Coinmarketcap’s coin rankings have long been the go-to resource for investors and traders looking to navigate the tumultuous waters of the cryptocurrency market. However, as the industry continues to evolve at breakneck speed, the lines between winners and losers, success and failure, have become increasingly blurred.

Rankings that were once viewed as gospel are now being called into question, as coins previously seen as promising investments can quickly plummet in value, while new and unknown projects can rise to the top of the leaderboard. This phenomenon requires a more nuanced approach to analyzing Coinmarketcap’s rankings and understanding the factors at play.

One must remember that Coinmarketcap’s rankings are not static, but rather a reflection of a dynamic market that is constantly in flux. The coin rankings are determined by a multitude of factors, including market capitalization, trading volume, liquidity, and community support. However, these metrics can be influenced by various external forces, such as news events, regulatory developments, and even manipulation.

Therefore, it is crucial for investors and traders to dig deeper and evaluate the fundamental aspects of a coin to truly understand its potential and value. A coin’s real-world use case, technology, team behind the project, and partnerships can all be indicators of long-term success, regardless of its position in Coinmarketcap’s rankings.

By analyzing the blurred lines of Coinmarketcap’s coin rankings, investors can gain a deeper understanding of the market, identify hidden gems, and make informed investment decisions that go beyond the surface-level rankings.

Understanding Coinmarketcap’s coin ranking methodology

When analyzing the blurred lines of Coinmarketcap’s rankings, it is important to understand the underlying methodology used to determine the position of each coin. Coinmarketcap ranks coins based on a combination of factors, including market capitalization, trading volume, and overall project quality.

The market capitalization of a coin is calculated by multiplying the current price by the total supply. This metric gives an indication of the overall value and popularity of a coin within the market. Coins with higher market capitalizations are typically ranked higher on Coinmarketcap, as they are seen as more established and trustworthy within the industry.

Trading volume is another key factor in determining coin rankings. Higher trading volumes indicate a greater level of interest and activity within the market. Coins with consistently high trading volumes are often seen as more liquid and attractive to investors, leading to a higher ranking on Coinmarketcap.

Lastly, Coinmarketcap takes into consideration the overall quality and credibility of a project when determining rankings. Factors such as project development, team expertise, and community engagement all play a role in assessing the strength of a coin’s project. Coins with strong fundamentals and active communities are more likely to be ranked higher on Coinmarketcap.

It is important to note that Coinmarketcap’s rankings are not set in stone and can change frequently. The cryptocurrency market is highly volatile, and rankings can shift based on market conditions and new developments within specific projects. Therefore, it is essential to keep an eye on the rankings and conduct thorough research before making any investment decisions.

In conclusion, understanding Coinmarketcap’s coin ranking methodology is crucial when analyzing the blurred lines of their rankings. By considering factors such as market capitalization, trading volume, and project quality, investors can gain valuable insights into the position and potential of different coins within the cryptocurrency market.

Criteria for coin ranking

In analyzing the blurred lines of Coinmarketcap’s coin rankings, it’s important to understand the criteria used for ranking coins. Coinmarketcap takes into account multiple factors to determine the ranking of each coin.

Market capitalization: One of the primary factors considered is the market capitalization of a coin. This represents the total value of all the coins in circulation and is calculated by multiplying the price of a coin by its circulating supply.

Liquidity: The liquidity of a coin is also taken into account. Coins with high trading volumes and active markets are generally ranked higher as they are easier to buy and sell.

Development activity: The level of development activity surrounding a coin is another important consideration. Coins with active development teams and regular updates are often ranked higher as they are seen as more likely to have future potential.

Community engagement: The level of community engagement and support for a coin is also a factor. Coins with a dedicated community and active social media presence are more likely to receive higher rankings.

Utility and use case: The utility and use case of a coin is also considered. Coins that have clear real-world applications and are actively being used for transactions or other purposes are often ranked higher.

Security and stability: The security and stability of a coin’s network and infrastructure are important factors. Coins with strong security measures and a stable blockchain are considered more reliable and are often ranked higher.

Overall popularity: Lastly, the overall popularity and recognition of a coin play a role in its ranking. Coins that are widely known and have a large user base are more likely to be ranked higher.

By considering these criteria, Coinmarketcap aims to provide a comprehensive and fair ranking system for cryptocurrencies. However, it’s important to note that rankings can still be subjective and may not reflect a coin’s true value or potential.

Weighted factors influencing rankings

When analyzing the blurred lines of Coinmarketcap’s coin rankings, it becomes evident that multiple factors play a significant role in determining the position of a coin. These factors are weighted differently, and understanding them is crucial for deciphering the rankings accurately.

One of the primary factors considered is market capitalization. A coin’s market capitalization represents its overall value in the market, calculated by multiplying the current price per coin by the total number of coins in circulation. Higher market capitalization generally results in a higher ranking on Coinmarketcap.

Liquidity is another crucial factor. Coins with higher trading volumes and greater liquidity tend to rank higher. This is because higher liquidity indicates a more active and robust market for buying and selling the coin, making it more attractive to traders and investors.

Another important factor is the project’s team and development activity. Coins that have a strong and active development team, with regular updates and improvements to the project, are often given higher rankings. This is because a strong team indicates long-term commitment and the potential for future growth and innovation.

Additionally, community involvement and social media presence contribute to a coin’s ranking. Coins that have a passionate and engaged community, with active social media channels and a strong following, are more likely to be ranked higher. This is because a strong community indicates a higher level of interest and support for the project.

Finally, factors like technological innovation, partnerships, and adoption also contribute to a coin’s ranking. Coins that introduce new and groundbreaking technologies, form strategic partnerships, and achieve real-world adoption are often rewarded with higher rankings. These factors demonstrate the potential for long-term success and growth.

In conclusion, Coinmarketcap’s coin rankings are influenced by a variety of weighted factors. Understanding and considering these factors is essential for accurately analyzing and interpreting the rankings. Market capitalization, liquidity, team and development activity, community involvement, and technological innovation all play a crucial role in determining the position of a coin.

Challenges in coin ranking accuracy

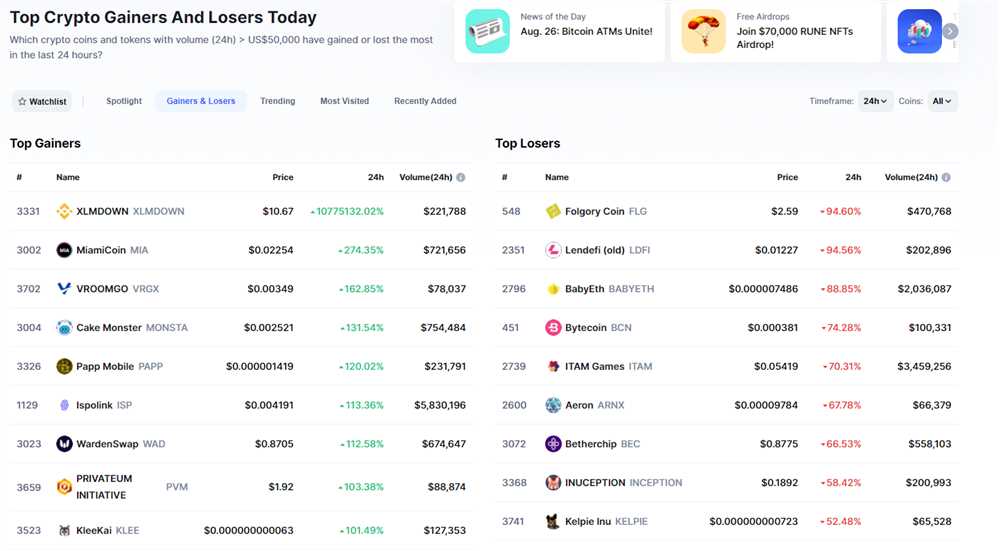

Analyzing the blurred lines of Coinmarketcap’s coin rankings poses several challenges to achieving accurate results. Coinmarketcap is a popular platform that provides information on various cryptocurrencies, including rankings based on metrics such as market capitalization, trading volume, and circulating supply. However, there are several factors that can affect the accuracy of these rankings.

Firstly, the data on which the rankings are based is constantly changing. Coinmarketcap updates its rankings in real-time, taking into account the fluctuations in the cryptocurrency market. This dynamic nature of the data makes it challenging to obtain completely accurate rankings, as the values can change rapidly.

Another challenge is the lack of standardized criteria for ranking cryptocurrencies. Different factors such as market capitalization, trading volume, and circulating supply are used to determine the rankings, but their weighting is not explicitly defined. This can lead to inconsistencies and disparities in the rankings, making it difficult to accurately compare and evaluate different coins.

Furthermore, there is a potential for manipulation and fraud in the cryptocurrency market. Some projects may engage in practices such as pump and dump schemes, artificially inflating the value and trading volume of their coins to improve their rankings. This deceptive behavior can affect the overall accuracy of the rankings and mislead investors.

In addition, the availability and reliability of data on lesser-known cryptocurrencies can also pose challenges. Coinmarketcap primarily focuses on the most popular and established coins, but there are thousands of other lesser-known coins in the market. The lack of comprehensive data on these coins can make it difficult to accurately rank and evaluate them.

To address these challenges, Coinmarketcap could consider implementing more standardized criteria for ranking cryptocurrencies and increasing transparency in its data sources. Additionally, implementing measures to detect and prevent manipulation in the market can help improve the accuracy of the rankings.

| Challenges in coin ranking accuracy: |

|---|

| Constantly changing data |

| Lack of standardized criteria |

| Potential for manipulation and fraud |

| Limited availability and reliability of data on lesser-known coins |

Volatility and market manipulation

When analyzing the blurred lines of Coinmarketcap’s coin rankings, one cannot ignore the impact of volatility and market manipulation on these rankings.

The cryptocurrency market has long been known for its extreme volatility, with prices often experiencing significant swings within short periods of time. This volatility can be attributed to a variety of factors, including market sentiment, news events, and technological advancements.

While volatility can be seen as an opportunity for traders to make profits, it can also lead to market manipulation. Manipulators can take advantage of the blurred lines in rankings to artificially inflate the price of a particular coin, creating a false sense of demand and pushing it higher up in the rankings.

This market manipulation can have serious consequences for investors and the overall market. Investors may be misled into believing that a coin is more popular or valuable than it actually is, leading to potential losses. Moreover, market manipulation undermines the integrity of the market and erodes trust among participants.

In addition to these concerns, Coinmarketcap’s rankings themselves can contribute to market manipulation. The rankings are based on a variety of factors, including market capitalization, trading volume, and price. However, these metrics can be easily manipulated by traders through techniques such as wash trading or spoofing.

Wash trading involves buying and selling a coin simultaneously to create the illusion of trading volume, while spoofing involves placing fake orders to manipulate the price. Both of these techniques can artificially inflate a coin’s ranking, further blurring the lines between legitimate trading activity and manipulation.

Overall, the presence of volatility and market manipulation in the cryptocurrency market highlights the need for transparency and regulation. Investors and market participants should be aware of these risks and take steps to protect themselves from potential manipulation. Additionally, regulatory bodies should continue to monitor and address these issues to ensure the integrity of the market.

Limited transparency in data collection

When analyzing the blurred lines of Coinmarketcap’s coin rankings, one issue that becomes apparent is the limited transparency in data collection. While Coinmarketcap provides a comprehensive list of coins and their rankings, it is not always clear how this data is collected and verified.

One potential concern is the accuracy of the trading volume data. Coinmarketcap relies on exchanges to report their trading volumes, and it is possible that some exchanges may inflate their volumes to appear more active and attract more users. This can create a distorted view of a coin’s popularity and trading activity.

Another area where transparency is lacking is in the process of determining the market capitalization of a coin. Coinmarketcap calculates market cap by multiplying the price of a coin by its circulating supply. However, there have been instances where coins with a low trading volume and limited liquidity have high market capitalizations, leading to doubts about the accuracy of this metric.

Additionally, Coinmarketcap does not provide information about the methodologies used to rank coins. It is unclear how factors such as price, trading volume, and market capitalization are weighted when determining a coin’s ranking. This lack of transparency makes it difficult to assess the validity and reliability of the rankings.

In conclusion, the limited transparency in data collection on Coinmarketcap’s coin rankings raises concerns about the accuracy and reliability of the rankings. Without clear information on how the data is collected, verified, and ranked, it is challenging to make informed investment decisions based on these rankings.

Impact of market sentiment on rankings

When analyzing the blurred lines of Coinmarketcap’s coin rankings, it becomes evident that market sentiment plays a significant role in determining the position of a coin. Market sentiment, also known as investor sentiment, refers to the overall attitude and feeling of market participants towards a particular asset.

Investors’ emotions and perceptions about a coin can have a profound impact on its ranking. Positive sentiment can drive up the price and demand for a coin, leading to an increase in its market cap and overall ranking. On the other hand, negative sentiment can cause a decline in a coin’s value and push it down the rankings.

Coinmarketcap’s rankings are not solely based on objective factors, such as market capitalization or trading volume. They also take into account subjective factors like community engagement, project development, and overall market reception. These subjective factors are influenced by market sentiment.

For example, a highly anticipated project with a strong and supportive community may experience a surge in positive sentiment. This positive sentiment can attract more investors and drive up the demand for the coin, resulting in a higher ranking on Coinmarketcap.

Conversely, a coin that faces negative sentiment due to controversies, security breaches, or market manipulation may experience a decline in its ranking. Investors may lose confidence in the project and start selling their holdings, causing the price to plummet and the coin’s ranking to decrease.

It is essential to consider market sentiment when analyzing Coinmarketcap’s coin rankings to gain a comprehensive understanding of the factors influencing a coin’s position. By staying informed about market sentiment, investors can make more informed decisions and navigate the blurred lines of Coinmarketcap’s rankings more effectively.

Implications of distorted coin rankings

The blurred lines in Coinmarketcap’s coin rankings can have significant implications for investors and the overall cryptocurrency market.

Firstly, analyzing these rankings becomes difficult when the lines between different coins are blurred. It becomes challenging to distinguish the top-performing coins from the rest, making it harder for investors to make informed decisions. This lack of transparency can lead to potential losses and missed opportunities.

Moreover, distorted rankings can create a false sense of superiority for certain coins. When the lines are blurred, it may seem like a coin is performing exceptionally well when, in reality, it is not. This can lead to inflated prices and market manipulation, as investors are driven by false perceptions.

The distorted rankings may also impact the credibility of Coinmarketcap as a trusted source of information. Investors rely on this platform to make investment decisions, and if the rankings are not accurate, it can erode trust in the platform and the cryptocurrency market as a whole.

Additionally, distorted rankings can hinder the growth and development of promising coins. If a coin with great potential is not accurately ranked, it may be overshadowed by other less-deserving coins. This can limit investment opportunities and slow down innovation within the cryptocurrency industry.

In conclusion, the blurred lines in Coinmarketcap’s coin rankings have far-reaching implications. They make it challenging to analyze and differentiate between coins, create false perceptions, impact the credibility of the platform, and hinder the growth of promising coins. It is crucial for investors to be aware of these implications and take them into consideration when making investment decisions in the cryptocurrency market.

What is Coinmarketcap?

Coinmarketcap is a website that provides information on cryptocurrency prices, market capitalization, trading volume, and other relevant data.

Why are there blurred lines in Coinmarketcap’s coin rankings?

The lines in Coinmarketcap’s coin rankings can be blurred due to various factors such as manipulation of trading volumes, lack of transparency in data reporting, and discrepancies in how different exchanges calculate their trading data.

+ There are no comments

Add yours