Cryptocurrencies have revolutionized the way we think about money, transforming it from a traditional transactional medium to a virtual and cashless form. Bitcoin, the first cryptocurrency to gain mainstream attention, set the stage for a wave of innovation in the financial industry. With its anonymous and decentralized nature, bitcoin offered a new level of privacy and security in managing financial transactions.

Zcash, another popular cryptocurrency, took the concept of privacy to a whole new level with its advanced technology. By utilizing smart contracts and a unique encryption method, Zcash allows users to conduct truly anonymous and untraceable transactions. This makes it an attractive option for those who value their privacy in an increasingly transparent world.

But bitcoin and Zcash are just two examples among the vast array of cryptocurrencies available today. There are altcoins, which are alternative cryptocurrencies to bitcoin, each with its own unique features and purposes. Some altcoins focus on specific industries or niches, while others aim to improve upon the shortcomings of existing cryptocurrencies.

Mining is an integral part of the cryptocurrency economy, as it is through mining that new coins are minted and transactions are verified. Miners use powerful computers to solve complex mathematical problems, which secures the blockchain and validates transactions. This process ensures the integrity and security of the cryptocurrency network.

The cryptocurrency market has also seen the rise of initial coin offerings (ICOs), which have provided a new way for startups to raise funds. ICOs allow investors to purchase tokens, which represent a stake in the company or project. This innovative approach to fundraising has sparked a wave of entrepreneurial activity and has made investing in startups more accessible to a wider range of people.

Blockchain technology, the underlying technology behind cryptocurrencies, has the potential to revolutionize industries beyond finance. Its decentralized and transparent nature allows for secure and efficient peer-to-peer transactions, bypassing traditional intermediaries. This has the potential to disrupt various sectors, from supply chain management to voting systems.

As the cryptocurrency market evolves, so does the speculation surrounding its future. Some see it as the future of money, replacing traditional fiat currencies like the dollar. Others view it as a speculative bubble waiting to burst. Regardless of one’s stance, it is undeniable that cryptocurrencies have introduced a new era of financial innovation and have the potential to shape the future of transactions.

Whether you are interested in trading cryptocurrencies, investing in ICOs, or simply exploring the possibilities of this new financial frontier, it is essential to stay informed and educated about the latest developments in the field. The world of cryptocurrencies is constantly evolving, and staying ahead of the curve is key to making informed decisions in an ever-changing landscape.

The Rise of Cryptocurrencies

The rise of cryptocurrencies has revolutionized the financial industry, introducing a new era of technology and innovation. Powered by blockchain, cryptocurrencies offer a transparent and secure way to conduct financial transactions without the need for intermediaries.

Cryptocurrencies like Bitcoin and Zcash are decentralized digital currencies that eliminate the need for traditional banking institutions. They allow users to store value in a virtual wallet, make peer-to-peer transactions, and even trade on various exchanges.

One of the key features of cryptocurrencies is the use of a decentralized ledger called a blockchain. This technology enables every transaction to be recorded and verified by multiple parties, ensuring the integrity of the financial system.

In addition to being decentralized, cryptocurrencies offer privacy and anonymity. While transactions on the blockchain are transparent, the identity of users is often pseudonymous, providing a level of privacy not possible with traditional cash-based transactions.

The rise of cryptocurrencies has also sparked a new form of fundraising called initial coin offerings (ICOs). ICOs allow startups to raise capital by issuing their own tokens on a blockchain platform. This has created a new way for investors to speculate on the success of new projects and technologies.

Cryptocurrencies are typically created through a process called mining, where powerful computers solve complex mathematical problems to validate transactions and secure the network. This process ensures the scarcity of digital assets and helps to maintain the stability of the cryptocurrency economy.

With the increasing popularity of cryptocurrencies, governments and financial institutions are starting to pay attention. Some countries have embraced cryptocurrencies, while others are exploring regulations to ensure their safe and responsible use.

Overall, cryptocurrencies have the potential to reshape the global financial system, providing a cashless and borderless economy. With their secure and decentralized nature, cryptocurrencies offer individuals the opportunity to have full control over their financial transactions.

As the technology continues to evolve, cryptocurrencies and their underlying blockchain technology are expected to drive further innovation in areas such as smart contracts and decentralized applications. The rise of cryptocurrencies is just the beginning of a new era in finance.

Understanding Cryptocurrencies

Cryptocurrencies have brought about a revolution in the financial world. Unlike traditional currencies like the dollar, cryptocurrencies are decentralized and not controlled by any central authority. This decentralization allows for greater transparency and eliminates the need for intermediaries in financial transactions.

One of the key features of cryptocurrencies is anonymity. Transactions made with cryptocurrencies are typically anonymous, allowing users to maintain their privacy. This feature has made cryptocurrencies popular in industries where privacy is crucial.

Cryptocurrencies rely on a technology called blockchain, which is a distributed ledger that records all transactions made with the cryptocurrency. This ledger is transparent, meaning that all transactions can be viewed by anyone with access to the blockchain. This transparency helps prevent fraud and ensures the integrity of the cryptocurrency system.

Mining is the process by which new cryptocurrency coins are created. Miners use powerful computers to solve complex mathematical problems that validate and verify transactions on the blockchain. In return for their efforts, miners are rewarded with newly minted coins. This process ensures the security and stability of the cryptocurrency network.

To store and manage cryptocurrencies, users use digital wallets. These wallets securely store the user’s private keys, which are needed to access and spend their cryptocurrencies. Wallets can be desktop applications, mobile apps, or hardware devices.

Cryptocurrencies can be used for a variety of purposes. They can be used as a medium of exchange to buy goods and services, or as a store of value for investing. Some cryptocurrencies, like Bitcoin, have gained popularity as speculative assets, with people buying and selling them in the hope of making a profit.

Smart contracts are a feature of some cryptocurrencies, such as Ethereum. These contracts are self-executing agreements with the terms of the agreement directly written into the code. Smart contracts enable the automation of processes and eliminate the need for intermediaries in certain transactions.

There are thousands of cryptocurrencies available today, each with its own unique features and use cases. Bitcoin is the first and most well-known cryptocurrency, but there are also many others, known as altcoins. Some popular altcoins include Zcash and Litecoin.

Initial Coin Offerings (ICOs) are a way for cryptocurrency projects to raise funds. During an ICO, tokens are sold to investors in exchange for other cryptocurrencies, such as Bitcoin or Ethereum. These tokens can then be used within the project’s ecosystem or traded on cryptocurrency exchanges.

In summary, cryptocurrencies have brought about a new era of innovation in the economy. With their decentralized, secure, and transparent nature, cryptocurrencies offer a cashless and virtual alternative to traditional financial systems. Whether you are interested in investing, trading, or simply exploring the possibilities of this new technology, cryptocurrencies offer exciting opportunities.

What are Cryptocurrencies?

Cryptocurrencies are a type of digital or virtual currency that use cryptography for security. They are decentralized and operate on a technology called blockchain, which is a transparent and distributed ledger. Blockchain technology enables secure and transparent peer-to-peer transactions without the need for a central authority or intermediary.

One of the key features of cryptocurrencies is their anonymous nature. While transactions on the blockchain are transparent, the identities of the parties involved are often pseudonymous, providing a certain level of privacy. This has led to speculation and volatile trading in the cryptocurrency market, as people look to capitalize on the potential gains.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009 and has since inspired the development of thousands of altcoins. Each cryptocurrency operates on its own blockchain and has its own unique features and use cases.

Cryptocurrencies can be used as a form of digital cash or as a means of investment. Individuals can store their cryptocurrencies in a digital wallet and use them to make transactions online or in physical stores that accept cryptocurrencies. Unlike traditional fiat currencies like the dollar, cryptocurrencies are not issued or regulated by a central bank or government, making them immune to inflation and manipulation.

In addition to being used for transactions, cryptocurrencies can also be utilized to power decentralized applications that run on smart contracts. These contracts are self-executing agreements with predefined conditions and rules. They enable the creation of decentralized applications and platforms, opening up new possibilities for innovation and financial services.

The process of creating new cryptocurrencies is called mining. Miners use powerful computers to solve complex algorithms and validate transactions on the blockchain. In return for their efforts, miners are rewarded with new coins. This process helps to secure the network and maintain the integrity of the blockchain.

Overall, cryptocurrencies have the potential to revolutionize the global economy by providing a more secure, transparent, and inclusive financial system. However, they also come with risks, such as price volatility and the potential for scams. It is important for individuals to understand the technology and do their research before investing or trading in cryptocurrencies.

The Advantages of Cryptocurrencies

Cryptocurrencies offer several advantages over traditional forms of currency and financial systems. Here are some key benefits:

- Decentralization: Cryptocurrencies operate on a decentralized network, meaning they are not controlled by any central authority or government. This allows for greater autonomy and independence.

- Privacy: Many cryptocurrencies, such as Bitcoin and Zcash, offer a high level of privacy and anonymity. Transactions are recorded on a public ledger called the blockchain, but the identities of the participants can remain hidden.

- Security: Cryptocurrencies use advanced encryption techniques to secure transactions and protect against fraud. The use of blockchain technology ensures that transactions are tamper-proof and transparent.

- Lower transaction fees: Cryptocurrency transactions often have lower fees compared to traditional banking systems. This can benefit individuals and businesses, especially those involved in cross-border transactions.

- Financial inclusion: Cryptocurrencies have the potential to provide financial services to individuals who do not have access to traditional banking systems. This can help promote economic growth and reduce poverty.

- Fast and convenient: Peer-to-peer cryptocurrency transactions can be completed quickly and easily, without the need for intermediaries such as banks. This makes them ideal for online purchases and international remittances.

- Innovation: Cryptocurrencies have sparked a wave of innovation in the financial sector. They have paved the way for the development of new technologies and applications, such as smart contracts and decentralized exchanges.

- Diversification: Cryptocurrencies offer investors an opportunity to diversify their portfolios. With hundreds of different cryptocurrencies available, investors can choose assets that align with their investment goals and risk tolerance.

In summary, cryptocurrencies provide a range of advantages, including decentralization, privacy, security, lower transaction fees, financial inclusion, fast and convenient transactions, innovation, and diversification. These benefits contribute to the growing popularity and adoption of cryptocurrencies worldwide.

Popular Cryptocurrencies

There are numerous cryptocurrencies available today, each with its own unique features and use cases. Here are some of the most popular cryptocurrencies:

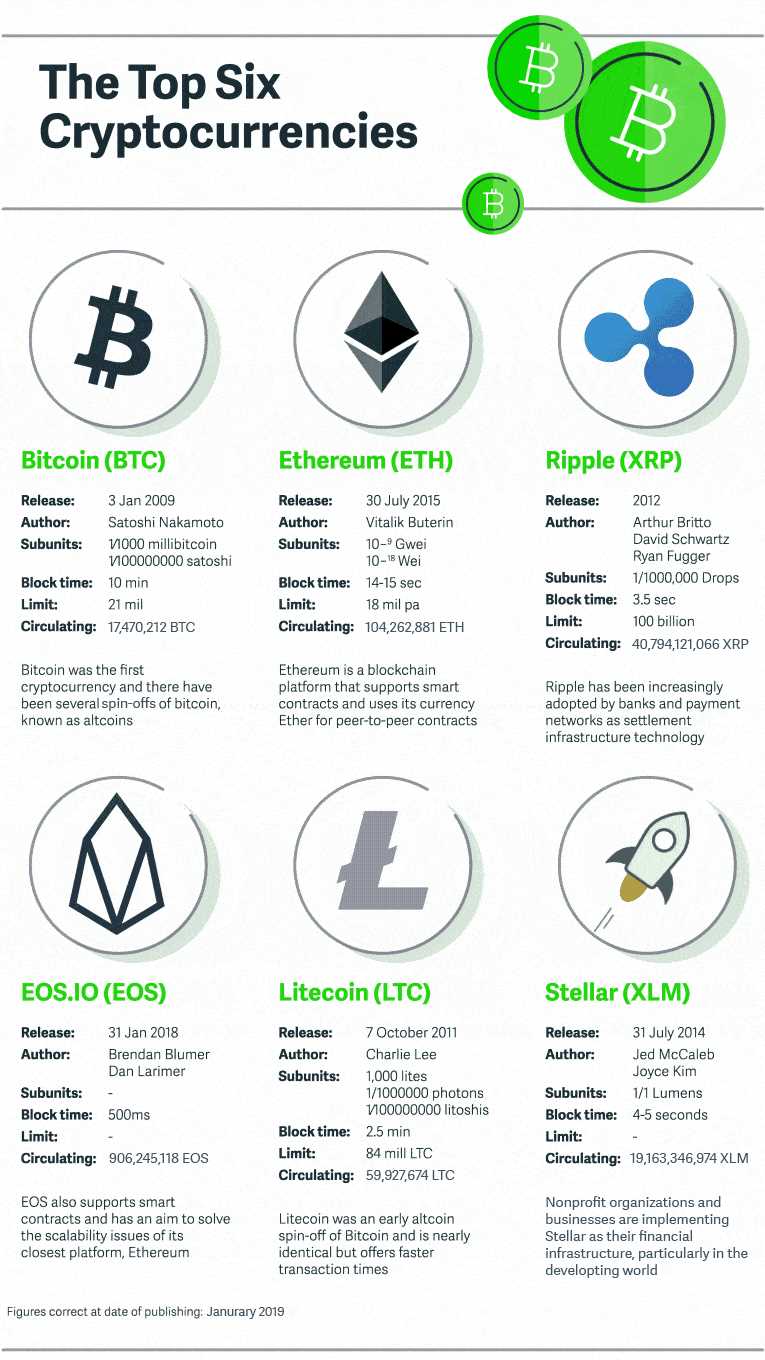

- Bitcoin (BTC): Bitcoin is the first and most well-known cryptocurrency. It was created in 2009 and operates on a decentralized ledger technology called blockchain. Bitcoin transactions are secure, transparent, and peer-to-peer, making it a popular choice for both investors and those who want to send or receive digital cashless payments.

- Ethereum (ETH): Ethereum is a decentralized platform that enables the creation and execution of smart contracts. It introduced the concept of altcoins, which are digital currencies other than Bitcoin. Ethereum’s innovation lies in its ability to enable developers to build decentralized applications on top of its blockchain.

- Zcash (ZEC): Zcash is a privacy-focused cryptocurrency that provides enhanced anonymity for transactions. It utilizes zero-knowledge proofs to ensure that transaction details remain hidden while still being validated by the network. This makes Zcash a popular choice for those who prioritize financial privacy.

- Ripple (XRP): Ripple is both a digital payment protocol and a cryptocurrency. It aims to provide fast and low-cost international money transfers. Ripple’s technology is utilized by various financial institutions, making it an attractive option for individuals and businesses involved in cross-border transactions.

- Litecoin (LTC): Litecoin is often considered the “silver” to Bitcoin’s “gold.” It was created with the intention of improving upon Bitcoin’s shortcomings, such as transaction speed and scalability. Litecoin is also often used for speculative investing and trading due to its high liquidity.

These are just a few examples of the popular cryptocurrencies available in today’s digital economy. Investing or trading in cryptocurrencies carries risks, so it is essential to conduct thorough research and understand the fundamentals of each coin before making any financial decisions.

Bitcoin

Bitcoin is a decentralized digital currency that was created in 2009 by an anonymous person, or group of people, using the name Satoshi Nakamoto. It is a virtual currency that operates on a peer-to-peer network, allowing users to send and receive funds without the need for intermediaries such as banks.

Bitcoin is often referred to as a cashless form of money, as it exists only in digital form. It has gained popularity as an innovative technology that enables secure and transparent transactions. The use of blockchain technology ensures the integrity and transparency of every bitcoin transaction.

One of the key features of Bitcoin is its decentralization, which means that it is not controlled by any central authority or government. This decentralization makes Bitcoin resistant to censorship and provides users with financial freedom.

Bitcoin can be used for various purposes, including online shopping, investing, trading, and even as a payment method for goods and services. It has also paved the way for the development of other cryptocurrencies, known as altcoins.

Investing in Bitcoin has become a popular choice for many individuals, as the value of Bitcoin has experienced significant growth over the years. However, it is important to note that the value of Bitcoin can be volatile, and there is a level of speculation involved in its trading.

To store and manage Bitcoin, users can use a digital wallet, which allows them to send, receive, and store their bitcoins securely. Each bitcoin transaction is recorded on the blockchain, a public ledger that ensures the transparency and security of the cryptocurrency.

In recent years, there has been a rise in Initial Coin Offerings (ICOs), which are fundraising events where companies raise capital by selling their own tokens or cryptocurrencies. These tokens are often built on blockchain technology and can be used for various purposes within a specific ecosystem.

Bitcoin has also paved the way for the development of other cryptocurrencies, such as Zcash. Zcash is a digital currency that provides enhanced privacy features by allowing users to shield their transactions and addresses.

Overall, Bitcoin has revolutionized the financial industry by introducing a decentralized and transparent form of currency. Its innovative technology has paved the way for the development of various applications and use cases, making it a popular choice for individuals and businesses alike.

Ethereum

Ethereum is a virtual currency that operates on a transparent and secure blockchain network.

Launched in 2015, Ethereum allows users to create and execute smart contracts, which are self-executing contracts with the terms of the agreement directly written into the code. This decentralization feature makes Ethereum more than just a digital currency; it has become a platform for decentralized applications.

One key feature of Ethereum is its ability to create and manage tokens, allowing individuals and businesses to issue their own digital currencies or assets. This innovation has led to the rise of Initial Coin Offerings (ICOs), a form of crowdfunding using cryptocurrencies.

Ethereum also supports privacy-focused features, such as anonymous transactions using zero-knowledge proofs. While Ethereum’s blockchain is public and transparent, users have the option to maintain privacy by utilizing privacy coins like Zcash.

The Ethereum network uses its native cryptocurrency called Ether (ETH) as a fuel to power transactions and execute smart contracts. Ether can be used for various purposes, including trading, investing, and participating in decentralized applications.

Mining is the process of validating transactions and adding them to the blockchain. Ethereum mining requires specialized hardware and software, and miners are rewarded with ETH for their computational efforts.

The Ethereum ecosystem has experienced significant growth and has become a major player in the cryptocurrency industry. It has fostered a thriving economy of different tokens and altcoins, with many projects built on top of the Ethereum platform.

With its focus on decentralization, security, and innovation, Ethereum has become a leading force in the cryptocurrency space. Its underlying technology has the potential to revolutionize various industries and transform the traditional financial system into a more peer-to-peer, transparent, and cashless economy.

Ripple

Ripple is a cryptocurrency that was created in 2012 as an innovative solution for instant and secure financial transactions. It is built on a decentralized blockchain technology similar to Bitcoin, but with some key differences.

Unlike Bitcoin, Ripple does not require mining to confirm transactions. Instead, it uses a consensus algorithm that relies on a unique network of trusted validators to validate and verify transactions. This makes Ripple much faster and more energy-efficient than Bitcoin.

Ripple’s main goal is to facilitate fast, low-cost international money transfers. It aims to provide a more efficient alternative to the traditional banking system, which can be slow and expensive for cross-border transactions.

One of the key features of Ripple is its native cryptocurrency called XRP. XRP can be used as a bridge currency to facilitate the exchange of other digital and fiat currencies. It can also be used as a token for paying transaction fees on the Ripple network.

Ripple’s blockchain technology allows for transparent and secure transactions. It keeps a public ledger of all transactions, which can be viewed by anyone. This transparency helps to prevent fraud and ensures the integrity of the network.

In addition to its use as a cryptocurrency, Ripple also offers a range of other products and services. These include RippleNet, a global network of financial institutions that use Ripple’s technology for faster and more efficient cross-border payments, and xRapid, a liquidity solution that uses XRP as a bridge currency.

With its focus on speed, security, and efficiency, Ripple has gained popularity in the banking and financial industry. It has partnered with major banks and payment processors, including Santander and American Express, to explore the potential of its technology for improving the global economy.

Ripple’s technology has also been adopted by various ICO (Initial Coin Offering) projects, as well as by other cryptocurrencies such as Zcash. Its smart contract functionality and privacy features make it an attractive option for developers and investors.

In conclusion, Ripple is a digital cryptocurrency that offers a cashless and decentralized solution for fast and secure financial transactions. Its transparent and peer-to-peer nature, combined with its innovative technology, has the potential to revolutionize the global economy.

What is Bitcoin?

Bitcoin is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

What is the difference between Bitcoin and Zcash?

Bitcoin and Zcash are both cryptocurrencies, but they use different technologies to achieve privacy and fungibility. Bitcoin transactions are transparent, while Zcash transactions can be shielded to protect the privacy of the sender, recipient, and transaction amount.

How can I invest in cryptocurrencies?

To invest in cryptocurrencies, you can open an account on a cryptocurrency exchange and buy the digital currencies of your choice using traditional fiat currency or other cryptocurrencies. It’s important to do thorough research and understand the risks before investing in any cryptocurrencies.

+ There are no comments

Add yours