their buying and selling decisions.

Could you explain a few common technical indicators used in cryptocurrency trading?

One common technical indicator is the Moving Average (MA), which calculates the average price over a specified period of time and is used to identify trends. Another popular indicator is the Relative Strength Index (RSI), which measures the speed and change of price movements to determine if a cryptocurrency is overbought or oversold. Bollinger Bands, MACD, and Fibonacci retracement levels are also commonly utilized indicators in crypto trading.

How can technical indicators be used to make trading decisions?

Technical indicators can be used in various ways to make trading decisions. For example, if the RSI indicator shows that a cryptocurrency is oversold, it may be a good buying opportunity as the price could potentially rebound. On the other hand, if a Moving Average crossover occurs, where a shorter-term moving average crosses above a longer-term moving average, it could be a signal to sell as it indicates a possible trend reversal. Traders often combine multiple indicators to confirm signals and make more informed trading decisions.

+ There are no comments

Add yours