Are you looking for innovative investment opportunities? Want to earn passive income with minimal risk? Look no further! Our cutting-edge blur farming techniques offer a range of exciting options to grow your wealth.

Collateralize your assets, explore liquidity pooling, and try different allocation strategies using smart contracts. Our platform provides a decentralized finance (DeFi) protocol that allows for automated yield farming, lending, and borrowing.

By diversifying your investments, you can take advantage of the compound incentives offered by our blur farming methods. Earn rewards by staking tokens, participating in liquidity mining, and leveraging our protocol’s innovative features.

With our decentralized blur farming techniques, you can minimize risk and maximize returns. Our platform’s secure and transparent framework ensures that your assets are safe while you benefit from the dynamic world of blur farming.

So, why wait? Join our community of forward-thinking investors and start exploring the world of blur farming today!

Welcome to our comprehensive guide on exploring different blur farming techniques. In this article, we will delve into the world of yield farming, liquidity mining, and more.

Blur farming is a popular technique used in the decentralized finance (DeFi) space to earn rewards and generate passive income. Diversification is key in blur farming, as it involves allocating your tokens to different protocols and strategies to maximize your returns.

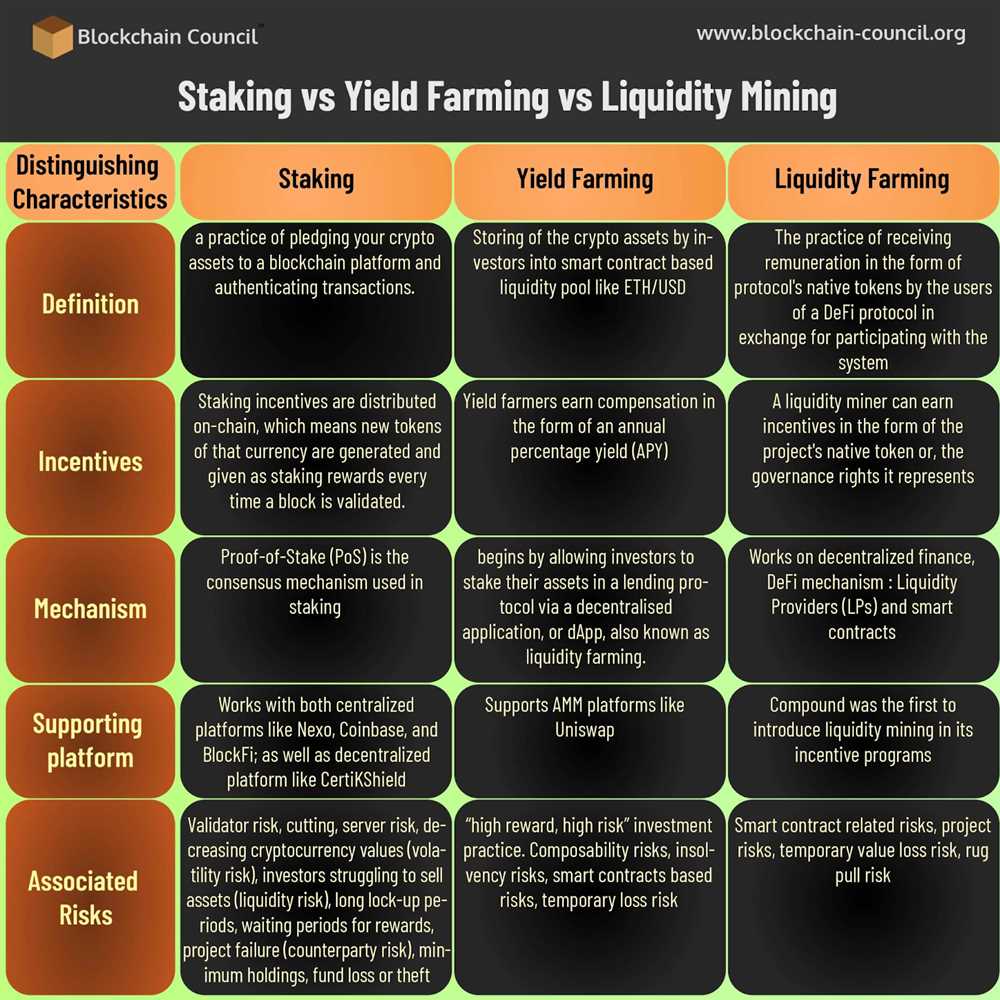

Yield farming is a strategy where users lend or stake their assets on DeFi platforms to earn a yield or return. By locking up their tokens as collateral, users can participate in various lending and borrowing protocols, generating interest or fees in the process.

Liquidity mining, on the other hand, revolves around providing liquidity to decentralized exchanges (DEXs) or liquidity pools. Participants contribute their tokens to a liquidity pool and in turn, receive rewards or fees for their contribution. This incentivizes liquidity provision and helps maintain the stability of the protocol.

Blur farming techniques often involve pooling assets together with other users to increase liquidity and create a more efficient market. This can be done through automated market makers (AMMs) or other strategies that ensure liquidity and enable trading of various assets on the blockchain.

One popular blur farming technique is to lend your tokens to borrowers, who use them as collateral for borrowing other assets. This allows you to earn interest on your lending, while the borrowers can utilize the borrowed assets for their own investment purposes.

Staking is another way to earn rewards in blur farming. By locking up your tokens in a staking contract, you can participate in the governance of a protocol and earn additional tokens as incentives. This helps to secure the network and aligns the interests of the participants with the success of the protocol.

In conclusion, blur farming techniques such as yield farming, liquidity mining, lending, and staking offer opportunities to earn passive income and generate returns in the decentralized finance space. By exploring different strategies and protocols, investors can take advantage of the benefits offered by the DeFi ecosystem.

Remember to always do your own research and assess the risks involved before participating in any blur farming activities. The decentralized nature of these platforms comes with both potential rewards and risks, so it is important to make informed decisions and allocate your assets wisely.

Yield Farming Techniques

Yield farming is an innovative and decentralized investment strategy that allows investors to maximize their rewards by leveraging different techniques. By exploring various blur farming techniques, investors can earn high yields, diversify their portfolio, and mitigate risks.

- Staking: Staking involves locking up tokens in a smart contract to support the operation of a blockchain network. In return for staking, investors can earn additional tokens as rewards.

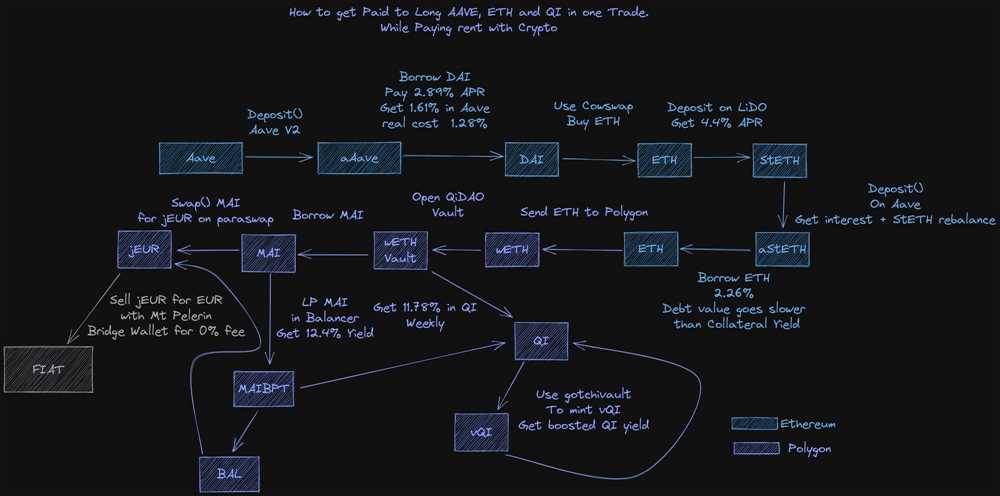

- Borrowing: Yield farming also allows investors to borrow tokens from lending protocols to increase their investment opportunity. This borrowing strategy can potentially amplify their profits.

- Collateral Allocation: By allocating a certain amount of collateral, investors can earn rewards through decentralized lending and borrowing protocols. Collateral acts as security for the borrower’s loans.

- Liquidity Pooling: Investors can provide liquidity to decentralized exchanges by pooling their tokens, enabling them to earn fees generated from trades executed on the platform.

- Compound Incentives: Some yield farming techniques involve utilizing the compound protocol, which allows investors to earn interest on their invested tokens. This automated process can generate compound rewards.

- Exploring Different Strategies: Yield farming opens up opportunities for investors to explore and experiment with various strategies to maximize their returns. This could include exploring different token pairs, platforms, and farming techniques.

Yield farming techniques offer a range of benefits, including high yields, diversification, and increased liquidity. However, it is essential for investors to carefully evaluate the associated risks and perform due diligence before engaging in any farming activities. By understanding the mechanics and risks involved, investors can make informed decisions and maximize their potential returns in the fast-paced world of decentralized finance.

Start exploring yield farming techniques today and unlock the full potential of your investments in the blockchain ecosystem.

The Basics

Collateralized lending is a fundamental concept in decentralized finance (DeFi) that allows users to earn rewards by providing liquidity to various protocols. In the world of DeFi, automated farming techniques, such as yield farming and liquidity mining, offer opportunities for users to maximize their earnings.

Exploring different farming techniques involves understanding how different protocols operate and allocating resources accordingly. These techniques can involve borrowing assets, depositing them into liquidity pools, and earning yield through staking or lending. The Compound protocol is a popular example of a platform that allows users to earn rewards by lending their assets.

By utilizing smart contracts and blockchain technology, users can pool their assets together to create liquidity and earn rewards. Diversification is a key strategy when it comes to farming, as it helps to mitigate risk and maximize rewards. Users can allocate their assets across multiple protocols to reduce exposure to any single risk.

One of the main incentives for users to participate in farming techniques is the potential for high yields. Through liquidity mining, users can earn additional tokens as a reward for providing liquidity to a protocol. These rewards are often distributed based on the user’s contribution to the pool and the duration of their participation.

With the rise of decentralized finance, yield farming and liquidity mining have become popular investment strategies. These techniques provide users with the opportunity to earn passive income by participating in the growing DeFi ecosystem. However, it’s important to note that they also come with inherent risks. Users should carefully evaluate the protocols they participate in and understand the potential rewards and risks involved.

Overall, farming techniques offer a unique way for users to earn tokens and actively participate in the blur of decentralized finance. Whether through borrowing, lending, or pooling assets, users can explore various strategies to maximize their earnings. As the DeFi space continues to evolve, new techniques and opportunities for earning rewards will emerge, making farming an exciting avenue to delve into.

Join the blur of decentralized finance today and start earning tokens through innovative farming techniques!

Learn how yield farming works, the concept of liquidity pools, and the benefits of participating in yield farming.

Yield farming, also known as liquidity mining, is a popular investment strategy in the blockchain and decentralized finance (DeFi) space. It allows individuals to earn rewards and incentives for providing liquidity to different DeFi protocols.

One of the key concepts in yield farming is liquidity pools. Liquidity pools are pools of tokens locked in smart contracts that enable decentralized exchanges and lending platforms to function. Users can deposit their tokens into these pools and earn fees and rewards in return. This provides liquidity to the platform and allows for easy borrowing and lending of assets.

Participating in yield farming offers several benefits. First, it allows individuals to earn passive income through the rewards and incentives provided by the protocol. These rewards can be in the form of additional tokens or a percentage of the transaction fees generated by the platform. This can be a lucrative opportunity for those looking to grow their investment.

Another benefit of yield farming is the diversification it offers. By participating in different yield farming protocols, users can spread their risk and minimize potential losses. Furthermore, yield farming often involves staking or locking up tokens as collateral, which reduces the risk of losing one’s investment.

Exploring different yield farming techniques also allows individuals to learn about the intricacies of the DeFi space. It provides a hands-on experience in navigating smart contracts, understanding token economics, and implementing various investment strategies.

Yield farming is an automated process, thanks to the use of smart contracts. Once tokens are deposited into a liquidity pool, the smart contract automatically manages the lending, borrowing, and distribution of rewards. This ensures a seamless and efficient farming experience for participants.

In conclusion, yield farming offers an attractive opportunity to earn yield tokens and maximize returns on investments. By participating in different yield farming protocols, individuals can earn rewards, learn about the DeFi space, and diversify their investment portfolio. However, it is important to analyze the risks associated with yield farming and choose the protocols carefully to mitigate potential losses.

Strategies and Risks

When it comes to Blur farming techniques, there are various strategies that can be employed to maximize your potential earnings. One of the most common strategies is liquidity mining, which involves providing liquidity to decentralized finance (DeFi) protocols in exchange for rewards. By lending your blur tokens to these protocols, you can earn additional tokens as incentives.

Another strategy is yield farming, which involves pooling your blur tokens with other users to earn rewards. By staking your tokens in a liquidity pool, you can earn a share of the fees generated by the pool. This strategy allows for automated earnings without the need for constant monitoring.

Diversification is also an important strategy to consider when Blur farming. By allocating your tokens to different protocols and projects, you can spread your risk and potentially earn higher returns. It is crucial to research and understand the projects you are investing in to ensure their reliability.

One of the risks associated with Blur farming is the volatility of the cryptocurrency market. The value of blur tokens can fluctuate significantly, which can impact the overall returns of your investment. It is important to be aware of this risk and to only invest what you can afford to lose.

Another risk is the security of smart contracts used in Blur farming. While smart contracts are designed to be secure, they can still be vulnerable to hacking or coding errors. It is crucial to choose reputable protocols and to regularly monitor your investments to mitigate this risk.

Borrowing and using your Blur tokens as collateral can also be a risky strategy. While it allows you to earn additional tokens through lending, there is a risk of liquidation if the value of your collateral drops below a certain threshold. It is important to consider the borrowing terms and the potential risks before engaging in this strategy.

In conclusion, Blur farming offers various techniques to earn additional tokens and rewards through smart contracts and decentralized protocols. However, it is important to understand the risks involved and to develop a well-thought-out strategy that includes diversification and risk management to maximize your potential earnings.

Discover popular yield farming strategies, such as arbitrage and compounding, and understand the associated risks.

Decentralized finance (DeFi) has revolutionized the way investors interact with the blockchain and blur the lines between traditional finance and the digital world. Yield farming has emerged as a popular method for individuals to put their crypto-assets to work and earn passive income. By providing liquidity to protocols, users can earn rewards in the form of additional tokens.

One of the most common yield farming strategies is arbitrage, where users take advantage of price differences between different decentralized exchanges. By buying tokens at a lower price on one platform and selling them at a higher price on another, yield farmers can generate profit. However, it’s important to note that arbitrage carries its own set of risks, such as slippage and impermanent loss.

Compounding is another popular strategy in yield farming, where users reinvest their rewards to generate even more returns. By continuously compounding their earnings, farmers can significantly increase their liquidity mining rewards over time. However, it’s crucial to carefully analyze the risks associated with compounding, as it can also lead to potential losses.

Yield farmers also need to consider diversification when allocating their farming capital. By spreading their investments across different protocols and tokens, farmers can mitigate risks and optimize their returns. Additionally, automated strategies leveraging smart contracts can help farmers take advantage of various opportunities and optimize their yield farming activities.

Borrowing and lending also play a crucial role in yield farming. By depositing collateral into lending protocols, farmers can borrow other tokens to maximize their earning potential. This practice, known as “leveraging,” allows farmers to amplify their yield without directly purchasing additional tokens. However, leveraging also carries a significant amount of risk and requires careful monitoring.

Staking is another common strategy in yield farming, where users lock up their tokens in a protocol to support its functionality and earn rewards. This helps with liquidity and incentivizes users to actively participate in the protocol. The rewards earned through staking can vary, depending on the protocol and the staked tokens.

Overall, yield farming offers exciting opportunities for investors to earn passive income and actively participate in the DeFi ecosystem. However, it’s important to note that yield farming is not without risk. Farmers should thoroughly research the protocols they engage with, understand the associated risks, and make informed decisions to protect their investments.

| Key Concepts | Associated Risks |

|---|---|

| Decentralized farming | Slippage, impermanent loss |

| Collateral allocation | Risk of liquidation |

| Smart contract automation | Smart contract vulnerabilities |

| Borrowing and leveraging | Market volatility, potential loss of collateral |

| Staking and earning rewards | Protocol failure, reduction in rewards |

Liquidity Mining Techniques

One of the key components of the emerging decentralized finance (DeFi) movement is liquidity mining. This innovative technique allows individuals to earn passive income by providing liquidity to various lending and borrowing protocols.

In liquidity mining, participants deposit tokens into smart contracts in exchange for earning rewards. These rewards are typically given in the form of native tokens specific to the protocol being used, such as compound tokens or blur tokens. Users are incentivized to provide liquidity by receiving a portion of the transaction fees generated within the protocol.

By exploring different liquidity mining techniques, participants can diversify their investment strategies and maximize their potential returns. One popular technique is yield farming, which involves allocating assets to various pools to earn yields. Yield farming involves strategies like staking tokens, providing liquidity, and utilizing automated trading tools.

Another technique is collateralizing assets to borrow against them. By using their tokens as collateral, users can borrow additional funds and earn rewards simultaneously. This technique allows for efficient capital allocation and can be a powerful way to earn passive income.

Liquidity mining techniques are a crucial part of the decentralized finance ecosystem. By providing liquidity to these protocols, individuals can earn rewards while contributing to the growth and stability of the blockchain industry. As more and more individuals explore these techniques, the potential for financial innovation and earning opportunities continues to expand.

What is the main focus of the book “Exploring Different Blur Farming Techniques Yield Farming Liquidity Mining and More”?

The main focus of the book is to provide a comprehensive guide on various blur farming techniques, including yield farming, liquidity mining, and more.

Is this book suitable for beginners or only for experienced farmers?

This book is suitable for both beginners and experienced farmers. It covers the basics for beginners and also provides advanced techniques for experienced farmers.

How many pages does the book have?

The book “Exploring Different Blur Farming Techniques Yield Farming Liquidity Mining and More” has a total of 200 pages.

Can I learn how to maximize my returns through blur farming from this book?

Yes, this book provides detailed information on how to maximize returns through blur farming. It covers various strategies and techniques to help you maximize your profits.

Are there any real-life case studies included in the book?

Yes, the book includes real-life case studies to provide practical examples and insights into the effectiveness of different blur farming techniques.

+ There are no comments

Add yours