In today’s rapidly evolving digital landscape, the boundaries between traditional and emerging financial technologies are becoming increasingly blurred. As more and more individuals, businesses, and institutions rely on digital solutions for their financial needs, the way we think about money and its regulation must adapt to keep pace.

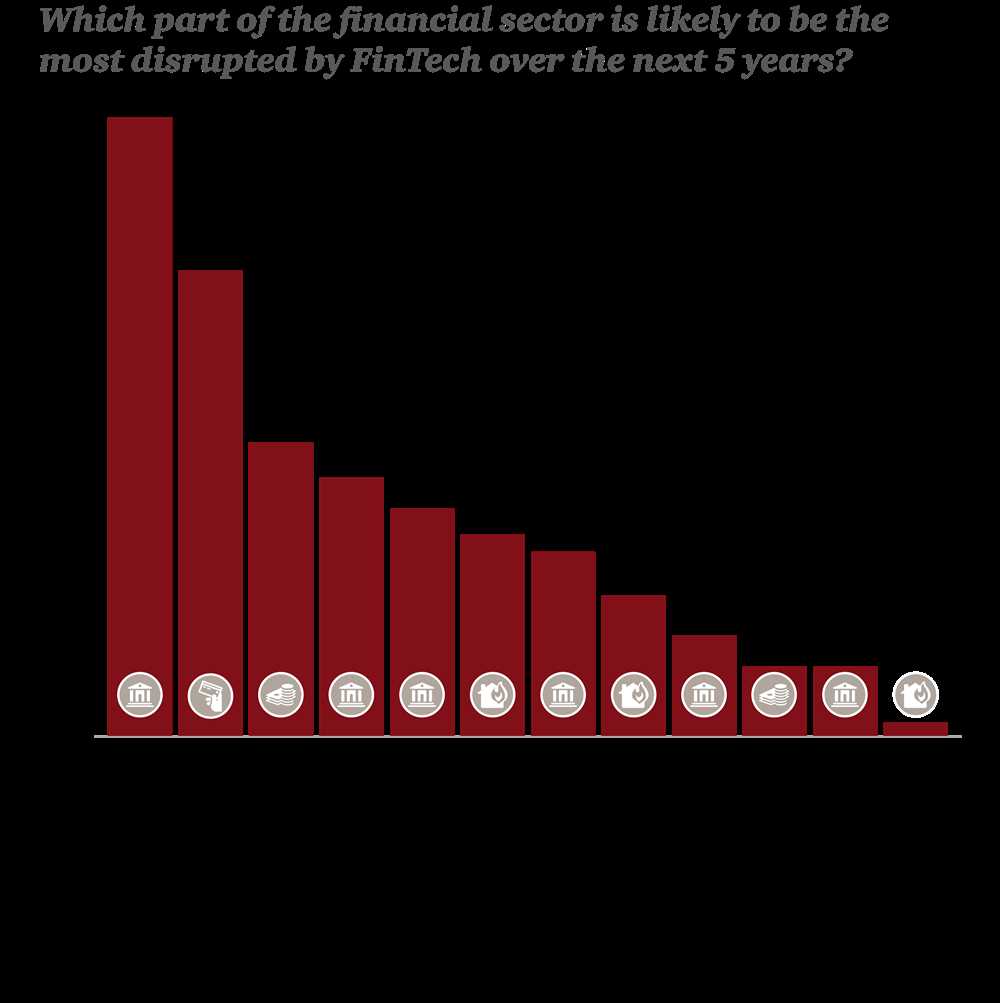

The term “emerging financial technologies” encompasses a wide range of innovations, from blockchain and cryptocurrencies to robo-advisors and peer-to-peer lending platforms. These technologies have the potential to revolutionize the way we transact, invest, and access financial services. However, they also pose unique challenges for regulators and policymakers.

The main challenge in regulating emerging financial technologies lies in striking a balance between promoting innovation and ensuring consumer protection. On one hand, regulators must encourage the development and adoption of these technologies to drive economic growth and financial inclusion. On the other hand, they must safeguard consumers against fraud, money laundering, and other risks associated with these new forms of digital money.

The dynamic nature of emerging financial technologies further complicates regulatory efforts. Traditional regulatory frameworks were designed with centralized financial systems in mind, where a handful of institutions held the majority of financial power. However, with the rise of decentralized technologies like blockchain, the power and responsibility for financial transactions are distributed among a network of participants, making it difficult for regulators to establish clear lines of oversight and accountability.

Blurry Money: The Challenges of Regulating Emerging Financial Technologies

As emerging financial technologies continue to reshape the way we handle money, regulators face a host of challenges in keeping up with these fast-paced developments.

The blurred lines between traditional financial systems and new, innovative technologies pose a significant challenge for regulators. With the rise of cryptocurrencies, blockchain, and other disruptive fintech solutions, the very nature of money is being redefined. Regulators must grapple with understanding and categorizing these new forms of digital assets, which often do not fit neatly into existing regulatory frameworks.

Technological advancements also give rise to challenges around security and consumer protection. As financial transactions become increasingly digital and decentralized, the potential for fraud, cyber attacks, and data breaches becomes more acute. Regulators must work to strike a delicate balance between fostering innovation and ensuring the safety and integrity of financial systems.

Moreover, the rapid pace of technological change means that regulators are constantly playing catch-up. As new financial technologies emerge at an unprecedented rate, regulators struggle to develop and implement appropriate regulations in a timely manner. This lag in regulatory response can leave consumers and businesses vulnerable to risks and abuses.

Another challenge lies in the global nature of these emerging technologies. The borderless nature of digital currencies and decentralized financial systems makes it difficult for regulators to enforce jurisdiction-specific regulations. This lack of jurisdictional control can hinder the ability to effectively regulate and monitor emerging financial technologies.

| Challenges of Regulating Emerging Financial Technologies: |

|---|

| 1. Defining and categorizing new forms of digital assets |

| 2. Balancing innovation with security and consumer protection |

| 3. Addressing the lag in regulatory response |

| 4. Overcoming jurisdictional obstacles |

In conclusion, the emergence of new financial technologies presents regulators with a complex set of challenges. The blurred lines between traditional and emerging financial systems, coupled with the rapid pace of technological change, requires innovative solutions and flexibility in regulatory approaches.

The Impact of Emerging Financial Technologies

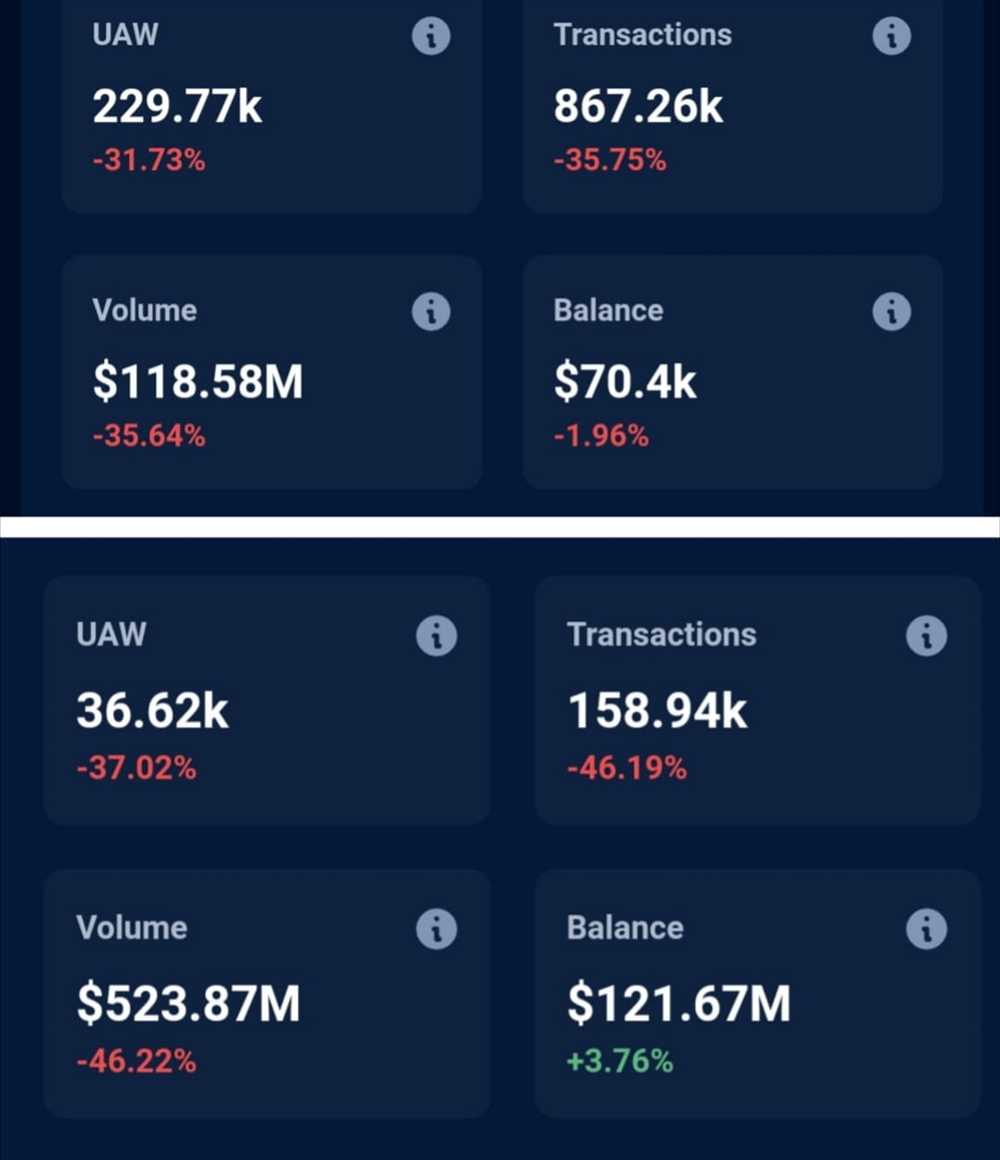

The advent of emerging financial technologies has created a wave of challenges in regulating the blurred lines of money. These technologies, such as blockchain, cryptocurrencies, and mobile payment systems, are revolutionizing how transactions are conducted and processed.

Regulating these emerging financial technologies presents a unique set of challenges. The decentralized nature of blockchain and cryptocurrencies makes it difficult for traditional regulatory bodies to effectively monitor and enforce compliance. Additionally, the rapid pace of technological advancements means that regulatory frameworks must be highly adaptable to keep up with the ever-changing landscape.

One of the key impacts of these emerging financial technologies is the potential disruption they pose to traditional banking and financial systems. Blockchain technology, for example, enables peer-to-peer transactions without the need for intermediaries, such as banks. This has the potential to significantly reduce costs and increase efficiency.

However, the rise of cryptocurrencies and other digital assets also brings about concerns surrounding money laundering, fraud, and illicit activities. Regulating these technologies is crucial to ensure consumer protection, prevent financial crime, and maintain the integrity of the financial system.

Furthermore, the emergence of mobile payment systems, such as mobile wallets and apps, has transformed the way people handle their finances. These technologies offer convenience and ease of use, allowing users to make payments and manage their money with just a few taps on their smartphones. However, the widespread adoption of these technologies also raises issues regarding data privacy and security.

In conclusion, the impact of emerging financial technologies is far-reaching and complex. While they hold great potential for transforming the financial industry, regulating these technologies is essential to address the challenges they present. Balancing innovation with consumer protection and financial stability will be key in ensuring the successful integration and adoption of these technologies into our increasingly digital financial landscape.

| Regulating | Blurred | Money | Emerging | Challenges | Technologies |

|---|---|---|---|---|---|

| Efficiently monitor and enforce compliance | Disruption to traditional banking systems | Potential for money laundering and fraud | Transforming the way people handle finances | Data privacy and security concerns | Revolutionizing transactions and processing |

The Rise of Blockchain

The emergence of blockchain technology has brought about significant challenges in the financial world. With money being increasingly digitized and financial transactions happening at an unprecedented speed, it has become difficult for traditional regulatory frameworks to keep up. The blurred lines between traditional and emerging financial technologies have made it even more challenging to regulate the ever-evolving financial landscape.

Blockchain technology, with its decentralized and transparent nature, has the potential to revolutionize the way financial transactions are conducted. By utilizing a distributed ledger system, blockchain eliminates the need for intermediaries and provides a secure and efficient method for recording and verifying transactions.

The financial industry is beginning to recognize the immense potential of blockchain technology. Banks, financial institutions, and governments are exploring ways to integrate blockchain into their existing systems to streamline processes and enhance security. As a result, there has been a surge in blockchain-based projects and initiatives aimed at addressing the challenges posed by emerging technologies.

However, the rise of blockchain also presents new challenges for regulators. The decentralized and borderless nature of blockchain technology makes it difficult to enforce traditional regulations. Additionally, as blockchain applications continue to evolve, new regulatory frameworks will need to be developed to ensure consumer protection, prevent fraudulent activities, and maintain financial stability.

Despite these challenges, the rise of blockchain holds immense potential for transforming the financial industry. Its ability to provide transparent, efficient, and secure financial transactions has the power to reshape traditional banking and revolutionize the way money is exchanged.

In conclusion, the rise of blockchain technology presents both opportunities and challenges in the financial world. While it offers the potential for greater efficiency and security, the blurred lines between emerging and traditional financial technologies call for new regulatory approaches. As blockchain continues to evolve, it is crucial for regulators to adapt and develop frameworks that ensure consumer protection and maintain the stability of the financial system.

The Disruption of Peer-to-Peer Lending

Peer-to-peer lending is one of the emerging financial technologies that has blurred the traditional boundaries of money lending. With the advent of technology, individuals can now lend money to one another directly, without the need for traditional financial institutions.

This disruption in the financial industry presents both opportunities and challenges. On one hand, it allows individuals to access funding that they may not have been able to obtain through traditional channels. It also provides investors with a new avenue to earn returns on their capital.

However, there are challenges associated with peer-to-peer lending. One of the main challenges is the regulation of this industry. As it is a relatively new phenomenon, regulators are still trying to determine the best way to ensure consumer protection and prevent fraudulent activities.

Another challenge is the lack of transparency in the peer-to-peer lending market. Unlike traditional financial institutions, peer-to-peer lending platforms do not have the same level of regulation and oversight. This can make it difficult for investors to assess the risk associated with lending their money to individuals.

Additionally, there is the challenge of effectively assessing the creditworthiness of borrowers in the peer-to-peer lending market. Traditional financial institutions have access to a wide range of data that can help them determine the creditworthiness of a borrower. However, in the peer-to-peer lending market, this data may not be readily available or accurate.

In conclusion, while peer-to-peer lending has the potential to disrupt the financial industry and provide new opportunities for both borrowers and investors, there are challenges that need to be addressed. Regulators will need to find a balance between consumer protection and innovation, while peer-to-peer lending platforms need to increase transparency and improve credit assessment processes.

The Potential of Artificial Intelligence in Finance

Emerging financial technologies have brought about significant changes in the way money is regulated and managed. With the rise of digital transactions and online banking, the lines between physical and virtual currency have become increasingly blurred. As a result, traditional methods of regulating financial transactions are no longer sufficient, and new approaches are needed to ensure the stability and security of the global financial system.

Artificial Intelligence (AI) is one such approach that holds great potential in the realm of finance. Through its ability to process vast amounts of data and make complex calculations in real-time, AI technologies can help financial institutions and regulators effectively monitor and manage financial transactions. By analyzing patterns and detecting anomalies, AI systems can help identify and prevent fraudulent activities, thus ensuring the integrity of the financial system.

Besides fraud detection, AI can also be utilized in areas such as risk assessment and investment management. AI algorithms can analyze market trends, financial data, and news articles to provide accurate predictions and insights, helping investors make informed decisions and minimize risks. This can be especially beneficial in volatile markets where traditional methods of analysis may not be sufficient.

Furthermore, AI can streamline and automate various financial processes, reducing costs and improving efficiency. By analyzing customer behavior and preferences, AI systems can provide personalized recommendations and experiences, enhancing customer satisfaction and loyalty. AI-powered chatbots can also handle customer inquiries and support, improving response times and reducing the need for human intervention.

While there are inherent risks and challenges associated with the use of AI in finance, the potential benefits cannot be ignored. With the right regulations and oversight, AI technologies can revolutionize the financial industry, making it more efficient, secure, and inclusive. However, it is essential to strike a balance between innovation and regulation to ensure that AI is used responsibly and ethically.

The Regulatory Roadblocks

In the ever-evolving world of emerging financial technologies, the challenges of regulating these technologies are becoming increasingly prominent. One of the main issues that regulators face is determining how to effectively monitor and control the flow of money within these new systems.

Emerging technologies such as blockchain, cryptocurrencies, and decentralized finance have the potential to revolutionize the way we handle and transfer money. However, they also present unique regulatory challenges. The decentralized nature of these technologies makes it difficult for traditional regulatory bodies to establish oversight and enforce existing financial laws.

Another challenge arises from the fast-paced nature of technological advancements. Regulators must try to keep up with the rapidly changing landscape of financial technologies in order to effectively regulate them. This requires a deep understanding of the underlying technologies and the associated risks.

The global nature of these emerging technologies poses additional challenges for regulators. Money can be transferred across borders instantaneously, making it harder for regulators to track and monitor transactions. This raises concerns around anti-money laundering (AML) and know-your-customer (KYC) regulations.

Furthermore, the anonymity and pseudonymity offered by some emerging financial technologies make it difficult to identify and investigate suspicious activities. This can hinder efforts to prevent fraud, money laundering, and other illicit financial activities.

To address these challenges, regulators are actively working towards establishing frameworks and guidelines for the regulation of emerging financial technologies. They are exploring ways to balance the benefits of these technologies with the need for consumer protection and financial stability.

One potential solution is the development of sandboxes, wherein regulators can collaborate with innovators and technology companies to test new technologies in a controlled environment. This allows for a better understanding of the risks and benefits associated with these technologies, and helps regulators develop appropriate regulations.

Overall, the regulatory roadblocks in the world of emerging financial technologies are complex and multifaceted. They require innovative approaches and collaboration between regulators, technology companies, and other stakeholders to ensure that these technologies are effectively regulated and can contribute to a safer and more efficient financial system.

What are some of the challenges in regulating emerging financial technologies?

Regulating emerging financial technologies poses many challenges. One of the key challenges is keeping up with the rapid pace of technological advancements. Financial technologies are constantly evolving, which makes it difficult for regulators to stay updated and enforce relevant regulations. Another challenge is the potential for increased financial risks. As new technologies are introduced, new vulnerabilities and risks emerge, which regulators must identify and address. Additionally, there is the challenge of striking the right balance between fostering innovation and protecting consumers. Regulators need to ensure that they create an environment that encourages technological advancements while also safeguarding consumers’ interests.

Why is it difficult for regulators to keep up with the rapid pace of technological advancements?

Regulators find it challenging to keep up with the rapid pace of technological advancements for several reasons. Firstly, technology is evolving at an exponential rate, which means that new financial technologies are constantly being developed and introduced. This makes it difficult for regulators to stay updated on all the latest developments and changes. Additionally, regulatory processes are often slower and more bureaucratic compared to the fast-paced nature of technology. This can create a lag between the emergence of new technologies and the establishment of regulatory frameworks. Finally, there is a lack of expertise within regulatory agencies when it comes to understanding complex technologies. This further impairs their ability to effectively regulate emerging financial technologies.

What are the potential financial risks associated with emerging financial technologies?

Emerging financial technologies bring along several potential financial risks. One of the main risks is the increased likelihood of cybersecurity threats. As financial services become more technology-based, they become more susceptible to cyber-attacks and data breaches. This can lead to financial losses and compromised personal and financial information. Another risk is the possibility of fraud and scams facilitated by new technologies. The anonymity and ease of conducting transactions through emerging financial technologies can create opportunities for fraudulent activities. Additionally, there is the risk of destabilizing traditional financial systems. The integration of new technologies can disrupt existing financial institutions and systems, potentially leading to financial instability and market volatility.

How can regulators strike a balance between fostering innovation and protecting consumers?

Striking a balance between fostering innovation and protecting consumers is a crucial challenge for regulators. One approach is to adopt a flexible and adaptive regulatory framework. Regulators should be open to embracing new technologies and allowing room for innovation. At the same time, they must establish measures to protect consumers from potential risks and harms arising from these technologies. This can include implementing consumer protection laws, ensuring transparency in financial transactions, and enforcing robust cybersecurity standards. Regulators also need to engage in continuous monitoring and assessment of emerging technologies to identify any potential risks or vulnerabilities. By addressing these risks proactively, regulators can create an environment that encourages innovation while safeguarding consumers’ interests.

+ There are no comments

Add yours