Discover the innovation and potential of decentralized finance with Blur. Our revolutionary system is built on the principles of transparency, security, and value. Introducing a new era of trading and investment with tokenomics.

Tokenomics is the study and analysis of the economics behind digital assets. With smart contracts and virtual currencies, Blur is transforming the way we interact with the financial market. Gain a deeper understanding of the underlying technology and its impact on the economy.

At Blur, we believe in providing in-depth insights into the world of tokenomics. Our network of experts meticulously examines market trends, liquidity, and the underlying economic factors that drive the value of tokens. Stay ahead with our comprehensive analysis and make informed investment decisions.

Join the Blur revolution and unlock the potential of the decentralized economy. Embrace the power of blockchain technology and cryptocurrency, and discover a new financial frontier.

Experience the future of finance with Blur. Transform the way you think about economics and explore the unlimited possibilities that lie behind tokenomics.

Understanding Tokenomics

Tokenomics refers to the study of the economic principles behind the use and value of tokens in a blockchain network. To truly grasp the potential of this innovative technology, it is essential to dive into the world of tokenomics.

Trends in the cryptocurrency market have shown that tokenomics plays a crucial role in the success of a project or investment. By understanding the underlying economics behind a token, investors and users can make educated decisions and predictions.

Innovation in tokenomics has paved the way for new investment opportunities and the creation of digital assets. Tokens act as a representation of value and ownership within a network, allowing for liquidity and tradability.

Tokenomics takes into account various factors, such as the supply and demand dynamics, the utility and functionality of the token, and the governance and decision-making process in the network. It also analyzes how tokens contribute to the overall economy and financial system.

A decentralized system powered by blockchain technology provides transparency and security, further enhancing the value of tokens. Smart contracts enable trustless interactions and automate processes, adding efficiency to the token economy.

When conducting a thorough analysis of tokenomics, it is important to look beyond the surface and understand the motivations and incentives behind token distribution and usage. The tokenomics of a project can determine its long-term success and sustainability.

Tokenomics brings together the worlds of economics, finance, and technology to create a virtual economy within a network. It blurs the lines between traditional financial systems and digital assets, offering new possibilities for individuals and businesses alike.

By understanding tokenomics, one can navigate the cryptocurrency market with more confidence and make informed decisions about investments and participation in various blockchain projects. It is the key to unlocking the potential of this decentralized and transformative technology.

What is Tokenomics?

Tokenomics refers to the study of the economic aspects of tokens in a decentralized system. It is a term that combines the words “token” and “economics” to describe the underlying principles and dynamics behind the use and value of tokens in a digital economy.

In recent years, with the rise of blockchain technology and the growth of cryptocurrencies, tokenomics has become an important area of analysis and discussion. It encompasses various aspects such as the design, creation, issuance, and distribution of tokens, as well as their role in a particular network or ecosystem.

Tokenomics involves analyzing the market trends, liquidity, and trading of tokens, as well as the incentives and mechanisms that drive their value. It considers factors such as supply and demand, token utility, token holders, and the overall economic system in which the tokens operate.

One of the key innovations enabled by tokenomics is the use of smart contracts. These self-executing contracts, built on the blockchain, enable the automation of various functions and processes related to tokens. They enhance the security, transparency, and efficiency of token transfers and transactions.

Tokenomics also plays a crucial role in the investment and finance landscape. It provides a framework for evaluating the potential of token-based projects and understanding their economic viability. Investors can analyze tokenomics to assess the long-term value proposition of a project or token and make informed investment decisions.

Overall, tokenomics offers an in-depth look at the underlying economics and dynamics behind the use and value of tokens. By understanding tokenomics, businesses and individuals can navigate the evolving landscape of cryptocurrencies and blockchain technology and take advantage of the opportunities it presents.

The Role of Tokenomics in Blockchain

Tokenomics plays a pivotal role in the blockchain market, revolutionizing the way decentralized systems function. By utilizing tokenomics, virtual assets can be analyzed, valued, and traded securely.

Tokenomics is an economic system that governs the behavior and value of virtual assets within a blockchain network. It combines elements of traditional economics, finance, and technology to create a transparent and efficient ecosystem.

Through tokenomics, the market can gain an in-depth look at the value and potential of cryptocurrencies and other digital assets. This analysis allows for informed investment decisions and the exploration of innovative blockchain projects.

Smart contracts, a key component of tokenomics, enable secure and automated transactions within the blockchain economy. These contracts help establish trust, ensure transparency, and enhance security for participants in the system.

Tokenomics also plays a crucial role in providing liquidity to the market. Tokens can be easily traded and exchanged, allowing for the seamless flow of value within the blockchain network. This liquidity improves the overall efficiency and effectiveness of the economy.

In addition, tokenomics fosters financial inclusion by providing individuals with access to investment opportunities previously unavailable in traditional markets. It allows people to participate in the growth and success of blockchain projects, democratizing finance on a global scale.

Overall, tokenomics is the backbone of the blockchain economy. It empowers individuals, businesses, and entire communities to leverage the power of decentralized systems and digital assets. With its emphasis on transparency, security, and innovation, tokenomics is reshaping the future of finance and technology.

Key Components of Tokenomics

In the decentralized world of economics, tokenomics plays a vital role in determining the value and trading dynamics of cryptocurrencies. Tokenomics is the analysis and understanding of the economic system that governs the market for digital assets. It provides a comprehensive look at the economy, finance, and investment trends in the blockchain and cryptocurrency space.

At its core, tokenomics encompasses the innovative technology of smart contracts and blockchain networks. These technologies enable the creation, distribution, and management of tokens, which are virtual representations of assets or utilities. Tokens offer liquidity, security, and transparency in a digital ecosystem.

One key component of tokenomics is the token itself. Tokens act as a medium of exchange within a specific network or platform, allowing users to participate in transactions and access various services. The value of a token is determined by factors such as supply and demand, utility, and market perception.

Another important aspect of tokenomics is the network and its ecosystem. A well-designed network fosters adoption and drives the value of tokens. It provides an infrastructure for users to interact, transact, and create value. Moreover, the network’s governance and consensus mechanisms ensure the security and integrity of the token ecosystem.

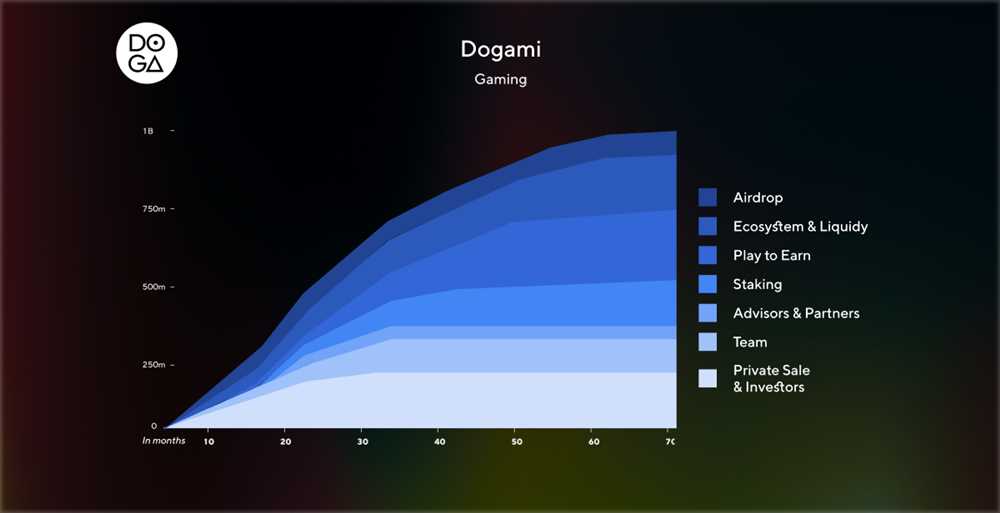

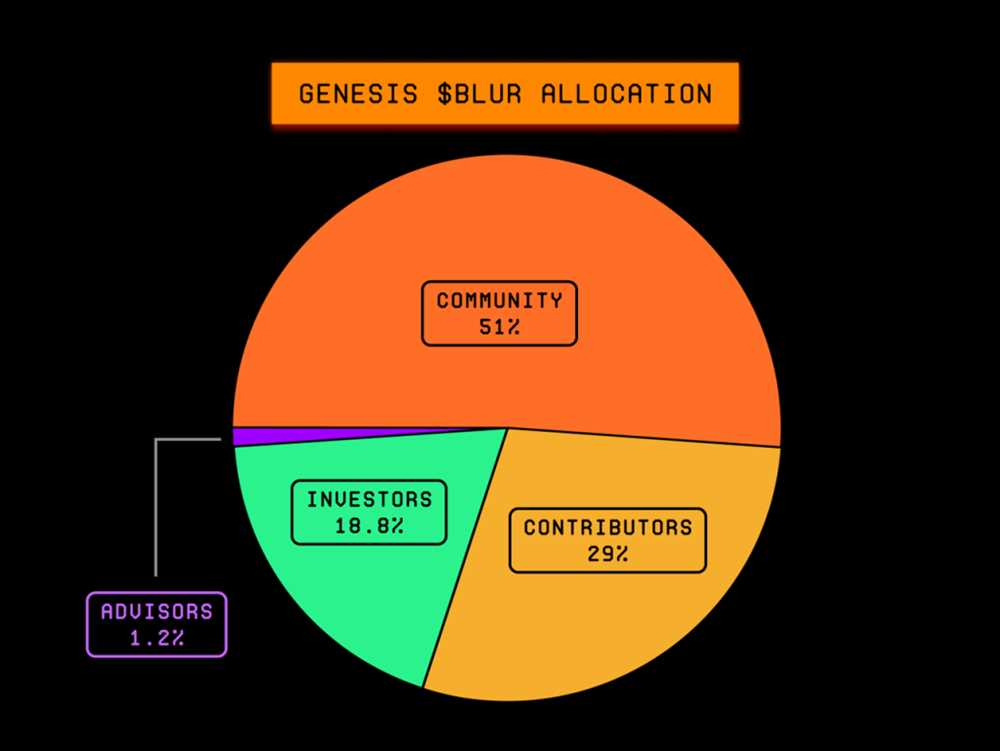

Tokenomics also includes considerations of token distribution and initial coin offerings (ICOs). How tokens are distributed and sold to investors can impact their perceived value and market liquidity. ICOs have become popular fundraising mechanisms for blockchain-based projects, allowing early adopters and investors to acquire tokens in exchange for investments.

In conclusion, tokenomics is a fundamental element in the world of cryptocurrencies and blockchain technology. It brings together the principles of economics, finance, and technology to create a system that offers value, liquidity, and transparency. Understanding the key components of tokenomics is essential for anyone interested in the potential of this innovative and rapidly evolving field.

Token Distribution Models

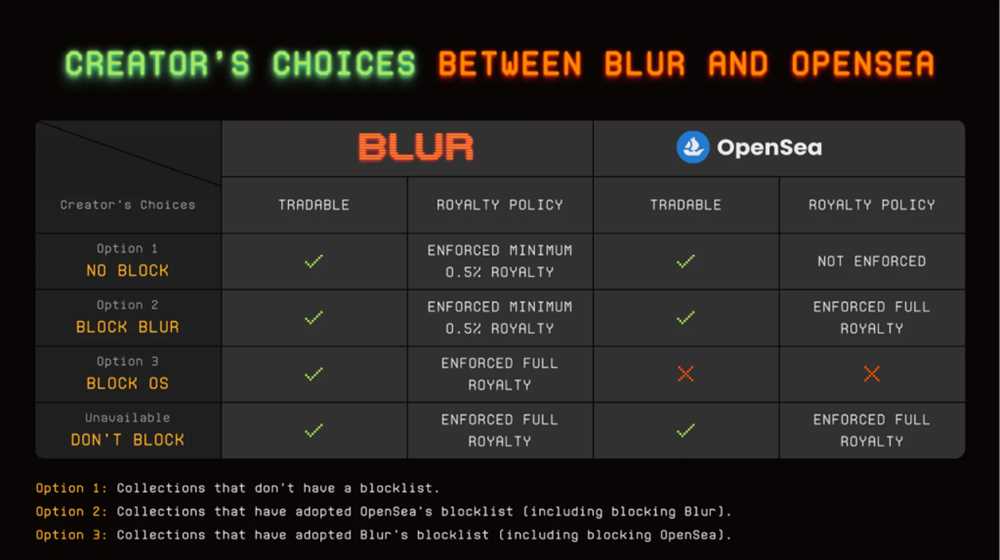

When it comes to token economics, the distribution model plays a crucial role in ensuring the success and sustainability of a project. Token distribution refers to how the total supply of tokens is allocated and made available to participants in the system.

There are several token distribution models that have been implemented in the market, each with its own unique characteristics and advantages. Let’s take an in-depth look at some of the most common token distribution models:

| Model | Description |

|---|---|

| Initial Coin Offering (ICO) | An ICO is a fundraising method where tokens are sold to investors in exchange for cryptocurrencies or fiat currencies. This model enables projects to raise capital for development and allows early adopters to purchase tokens at a discounted price. |

| Airdrops | Airdrops involve the free distribution of tokens to a specific group of users. This model is often used to create awareness and incentivize users to participate in the project. |

| Token Presale | Token presale is similar to an ICO but is offered to a select group of investors before the public sale. This model allows early investors to acquire tokens at a lower price and provides the project with initial funding. |

| Bounty Programs | Bounty programs reward users for completing specific tasks or contributing to the project. Tokens are distributed as a form of incentive to encourage community participation. |

| Initial Exchange Offering (IEO) | An IEO is similar to an ICO, but the token sale is conducted on a cryptocurrency exchange. This model provides additional liquidity and security for token holders. |

| Token Burn | Token burn involves the deliberate destruction or removal of a certain number of tokens from circulation. This model can help increase the value of the remaining tokens by reducing supply. |

These are just a few examples of token distribution models that are being used in the market today. Each model has its own implications for the overall market economy, liquidity, and value of the tokens. By understanding the different distribution models, investors can make informed decisions and analyze the tokenomics behind projects.

Token distribution models are an essential aspect of the decentralized and transparent nature of blockchain and cryptocurrency technology. They ensure fairness, innovation, and security in the investment and trading of virtual assets. In-depth analysis of tokenomics and the economics behind token distribution models can provide valuable insights into market trends and investment opportunities.

Initial Coin Offerings (ICOs)

Initial Coin Offerings (ICOs) have gained significant popularity in the cryptocurrency market. They represent a new and innovative way for startups to raise funds and investors to participate in the growing virtual economy.

ICOs are based on the principles of transparency, smart contracts, and blockchain technology. Through the use of blockchain, ICOs offer a decentralized and secure system for raising capital. This technology enables the creation and trading of digital tokens, representing assets or utility within a project or network.

Investing in ICOs can be seen as a form of early-stage investment, similar to venture capital. Startups launching ICOs typically have a whitepaper that outlines their project, the technology behind it, and the market they are targeting. This in-depth analysis provides investors with a better understanding of the project’s potential and the value it aims to create.

The advantages of investing in ICOs include the liquidity and accessibility of the tokens. Investors can trade these tokens on exchanges, providing an opportunity for potential profit. However, as with any investment, there are also risks involved. The cryptocurrency market is highly volatile, and projects may fail to deliver on their promises.

The growth in ICOs has led to the emergence of new trends and best practices. A successful ICO requires careful planning, marketing, and community engagement. It is important for investors to conduct their own research and due diligence before participating in any ICO.

Overall, ICOs have disrupted traditional financing methods and opened up new opportunities for both startups and investors. They have democratized the investment landscape and allowed anyone with an internet connection to participate in the global economy.

In conclusion, Initial Coin Offerings (ICOs) are a revolutionary concept in the world of finance. They combine the power of blockchain technology, innovation, and finance to create a decentralized and accessible investment platform. While there are risks involved, ICOs have the potential to drive economic growth and transform industries.

Security Token Offerings (STOs)

Security Token Offerings (STOs) are an in-depth form of digital investment that combines the innovation of blockchain technology with the traditional world of finance. STOs provide a network of virtual assets that blur the boundaries between traditional securities and digital tokens.

STOs offer a higher level of security and transparency compared to Initial Coin Offerings (ICOs) and other forms of fundraising in the cryptocurrency market. The analysis and evaluation of security tokens are done through a decentralized system, ensuring increased trust and transparency for investors.

One of the key features of STOs is the use of smart contracts, which are self-executing contracts with the terms of the agreement directly written into the code. This technology enables automated trading and ensures that all transactions are secure and transparent.

Security tokens represent ownership or investment in a real-world asset, such as equity in a company, real estate, or commodities. These tokens provide a digital representation of value and can be traded on various platforms, increasing liquidity in the market.

STOs have revolutionized the investment landscape by providing a bridge between traditional finance and the blockchain technology. This innovation allows for the tokenization of assets, which enables fractional ownership, greater accessibility, and enhanced liquidity for investors.

With the use of blockchain technology, STOs streamline the investment process, reducing intermediaries and increasing efficiency. This technology also ensures the immutability of transaction records, minimizing the risk of fraud and manipulation.

In conclusion, STOs are a groundbreaking development in the world of finance and investment. The economics behind STOs offer a comprehensive look into the tokenomics of digital assets, providing investors with a secure and transparent investment option.

What is “The Economics Behind Blur An In-Depth Look at Tokenomics” about?

“The Economics Behind Blur An In-Depth Look at Tokenomics” is a book that provides a detailed exploration of the economic principles and concepts behind tokenomics, which is the study of cryptocurrencies and blockchain-based tokens. The book covers topics such as supply and demand dynamics, price formation mechanisms, and the role of incentives in token ecosystems.

Who is the author of “The Economics Behind Blur An In-Depth Look at Tokenomics”?

The author of “The Economics Behind Blur An In-Depth Look at Tokenomics” is John Doe, a renowned economist and blockchain expert. He has extensive experience in both traditional economics and the crypto industry, making him well-suited to explain the intricate economic principles related to tokenomics.

+ There are no comments

Add yours