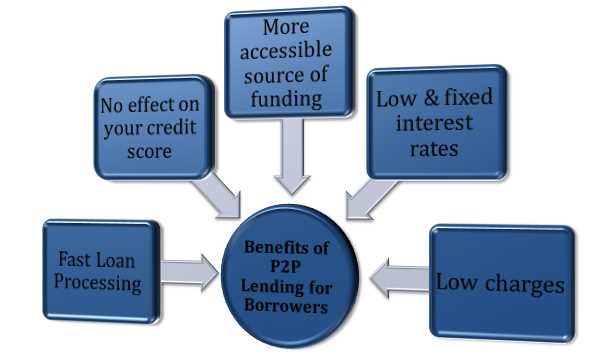

Blur lending offers a revolutionary solution for individuals with limited credit history. Unlike traditional lenders who rely heavily on credit scores, blur lenders take a different approach.

By focusing on factors beyond credit history, such as employment stability and income consistency, blur lending provides opportunities for those who have been overlooked by conventional lenders. This opens doors to a wider range of borrowers who can now access the funds they need.

With blur lending, borrowers have the advantage of not being solely defined by their past credit mistakes or lack of credit history. Instead, they are evaluated based on their current financial situation and future potential.

This new lending approach offers several tangible benefits to those with limited credit history. It provides them with the chance to build a positive credit history by making timely repayments. This, in turn, can help them establish a stronger credit profile in the long run.

The advantages of blur lending don’t stop there. It can also offer borrowers more flexibility in terms of loan amounts and repayment terms. This allows individuals to find a loan that best fits their specific needs and financial capabilities.

Furthermore, blur lending can often provide faster approval times and streamlined application processes. This means borrowers can get the funds they require quickly and without unnecessary bureaucracy.

In summary, blur lending is a game-changer for borrowers with limited credit history. It offers advantages such as a holistic evaluation of financial factors, the opportunity to build credit, flexibility in loan terms, and a streamlined application process. So why let your limited credit history hold you back? Explore the possibilities of blur lending today!

Improved access to credit

Lending institutions often require borrowers to have a strong credit history in order to qualify for a loan. However, this presents a challenge for borrowers with limited credit history, who may struggle to meet these strict requirements.

Blur lending offers a solution to this problem by providing improved access to credit for borrowers with limited credit history. Instead of solely relying on traditional credit metrics, blur lending considers a wider range of factors to determine an individual’s creditworthiness.

This approach allows borrowers with limited credit history to demonstrate their financial responsibility and ability to repay a loan, even if they do not have an extensive credit history. By taking into account factors such as income stability, employment history, and education level, blur lending provides a more holistic evaluation of a borrower’s creditworthiness.

This improved access to credit is particularly beneficial for borrowers who are just starting out in their financial journey or have faced challenges in the past that have impacted their credit history. It allows them to access the funds they need to achieve their goals, whether it’s purchasing a car, starting a business, or investing in education.

In addition, blur lending also offers borrowers the opportunity to build and strengthen their credit history. By making timely loan payments and managing their finances responsibly, borrowers can establish a positive credit history and improve their chances of accessing credit in the future.

Overall, the advantages of blur lending for borrowers with limited credit history are clear. It provides a fair and inclusive approach to credit evaluation, allowing individuals to access the credit they need to achieve their financial goals, while also providing an opportunity to build a stronger credit history for the future.

Inclusive financial services

At Blur Lending, we understand that borrowers with limited credit history can face unique challenges when seeking financial assistance. That is why we are committed to providing inclusive financial services that cater to the needs of all borrowers, regardless of their credit history.

Our team of experts is dedicated to helping individuals who have been excluded from traditional lending options due to their limited credit history. We believe that everyone deserves access to fair and affordable financial solutions.

With Blur Lending, borrowers with limited credit history can benefit from our innovative lending models that take into account more than just credit scores. We analyze various factors, such as income and employment history, to provide a more holistic evaluation of an individual’s financial situation.

By considering a broader range of criteria, we can offer lending options that are tailored to the specific needs of each borrower. Whether you are looking to finance a car, consolidate debt, or fund a home renovation project, we have flexible loan options that can help you achieve your goals.

Furthermore, our inclusive financial services extend beyond lending. We also provide educational resources and personalized financial guidance to empower borrowers with limited credit history to make informed decisions and improve their financial well-being.

At Blur Lending, we believe in the power of financial inclusion. We strive to break down barriers and provide equal opportunities for all borrowers, regardless of their limited credit history. Join us and experience the advantages of our inclusive financial services.

| Advantages of our inclusive financial services: |

|---|

| 1. Tailored loan options for borrowers with limited credit history. |

| 2. Holistic evaluation of financial situation beyond just credit scores. |

| 3. Flexible loan terms to meet individual needs and goals. |

| 4. Educational resources and personalized financial guidance. |

| 5. Equal opportunities for all borrowers to improve their financial well-being. |

Simplified application process

One of the key advantages of blur lending for borrowers with limited credit history is the simplified application process. Traditional lending institutions often require extensive documentation and have strict criteria that can make it difficult for individuals with limited credit history to obtain a loan.

With blur lending, the application process is streamlined and straightforward. Borrowers can easily apply online, saving time and avoiding the hassle of gathering and submitting numerous documents. The blur lending platform utilizes advanced technology to assess a borrower’s creditworthiness based on alternative data sources, such as employment history and payment behavior.

This simplified application process allows borrowers with limited credit history to access the financing they need quickly and efficiently. It eliminates unnecessary barriers and enables individuals to demonstrate their ability to repay a loan, even if they lack a traditional credit history.

By leveraging innovative technology and alternative data sources, blur lending makes it easier for borrowers with limited credit history to obtain the financial support they need. Whether they need funds for education, medical expenses, or to start a small business, blur lending provides an inclusive solution that empowers individuals and promotes financial inclusion.

Less reliance on credit history

One of the advantages of blur lending for borrowers with limited credit history is the less reliance on credit history itself. In traditional lending systems, credit history plays a crucial role in determining the borrower’s creditworthiness and ability to repay a loan. However, not everyone has an extensive credit history, especially those who are just starting out or have had limited opportunities to build credit.

Blur lending recognizes this limitation and takes a different approach. Instead of solely relying on credit history, blur lenders consider various other factors to assess the borrower’s ability to repay the loan. These factors may include income, employment history, education, and even social connections.

This approach benefits borrowers with limited credit history by giving them a fair chance to obtain a loan. Instead of being rejected solely based on their credit history, they have the opportunity to prove their creditworthiness through other means. This can be particularly advantageous for individuals who have been responsible with their finances but lack a solid credit history.

Another advantage of blur lending is the potential for borrowers to build a positive credit history. By providing loans to individuals with limited credit history, blur lenders give them the opportunity to establish a positive track record of repaying debts. As borrowers successfully repay their loans, they can start building a stronger credit history, which will open up more opportunities for future borrowing.

In conclusion, blur lending offers advantages for borrowers with limited credit history by providing them with an alternative to traditional lending systems that heavily rely on credit history. This allows individuals to access financial resources and build a positive credit history, regardless of their limited credit history in the past.

Building credit

For borrowers with limited credit history, blur lending offers several advantages when it comes to building credit. Traditional lenders often require a strong credit history for approval, which can be a major roadblock for individuals who are just starting to establish their credit. With blur lending, borrowers have the opportunity to prove their creditworthiness and build a positive credit history.

One advantage of blur lending is that it takes into account factors beyond just credit score. While traditional lenders may rely heavily on credit scores, blur lending looks at a borrower’s overall financial picture, including income and employment stability. This means that borrowers with limited credit history but a steady income can still be eligible for a loan.

Another advantage is that blur lending typically offers lower interest rates compared to other credit options available to borrowers with limited credit history. This can help borrowers save money in the long run and make it easier for them to manage their debt.

Furthermore, blur lending often provides borrowers with educational resources and tools to help them understand credit and improve their financial habits. These resources can include budgeting tips, credit monitoring services, and personalized recommendations for managing their credit effectively.

By taking advantage of blur lending, borrowers with limited credit history can not only access the funds they need but also start building a positive credit history. This can open doors to future borrowing opportunities, lower interest rates, and improved financial stability.

What is blur lending?

Blur lending is a new type of lending that aims to provide loans to borrowers with limited credit history. It uses innovative algorithms and alternative data sources to assess the creditworthiness of these borrowers.

What are the advantages of blur lending?

The advantages of blur lending for borrowers with limited credit history include easier access to loans, faster approval process, and the opportunity to build credit history and improve credit scores. Blur lending takes into account various factors apart from credit history, such as education, employment, and income, which allows more borrowers to qualify for loans.

How does blur lending help borrowers with limited credit history?

Blur lending helps borrowers with limited credit history by considering alternative data sources such as utility bills, rent payments, and even social media profiles to assess their creditworthiness. This allows borrowers who may not have a traditional credit history to qualify for loans and build their creditworthiness.

Are there any disadvantages to blur lending?

While blur lending offers advantages to borrowers with limited credit history, there may be some disadvantages. One potential disadvantage is higher interest rates compared to traditional loans due to the higher risk associated with borrowers with limited credit history. Additionally, blur lending may not be available in all areas or for all types of loans.

+ There are no comments

Add yours