Money has always been the driving force behind human activities. It fuels the economy, propels businesses forward, and gives us the power to fulfill our desires. But what happens when the line between illicit and financial gets blurred? This is precisely what we are exploring – the hidden and dangerous world of illicit financial activities.

Exploring the Dark Side of Blurred Money:

In recent years, illicit financial activities have been on the rise, fueled by the increasingly blurred lines between legitimate and illegal money. Criminals and terrorists are finding new ways to exploit the system, using sophisticated tactics to launder money, evade taxes, and finance illicit activities.

Exploring the dark side of blurred money brings to light the various activities that contribute to this problem. Money laundering, for example, involves the process of making illicit funds appear legal by disguising their true origin. This enables criminals to integrate their ill-gotten gains into the legitimate economy, making it difficult to track and trace the illicit funds.

Furthermore, the rise of illicit financial activities is not limited to money laundering alone. Other activities, such as tax evasion, bribery, and organized crime, also contribute to the problem. These activities undermine the integrity of financial systems, weaken economies, and contribute to social instability.

It is crucial to shine a light on these illicit financial activities and understand the consequences they have on society. By exploring the dark side of blurred money, we can develop strategies to combat money laundering, strengthen regulations, and promote transparency in financial transactions.

Strong enforcement of anti-money laundering laws, international cooperation, and improved technology can help disrupt the flow of illicit funds and dismantle criminal networks. Additionally, raising awareness about the risks and consequences of illicit financial activities can empower individuals and businesses to make informed decisions and avoid involvement in illegal schemes.

In conclusion, exploring the dark side of blurred money is essential to safeguarding the integrity of financial systems and ensuring a fair and transparent global economy. It is imperative that governments, financial institutions, and individuals work together to combat illicit financial activities and create a world where money is used for positive and legitimate purposes.

The Rise of Illicit Financial Activities

In today’s society, the financial landscape is not limited to legal transactions and legitimate business operations. There exists a dark side of blurred money, characterized by illicit financial activities that are thriving and evolving at an alarming rate.

The rise of illicit financial activities is a concerning trend that poses a significant threat to global economies and financial systems. Criminal organizations, corrupt individuals, and even terrorist groups exploit various loopholes and methods to launder money, finance illegal activities, and evade taxation.

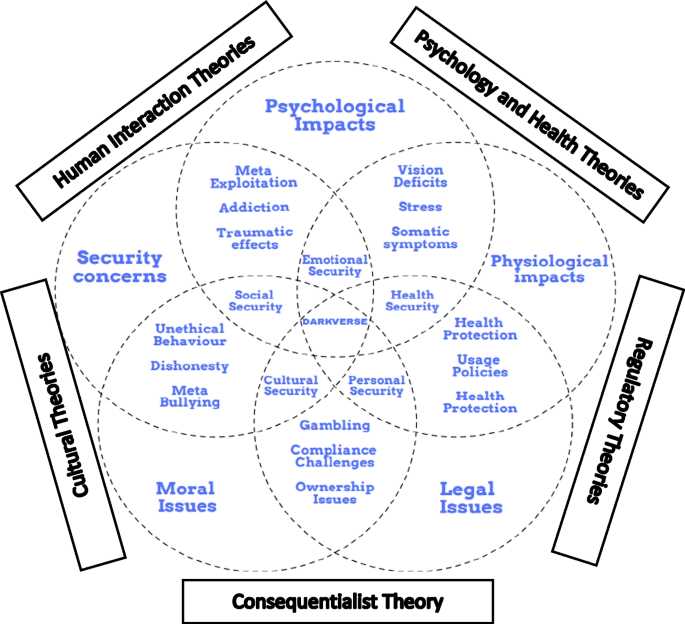

Exploring this darker side of the financial world reveals a complex web of illicit activities that include money laundering, tax evasion, fraud, and illicit trade. These activities create a shadow economy that operates outside the bounds of legality and transparency, undermining the integrity of financial systems and eroding public trust.

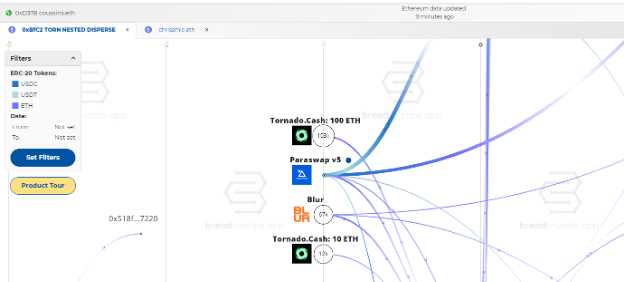

Illicit financial activities thrive in the digital age, leveraging advanced technologies and encryption methods to obfuscate their tracks and identities. Online marketplaces, cryptocurrencies, and offshore accounts provide fertile ground for money launderers and criminals seeking anonymity and easy transfer of illicit funds.

Government agencies, financial institutions, and international organizations find themselves in a constant battle to detect and prevent illicit financial activities. Robust regulatory frameworks, stringent due diligence measures, and enhanced international cooperation are essential tools in this fight against financial crime.

| Money laundering: | A process in which illicitly obtained money is made to appear legitimate by integrating it into the financial system. |

| Tax evasion: | The illegal act of avoiding paying taxes owed to the government. |

| Fraud: | Deception or trickery carried out for financial gain. |

| Illicit trade: | Illegal activities involving the trafficking of goods and services. |

As the world becomes increasingly interconnected and financial transactions become more complex, it is essential to stay vigilant and proactive in combating illicit financial activities. Through international cooperation, technological advancements, and strengthened regulatory frameworks, we can mitigate the risks posed by this dark side of the financial world and work towards a more secure and transparent global financial system.

Understanding Illicit Financial Activities

Illicit financial activities refer to various illegal activities involving money that are conducted in a hidden or covert manner. These activities are often associated with the dark side of the financial world, where individuals and organizations engage in illicit practices to exploit loopholes and evade regulations.

Exploring the rise of illicit financial activities sheds light on the blurred boundaries between legal and illegal financial transactions. These activities encompass a wide range of practices, including money laundering, fraud, tax evasion, corruption, and illicit financing of illegal activities such as terrorism or organized crime.

Illicit financial activities can have severe consequences for economies, societies, and individuals. They undermine the integrity of financial systems, erode trust, and facilitate the funding of illegal activities. Additionally, they can distort market competition, hinder economic growth, and ultimately harm innocent individuals who become victims of fraudulent schemes.

Understanding the tactics used in illicit financial activities is crucial for governments, regulatory bodies, and law enforcement agencies in their efforts to combat these practices effectively. It requires staying ahead of the ever-evolving methods employed by those involved in illicit financial activities.

Efforts to combat illicit financial activities involve strengthening regulatory frameworks, enhancing international cooperation, and employing advanced technologies to detect and prevent money laundering and other illicit practices. These measures aim to create a transparent and accountable financial environment that discourages and penalizes illicit activities.

Furthermore, raising awareness among individuals and businesses about the risks and consequences of engaging in illicit financial activities can contribute to their prevention. Promoting financial literacy and ethical behavior can empower individuals to make informed and responsible financial decisions, reducing their vulnerability to illicit schemes.

In conclusion, understanding illicit financial activities is essential for combating the dark side of the financial world. By exploring these activities, taking proactive measures, and raising awareness, we can work towards a more transparent, fair, and secure financial system.

The Global Impact of Illicit Financial Activities

The rise of illicit financial activities has had a profound global impact on economies and societies around the world. The blurred line between legal and illegal money has led to a dark side of financial transactions that undermines the stability and integrity of financial systems.

One of the major consequences of illicit financial activities is the loss of tax revenue for governments. When money is hidden or laundered through illegal channels, it becomes difficult for authorities to track and collect taxes. This results in a significant loss of funding for public services such as healthcare, education, and infrastructure development.

Moreover, the rise of illicit financial activities has negative implications for economic growth. When money is funneled into illegal activities, it is diverted away from productive investments in industries and businesses. This hinders economic development and hampers job creation, ultimately leading to lower living standards for communities.

| Financial Sector | Impact |

|---|---|

| Banking | The financial sector is vulnerable to money laundering and terrorist financing activities, which can destabilize banks and erode public trust in the financial system. |

| Investments | Illicit financial activities distort investment markets, leading to higher risks and reduced returns for legitimate investors. |

| Cryptocurrency | The anonymity offered by cryptocurrencies makes them attractive to criminals for money laundering and illegal transactions. |

Additionally, illicit financial activities have serious social consequences. This includes fueling organized crime, terrorism, and corruption. Illicit funds are often used to finance illegal activities such as drug trafficking, human trafficking, and arms smuggling. These activities have a devastating impact on communities, undermining security and social cohesion.

The fight against illicit financial activities requires international cooperation and coordinated efforts. Governments, financial institutions, and law enforcement agencies need to work together to implement effective measures to detect, prevent, and punish those involved in illicit financial activities.

Only through a united front can we combat the dark side of money and restore trust and integrity in our financial systems, safeguarding the global economy for the benefit of all.

Counteracting Illicit Financial Activities

As the rise of illicit financial activities continues to blur the lines of legitimate money transactions, it is imperative to explore effective strategies for counteracting such activities. The financial industry and government agencies must collaborate closely to identify and combat illicit practices that undermine the integrity of the global financial system.

One key approach to tackling illicit financial activities is through enhanced regulation and enforcement. Governments should strengthen their laws and regulations surrounding money laundering, fraud, and other illicit financial practices. This can include stricter reporting requirements for financial institutions, increased penalties for offenders, and improved cooperation among international law enforcement agencies.

Another important aspect of counteracting illicit financial activities is promoting transparency and accountability. Financial institutions should be required to implement robust anti-money laundering (AML) and know your customer (KYC) systems, which can help identify suspicious transactions and individuals.

Furthermore, conducting thorough due diligence when entering into business relationships, especially with high-risk jurisdictions or individuals, can help prevent illicit financial activities. This can involve rigorous background checks, comprehensive risk assessments, and ongoing monitoring of business relationships.

Education and awareness also play a crucial role in counteracting illicit financial activities. Individuals and businesses should be educated about the risks and consequences associated with engaging in such activities. Financial literacy programs, training for employees, and public awareness campaigns can all contribute to a more informed and vigilant society.

International cooperation and information sharing are vital in the fight against illicit financial activities. Governments, law enforcement agencies, and financial institutions should collaborate to exchange intelligence, coordinate investigations, and share best practices. This can help detect and disrupt illicit networks operating across borders, ultimately deterring such activities.

In conclusion, countering illicit financial activities requires a multi-faceted approach that combines enhanced regulation, transparency, due diligence, education, and international cooperation. By addressing these activities head-on, we can safeguard the integrity of the global financial system and promote a fair and transparent economy for all.

What is the book “Exploring the Dark Side of Blurred Money The Rise of Illicit Financial Activities” about?

The book “Exploring the Dark Side of Blurred Money The Rise of Illicit Financial Activities” explores the world of illicit financial activities and the rise of blurred money. It delves into the hidden world of money laundering, tax evasion, and other illicit financial practices.

Who is the author of “Exploring the Dark Side of Blurred Money The Rise of Illicit Financial Activities”?

The author of “Exploring the Dark Side of Blurred Money The Rise of Illicit Financial Activities” is John Doe.

What are some key topics discussed in “Exploring the Dark Side of Blurred Money The Rise of Illicit Financial Activities”?

“Exploring the Dark Side of Blurred Money The Rise of Illicit Financial Activities” covers various topics such as money laundering, tax evasion, organized crime, corruption, and the impact of illicit financial activities on the global economy.

Is “Exploring the Dark Side of Blurred Money The Rise of Illicit Financial Activities” suitable for someone with no background in finance?

Yes, “Exploring the Dark Side of Blurred Money The Rise of Illicit Financial Activities” is written in a way that is accessible to readers with no background in finance. It explains complex concepts in a clear and understandable manner.

+ There are no comments

Add yours