In the world of cryptocurrency, data is everything. The volatile nature of the crypto market is heavily influenced by news events and their impact on price changes. Analyzing this relationship can provide valuable insights into the factors that drive market trends and blur the line between cause and effect.

News events have a direct correlation with the price of cryptocurrencies. The sentiment surrounding these events can create patterns of volatility in the market, leading to significant changes in the price of coins. By analyzing the influence of news on crypto prices, traders and investors can better predict market movements and make informed trading decisions.

Through data analysis and algorithms, it is possible to identify the triggers that cause price changes in response to news events. By examining the patterns and trends that emerge from this analysis, it becomes possible to develop predictive models that can help traders navigate the volatile crypto market with greater success.

However, the relationship between news events and crypto price changes is not always clear-cut. The market is influenced by a multitude of factors, and it can be challenging to isolate the impact of individual events. Additionally, news sentiment can be subjective and interpreting its influence on price changes can be a complex task.

Nevertheless, by conducting thorough analysis and studying the correlation between news events and price changes, traders and investors can gain a deeper understanding of how the market behaves. This knowledge can help them make more informed decisions, anticipate market trends, and potentially increase their profits in the fast-paced world of crypto trading.

Importance of News Events in Crypto Market

In the dynamic and fast-paced world of cryptocurrency trading, the relationship between news events and price changes is a critical factor to consider. As traders and investors navigate through the vast sea of data, sentiment, and trading triggers, it becomes evident that news events play a vital role in driving and influencing market volatility.

Analyzing the correlation between news events and cryptocurrency price changes can help identify trends and patterns that can be used to predict future market movements. By utilizing sophisticated algorithms and data analysis techniques, analysts can assess the impact of various factors on crypto prices.

One of the key factors that influences the market is the release of news events. Major announcements, regulatory changes, technological advancements, or even celebrity endorsements can have a profound effect on the price of a particular cryptocurrency.

When news events occur, they often create a sense of anticipation and speculation among traders. If the news is positive and indicates potential growth or adoption, it can lead to an increase in demand and subsequently drive up the price of the crypto coin. Conversely, negative news can spark fear and uncertainty, causing prices to plummet.

It is important to note that not all news events have an immediate and direct impact on crypto prices. Sometimes, the influence of news can be difficult to measure or quantify, as it depends on numerous factors such as market sentiment, investor psychology, and overall market conditions.

However, by analyzing past news events and their subsequent impact on crypto prices, it is possible to identify certain patterns and trends. This can enable traders to make informed decisions and develop strategies to capitalize on future price fluctuations.

The crypto market is known for its volatility, making it essential for traders to stay updated with the latest news and events. By monitoring news sources, social media platforms, and reputable cryptocurrency websites, traders can gain valuable insights into potential market-moving events.

In conclusion, understanding the relationship between news events and crypto price changes is crucial for successful trading. By analyzing the impact of news on market trends and utilizing data-driven approaches, traders can increase their chances of making profitable trades and staying ahead of the curve.+

Market Volatility and News Events

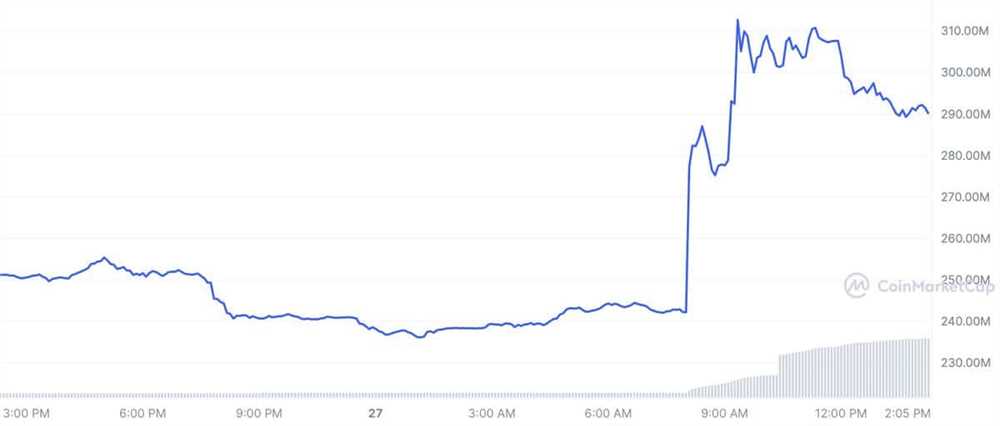

The crypto market is known for its high levels of volatility, with prices experiencing significant fluctuations in a short period. One of the key factors that contribute to this volatility is news events.

News events can have a significant impact on the sentiment and perception of the market. Positive news, such as new partnerships or adoption by major companies, can create a sense of optimism and lead to an increase in trading activity and price. On the other hand, negative news, such as regulatory crackdowns or security breaches, can create panic and lead to a decrease in trading activity and price.

Analyzing the relationship between news events and crypto price changes is crucial for understanding the market trends and making informed trading decisions. By tracking news events and analyzing their impact on price changes, traders can identify patterns and trends to predict future price movements.

Market volatility can often be a blur, with prices changing rapidly due to various factors. However, news events play a significant role in shaping the market’s volatility. A single news event can trigger a chain reaction of buying or selling activity that influences the price of a coin.

Market volatility and news events are closely interconnected. Algorithms and data analysis can help identify the relationship between specific news events and their impact on price changes. This analysis allows traders to better predict market trends and adjust their trading strategies accordingly.

When it comes to news events, timing is crucial. The market’s initial reaction to a news event can often be exaggerated, with prices experiencing sharp movements. However, as time passes, the market tends to assimilate the news, and prices may stabilize or continue the trend initiated by the news event.

Overall, understanding the relationship between news events and market volatility is essential for successful crypto trading. By analyzing news events and their impact on price changes, traders can gain valuable insights into market trends and make informed decisions.

Influence of News Events on Investor Sentiment

Investor sentiment plays a crucial role in the crypto market, as it often drives price changes and trading patterns. News events are one of the main factors that influence investor sentiment, as they provide valuable information and insights into the market.

When analyzing the relationship between news events and crypto price changes, it is important to consider the impact they have on investor sentiment. Significant news events can trigger changes in investor sentiment, leading to fluctuations in the market. For example, positive news such as regulatory approvals or partnerships can boost investor confidence and drive up coin prices. On the other hand, negative news like security breaches or regulatory crackdowns can cause panic and lead to selling pressure.

Through careful analysis of news events and their influence on investor sentiment, algorithms can be developed to predict market trends. By analyzing the correlation between news events and price changes, these algorithms can identify patterns and triggers that affect investor sentiment. This analysis can help traders and investors make informed decisions based on the impact of news events.

Furthermore, by analyzing the impact of news events on investor sentiment, traders can determine the significance of different types of news. Some news events may have a stronger influence on sentiment and price changes, while others may have a more transient effect. This analysis can guide traders in filtering out noise and focusing on relevant news events that can drive market movements.

Overall, analyzing the relationship between news events and investor sentiment is crucial for understanding the dynamics of the crypto market. It helps to uncover the underlying factors that influence price changes, trading patterns, and investor behavior. By leveraging data and news analysis, traders and investors can gain insight into the market and make more informed decisions.

News Events as Catalysts for Substantial Crypto Price Changes

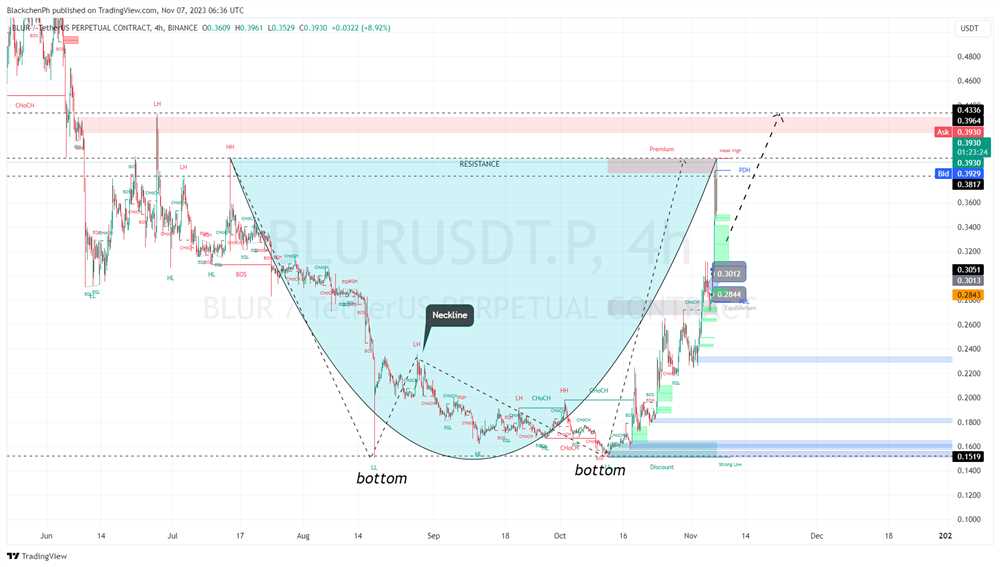

The crypto market is highly volatile, with prices fluctuating unpredictably. However, extensive analysis has shown that news events can often act as catalysts for substantial price changes in the crypto market.

By analyzing historical data and patterns, traders can identify the relationship between news events and crypto price changes. Through correlation analysis, they can predict the impact of specific events on the market.

Using sophisticated algorithms and trading strategies, traders can leverage this information to make more informed trading decisions. They can adjust their positions in response to news events, taking advantage of the resulting price changes.

A wide range of news events can influence the crypto market, including regulatory announcements, technological breakthroughs, partnerships, and market trends. Positive news can drive up prices, while negative news can trigger significant declines. The sentiment surrounding these events can also play a crucial role.

Traders and investors rely on data and news analysis platforms to monitor and analyze news events that may impact the crypto market. These platforms aggregate news from various sources, analyze sentiment trends, and provide real-time updates on important events.

Volatility in the crypto market often leads to blur price movements. However, carefully analyzing news events and their influence on the market can help traders navigate this volatility more effectively. By understanding the factors that trigger price changes, traders can adjust their strategies accordingly.

| Benefits of Analyzing News Events for Crypto Traders |

|---|

| 1. Improved ability to predict price changes |

| 2. Better understanding of market trends and sentiment |

| 3. Increased profitability through informed trading decisions |

| 4. Ability to capitalize on significant market movements |

In conclusion, analyzing news events and their impact on the crypto market is essential for traders who want to stay ahead of market trends and volatility. By understanding the relationship between news events and price changes, traders can make more informed decisions and increase their chances of profiting from crypto trading.

Methods for Analyzing News Event Impact

To understand the correlation between news events and crypto market trends, analysts employ various methods. These techniques help predict price changes, identify triggers, and develop algorithms to analyze market sentiment.

One approach is to examine the relationship between specific news events and coin price changes. Through careful analysis of news data, analysts can identify factors that influence the volatility of crypto prices. By studying patterns and trends, they can determine which events have a significant impact on trading activity.

Sentiment analysis is another method used to assess the impact of news events on the market. This involves analyzing the overall sentiment expressed in news articles, social media posts, and other sources of information. By gauging the sentiment, analysts can gain insights into the influence of news events on market behavior.

Crypto price data is also analyzed using statistical methods to identify correlations between news events and price changes. This involves conducting regression analysis to determine the relationship between specific news events and the corresponding changes in crypto prices. By evaluating the statistical significance of these relationships, analysts can make predictions about future price movements.

Furthermore, machine learning algorithms can be utilized to analyze news events and predict their impact on crypto prices. By training algorithms on historical data, they can learn to identify patterns and predict future price changes based on similar events in the past. This helps traders and investors make informed decisions in the volatile crypto market.

In conclusion, analyzing news events is crucial for understanding the relationship between news and crypto price changes. By employing various methods such as correlation analysis, sentiment analysis, statistical analysis, and machine learning algorithms, analysts can gain valuable insights and predict market trends in the blur of crypto trading.

Sentiment Analysis of News Articles

One key aspect of analyzing the relationship between news events and crypto price changes is sentiment analysis of news articles. This involves the use of data and algorithms to measure the sentiment expressed in news articles related to the crypto market.

Sentiment analysis aims to predict the impact of news events on the market by analyzing the emotions and opinions conveyed in news articles. By examining the sentiment of news articles, traders and investors can gain insights into the potential influence of these articles on coin prices.

News events can trigger trends and patterns in trading, and sentiment analysis helps to identify these triggers. By analyzing the sentiment of news articles, traders can better understand the potential impact of these articles on price volatility and make informed trading decisions.

There are various factors that influence the sentiment expressed in news articles. These factors can include the tone of the article, the opinions of the author, and the overall market sentiment at the time of publication. By analyzing these factors, sentiment analysis algorithms can determine the sentiment of news articles and provide insights into market trends and price changes.

The correlation between news events and crypto price changes is an important aspect of sentiment analysis. By analyzing the relationship between news events and price changes, traders can gain a deeper understanding of the impact of news on the market. This understanding can help traders predict future price movements and make more accurate trading decisions.

In conclusion, sentiment analysis plays a crucial role in analyzing the relationship between news events and crypto price changes. By examining the sentiment expressed in news articles, traders can gain insights into market trends, predict price changes, and make informed trading decisions. Sentiment analysis algorithms provide a valuable tool for analyzing the impact of news events on the crypto market.

Correlation Analysis between News Events and Price Changes

Analyzing the relationship between news events and price changes in the cryptocurrency market is crucial for traders and investors. The impact of news on crypto prices is well-documented, highlighting the need for an in-depth analysis to predict trends and volatility in the market.

It is widely acknowledged that news events have a significant influence on the price of cryptocurrencies. By analyzing historical price data and correlating it with relevant news events, traders can identify patterns and triggers that can help predict future price changes.

Correlation analysis involves studying the relationship between news events and the corresponding coin price changes. By assessing the strength and direction of this correlation, traders can make more informed decisions when trading cryptocurrencies.

Trading algorithms also play a significant role in analyzing the correlation between news events and price changes. These algorithms can process large amounts of data and identify trends and patterns that may not be apparent to human traders.

Factors such as sentiment analysis, market news updates, and significant events can all contribute to the correlation between news events and price changes. This correlation can be used to develop trading strategies and make more accurate predictions.

Overall, understanding the relationship between news events and price changes is crucial for successful trading in the cryptocurrency market. By analyzing correlations and using advanced algorithms, traders can gain valuable insights into market dynamics and make more informed decisions.

Is there a correlation between news events and changes in cryptocurrency prices?

Yes, there is a correlation between news events and changes in cryptocurrency prices. This correlation can be observed because news events can have a significant impact on market sentiment, which in turn affects the demand and supply of cryptocurrencies. Positive news events, such as the adoption of cryptocurrencies by major companies or regulatory advancements, can lead to an increase in prices. On the other hand, negative news events, such as security breaches or bans on cryptocurrencies, can cause prices to decline.

What are some examples of positive news events that can affect cryptocurrency prices?

Some examples of positive news events that can affect cryptocurrency prices include the announcement of major companies accepting cryptocurrencies as a form of payment, the approval of regulatory frameworks that promote the use and adoption of cryptocurrencies, and the integration of blockchain technology into mainstream industries.

Are there any specific types of news events that have a stronger impact on cryptocurrency prices?

Yes, there are certain types of news events that tend to have a stronger impact on cryptocurrency prices. For example, regulatory news can have a significant influence on the prices of cryptocurrencies, especially if the regulation is perceived as restrictive or negative for the industry. Similarly, news related to security breaches or hacking incidents can lead to a sharp decline in prices, as it undermines confidence in the security of cryptocurrencies.

How quickly do cryptocurrency prices react to news events?

Cryptocurrency prices can react to news events quite quickly, especially if the news is considered to be significant or has a high impact on market sentiment. In some cases, prices can start moving within minutes or even seconds of a major news event. However, the extent and duration of the price movement may vary depending on the nature of the news event and the overall market conditions.

+ There are no comments

Add yours