If you are new to the world of cryptocurrency, you may have come across the term “Coingecko” in your research. Coingecko is a popular website that provides market data and information for various cryptocurrencies. However, navigating Coingecko can be overwhelming for beginners due to the sheer amount of data and the ever-changing market conditions.

So, how can you effectively navigate Coingecko blur to get the accurate market data you need? Firstly, it’s important to understand that Coingecko provides real-time data on various cryptocurrencies, including their current price, market cap, trading volume, and more. This information can be invaluable for both investors and traders looking to make informed decisions.

One way to effectively navigate Coingecko blur is by using the search function. Simply type in the name of the cryptocurrency you are interested in, and Coingecko will provide you with the relevant data. This can save you time and help you quickly find the information you need without getting lost in the sea of data.

Another useful feature of Coingecko is the ability to filter and sort the data. By clicking on the “Filters” button, you can narrow down your search based on criteria such as price, market cap, and volume. This can help you find the most accurate and relevant market data for the cryptocurrency you are interested in.

In conclusion, navigating Coingecko blur for accurate market data is essential for anyone involved in the cryptocurrency market. By using the search function, filtering and sorting options, you can effectively find the information you need to make informed decisions. Remember to stay updated with the ever-changing market conditions and use Coingecko as a valuable tool in your cryptocurrency journey.

Tips for Efficiently Using Coingecko

Coingecko is a popular platform for obtaining market data for various cryptocurrencies. However, the interface can sometimes be overwhelming or confusing, making it difficult to navigate and obtain accurate information. Here are some tips on how to effectively use Coingecko to get the data you need:

| 1. Familiarize yourself with Coingecko’s layout: | Before diving into the data, take some time to explore Coingecko’s interface and understand where different sections are located. This will help you navigate quickly and efficiently. |

| 2. Use the search bar: | Coingecko has a search bar at the top of the page that allows you to easily find specific cryptocurrencies. Simply type in the name or ticker symbol of the cryptocurrency you are interested in, and Coingecko will take you directly to its data. |

| 3. Filter and sort: | Coingecko provides various filters and sorting options to help you refine your search results. Take advantage of these features to narrow down the data to the specific criteria you need. |

| 4. Use the charting tools: | Coingecko offers intuitive charting tools that allow you to visualize and analyze the market data. Experiment with different chart types and timeframes to gain insights into the cryptocurrency’s performance. |

| 5. Read the news and updates: | Coingecko features a news section where you can find the latest updates, articles, and announcements related to cryptocurrencies. Stay informed about market developments to make informed investment decisions. |

| 6. Join the Coingecko community: | Coingecko has a community section where you can engage with other users, ask questions, and share insights. Participating in the community can broaden your knowledge and help you stay up to date with the latest trends. |

By following these tips, you will be able to efficiently navigate Coingecko’s interface and obtain accurate market data for your cryptocurrency analysis and investment decisions.

Utilizing Filters:

When navigating the market data on Coingecko, it is essential to effectively utilize filters in order to obtain accurate information. The blur effect on Coingecko can make it difficult to distinguish between different market data points, but with the right filters, you can cut through the noise and find the data you need.

Firstly, it is important to understand the various filters available on Coingecko. These filters allow you to sort and organize the market data based on different parameters such as price, volume, market cap, and liquidity. By selecting the appropriate filters, you can narrow down the data and focus on the specific metrics that are relevant to your analysis.

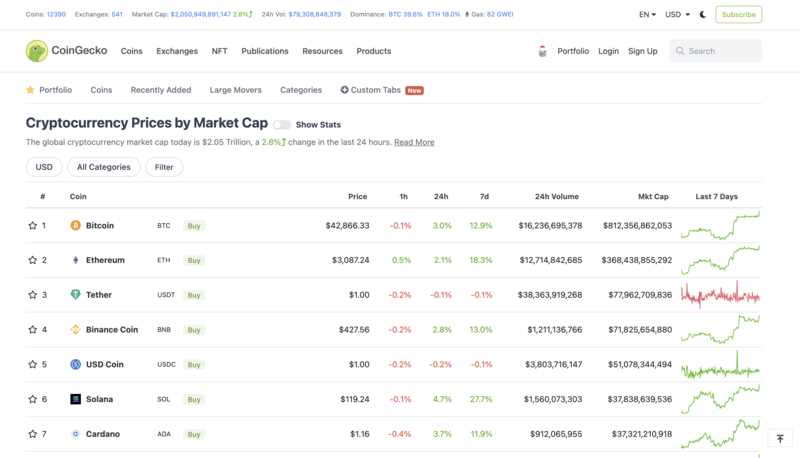

For example, if you are interested in analyzing the top-performing coins in terms of market capitalization, you can use the “Market Cap” filter to sort the data and view the coins with the highest market cap at the top of the list. This allows you to quickly identify the coins with the highest market value and focus your analysis on those specific assets.

Additionally, you can utilize filters to navigate the market data based on different timeframes. Coingecko provides filters for hourly, daily, weekly, monthly, and yearly data. This allows you to analyze the market trends and fluctuations over different time periods, giving you a more comprehensive understanding of the market movements.

Lastly, it is crucial to regularly update and adjust your filters as the market conditions change. The cryptocurrency market is highly volatile, and the data can quickly become outdated. By regularly reviewing and adjusting your filters, you can ensure that you are always accessing the most accurate and up-to-date market data.

| Filter | Description |

|---|---|

| Price | Sorts the market data based on the coin’s price. |

| Volume | Sorts the market data based on the coin’s trading volume. |

| Market Cap | Sorts the market data based on the coin’s market capitalization. |

| Liquidity | Sorts the market data based on the coin’s liquidity. |

In conclusion, by effectively utilizing filters on Coingecko, you can navigate the blur and obtain accurate market data. Understanding the available filters, sorting based on relevant parameters, analyzing different timeframes, and regularly updating your filters will ensure that you have the most accurate and up-to-date information for your cryptocurrency analysis.

Setting Custom Timeframes:

Coingecko provides a wide range of market data, but sometimes the default timeframes may not accurately reflect the information you need. By setting custom timeframes, you can effectively navigate the blur and obtain the most accurate market data on Coingecko.

To set custom timeframes on Coingecko, follow these steps:

- Go to the Coingecko website and search for the specific cryptocurrency or token you are interested in.

- Once you are on the cryptocurrency’s page, locate the chart section.

- In the chart section, you will find a timeline at the top with preset timeframes like 1 day, 7 days, 1 month, etc. These are the default timeframes provided by Coingecko.

- To set a custom timeframe, click on the “Custom” button or icon next to the default timeframes.

- A dropdown menu will appear, allowing you to select your desired start and end date for the custom timeframe.

- Select the start and end dates according to your requirements.

- Once you have selected the custom timeframe, the chart will update accordingly, displaying the accurate market data for that specific time period.

Setting custom timeframes on Coingecko enables you to navigate through the blur of market data effectively and obtain more precise information. This feature is particularly useful if you want to analyze specific periods or track the performance of a cryptocurrency over a certain time span.

By customizing the timeframes, you can focus on the data that matters most to you and make more informed decisions when it comes to trading or investing in cryptocurrencies.

Strategies for Accurate Market Analysis

When it comes to analyzing the market, Coingecko can be a valuable tool. However, the blur on Coingecko can make it difficult to navigate and obtain accurate data. Therefore, it is important to employ effective strategies for accurate market analysis.

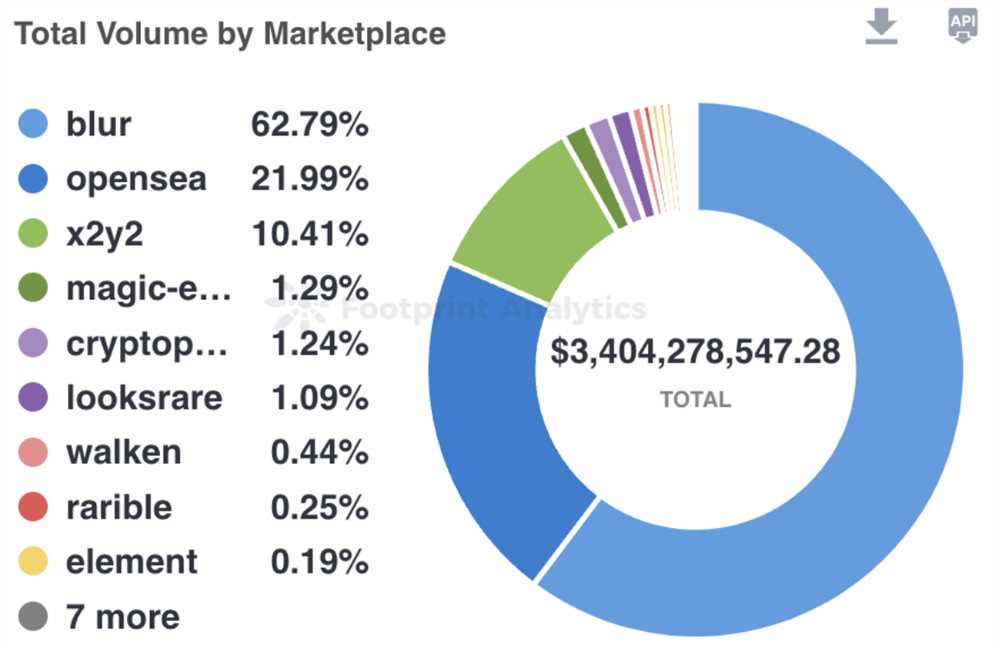

Firstly, it is crucial to understand the concept of blur on Coingecko. Blur refers to the noise or inconsistencies in the data presented on the platform. This can be caused by various factors, such as delays in data updating or manipulation by traders. Being aware of this blur is the first step towards filtering out inaccurate information.

To navigate the Coingecko blur effectively, one strategy is to use multiple data sources. Relying on a single source can increase the risk of being misled by inaccurate data. By cross-referencing information from different platforms and sources, it becomes easier to identify and filter out any inconsistencies.

Another strategy is to focus on reputable and reliable sources. Coingecko itself is known for providing relatively reliable market data, but it is always recommended to check and verify the information through other trustworthy platforms. This helps in reducing the impact of blur and ensuring accurate analysis.

Additionally, it is important to utilize analytical tools and indicators. These tools can help in identifying patterns, trends, and anomalies in the market data. By using indicators such as moving averages or relative strength indexes, one can obtain a clearer picture of the market, filtering out any potential blur.

Lastly, it is crucial to stay updated and informed about the latest news and developments in the cryptocurrency market. Market conditions can change rapidly, and staying up-to-date can help in understanding any anomalies or fluctuations in the data. Following reputable news sources and staying connected with the crypto community can provide valuable insights for accurate market analysis.

In conclusion, to effectively navigate the Coingecko blur for accurate market data, it is essential to utilize strategies such as using multiple data sources, focusing on reliable sources, employing analytical tools, and staying updated with the latest news. By doing so, one can minimize the impact of blur and obtain accurate market analysis.

Comparing Coin Performance:

When it comes to effectively navigating Coingecko blur and obtaining accurate market data, comparing coin performance is essential. Coingecko provides a wide range of data and metrics for different cryptocurrencies, allowing investors to make informed decisions.

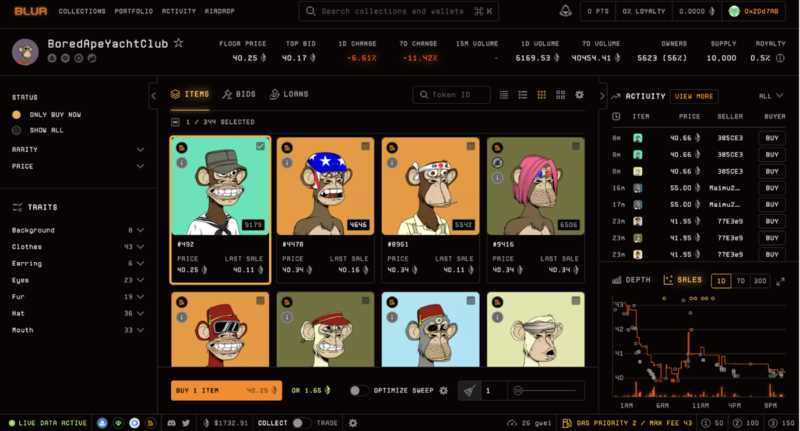

To compare coin performance on Coingecko, start by navigating to the coin’s page of interest. Here, you will find valuable information about the coin’s market capitalization, trading volume, price charts, and more.

One of the key metrics to consider is the coin’s price change over time. Coingecko provides charts and graphs that display the coin’s price movement, enabling you to analyze its performance over different time intervals. It’s important to consider both short-term fluctuations and long-term trends when comparing coin performance.

In addition to price change, Coingecko also offers data on trading volume and liquidity. These metrics are crucial for understanding the overall interest and activity surrounding a coin. Higher trading volumes and liquidity indicate a more active and liquid market, making it easier to buy or sell the coin at desired prices.

Another factor to consider when comparing coin performance is the coin’s market capitalization. This metric represents the total value of a coin’s circulating supply and is often used as an indicator of its overall popularity and adoption. Higher market capitalization generally signifies a more established and widely recognized coin.

While Coingecko provides a wealth of data for comparing coin performance, it’s important to navigate through the blur and filter the noise to obtain accurate information. Take the time to research and analyze the data provided, ensuring that you are making well-informed decisions based on reliable market data.

By effectively navigating Coingecko blur and utilizing its data to compare coin performance, you can gain valuable insights and make informed investment decisions in the cryptocurrency market. Stay updated with the latest data, keep track of market trends, and always consider multiple factors when evaluating coin performance.

Analyzing Historical Data:

When it comes to accurately analyzing market data, especially in the blur of fluctuating trends, Coingecko provides a valuable platform for navigating through the vast amount of information available. By understanding how to effectively use Coingecko, traders can gain valuable insights into historical data that can help inform their investment decisions.

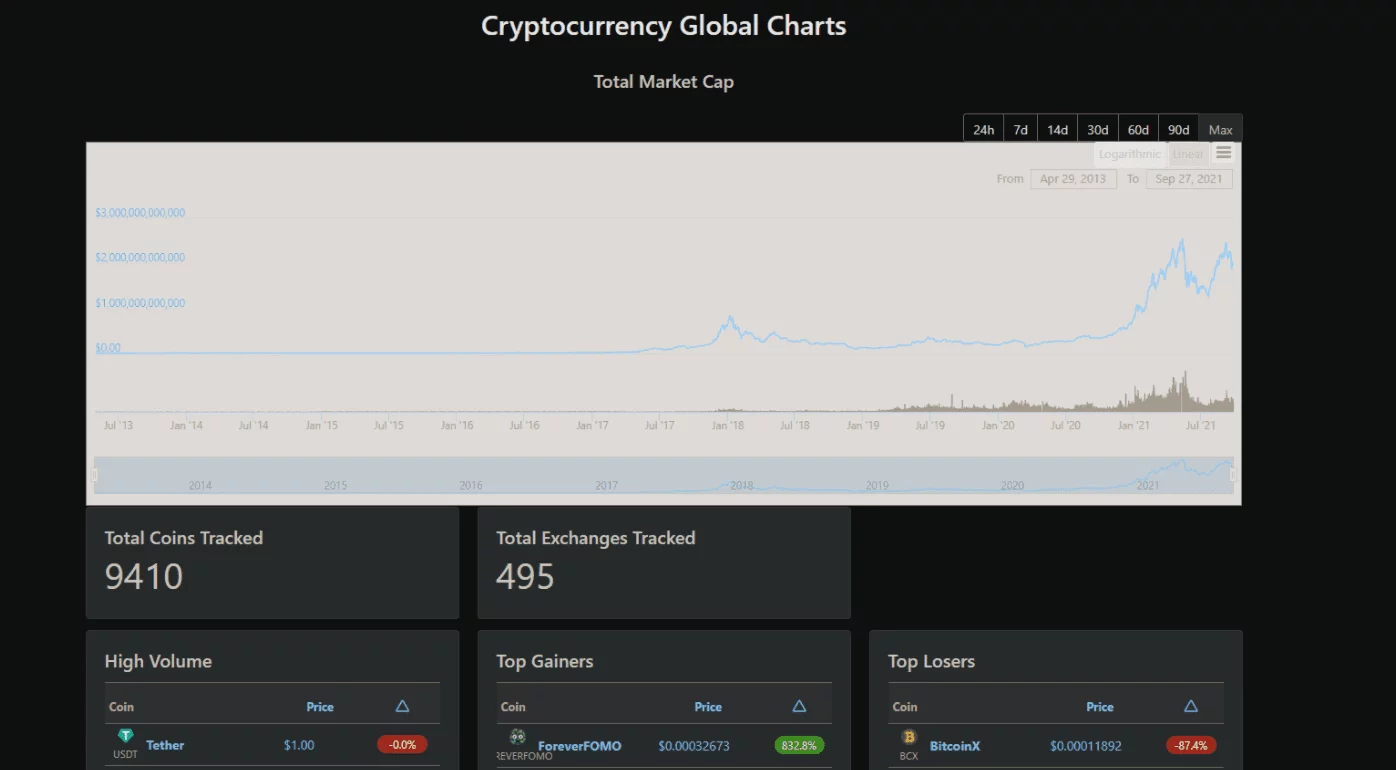

Coingecko offers a variety of tools and features that allow users to access and analyze historical market data. This includes price charts, trading volume, market capitalization, and more. By utilizing these tools, traders can track the performance of specific cryptocurrencies over time, identifying patterns and trends that may indicate future price movements.

One of the key aspects of analyzing historical data on Coingecko is understanding how to navigate the platform effectively. This involves familiarizing yourself with the different tabs and filters available, such as selecting specific time periods, adjusting the zoom level on the price chart, and comparing the performance of multiple cryptocurrencies.

Accuracy is of utmost importance when analyzing historical data on Coingecko. Traders must ensure that the data they are using is up-to-date and reliable. By cross-referencing information from multiple sources and verifying data points, traders can obtain a more accurate picture of market trends and make informed decisions.

In conclusion, Coingecko is a valuable tool for analyzing historical market data. By understanding how to effectively navigate the platform and ensuring the accuracy of the data, traders can gain valuable insights into market trends and make more informed investment decisions.

What is Coingecko blur and how does it affect market data accuracy?

Coingecko blur refers to the constant fluctuations and inconsistencies in market data on the Coingecko platform. It can affect market data accuracy by distorting the real-time prices and trading volumes of cryptocurrencies. Traders and investors need to navigate through these blurs in order to make informed decisions.

How can I effectively navigate Coingecko blur for accurate market data?

Navigating Coingecko blur requires a combination of strategies. Firstly, it’s important to cross-reference data from multiple sources to verify the accuracy. Secondly, studying the historical data and patterns can help identify the underlying trends despite the blur. Additionally, it’s advisable to follow reputable influencers and experts in the crypto industry who can provide insights and analysis to help navigate through the blur.

What are some of the risks associated with relying on Coingecko blur for market data?

Relying solely on Coingecko blur for market data can have several risks. One major risk is inaccurate pricing information, which can lead to incorrect assessments of the value and potential profitability of a cryptocurrency. Another risk is making decisions based on distorted trading volumes, which can result in illiquid investments or missed trading opportunities. Traders and investors need to be cautious and consider multiple sources of data for accurate market analysis.

Are there any tools or strategies available to filter out Coingecko blur and obtain accurate market data?

While it’s not possible to completely filter out Coingecko blur, there are some tools and strategies that can help obtain more accurate market data. For example, using price averaging techniques can help smooth out the fluctuations in real-time prices. Additionally, employing technical analysis indicators and patterns can provide a more reliable assessment of market trends. It’s important to have a comprehensive approach that combines different strategies to minimize the impact of Coingecko blur on market data accuracy.

+ There are no comments

Add yours