Discover the power of leveraging farming pools to achieve maximum profits in the world of Blur farming. With the use of smart contracts and blockchain technology, the opportunities for high returns on investment (ROI) are endless.

Blur farming allows you to earn APY through staking and liquidity mining, while hedging against the risks of the market. By diversifying your cryptocurrency tokens across different farming pools, you can compound your earning potential and ensure steady growth.

Join the revolutionary world of decentralized finance (DeFi) and take advantage of the innovative Blur farming platform. With its aggregator feature, you can easily manage your farming activities, maximizing your profits and minimizing your risk.

Don’t miss this chance to be a part of the future of finance. Start blur farming today and unlock the potential to earn high yields through leveraging, farming pools, and smart contracts. Explore the rewards of this exciting opportunity and embrace the power of innovation in the crypto space.

Leveraging Farming Pools

As the popularity of cryptocurrencies continue to grow and the world of decentralized finance (DeFi) becomes increasingly mainstream, leveraging farming pools has emerged as an innovative way to maximize profits in the market. Farming pools allow investors to earn passive income through yield farming, a process that involves using smart contracts to lock up tokens and earn returns.

The concept of leveraging farming pools revolves around the APY (Annual Percentage Yield) of different farming pools. APY represents the rate of return an investor can expect to earn on their investment over a one-year period. However, with great rewards comes great risk. It’s important to carefully analyze the risks associated with different tokens and farming pools before making any investment decisions.

One advantage of leveraging farming pools is the ability to diversify investments. By allocating funds across multiple pools, investors can mitigate risk and optimize their return on investment (ROI). This hedging strategy helps safeguard against fluctuations in the cryptocurrency market, ensuring a more stable growth trajectory.

Moreover, leveraging farming pools provides an opportunity for compound staking and earning additional rewards. By reinvesting the profits earned from one pool into another, investors can compound their gains and exponentially increase their overall returns. This strategy can truly unlock the full potential of farming pools and maximize profits.

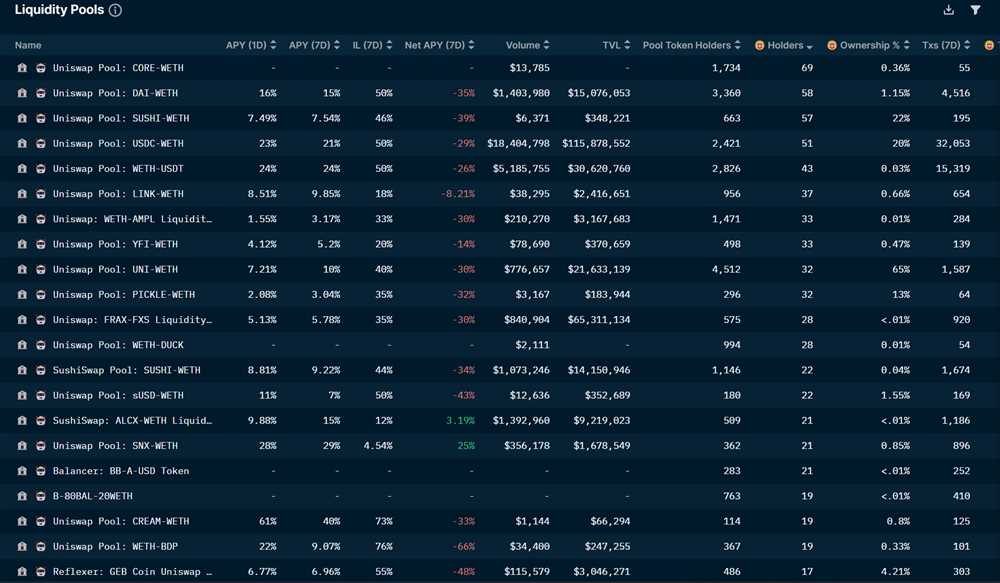

The growing popularity of farming pools has led to the development of blockchain-based aggregators. These platforms help simplify the process of farming by providing users with a single interface to access multiple pools. Aggregators enable investors to efficiently manage their assets, monitor performance, and explore new opportunities in the constantly evolving DeFi space.

When it comes to leveraging farming pools, it’s essential to consider the concept of liquidity. Liquidity refers to the ease with which an asset can be bought or sold without causing significant price fluctuations. Investing in farming pools with high liquidity ensures that the tokens can be easily traded, providing more flexibility and potential for profit.

In conclusion, leveraging farming pools has become a game-changer in the world of cryptocurrency investment. Through smart contracts, investors can earn passive income, optimize their ROI, and diversify their holdings. By seizing the opportunity presented by farming pools and embracing the innovation of DeFi, individuals can unlock the potential for maximized profits in the market.

Maximizing Blur Farming Profits

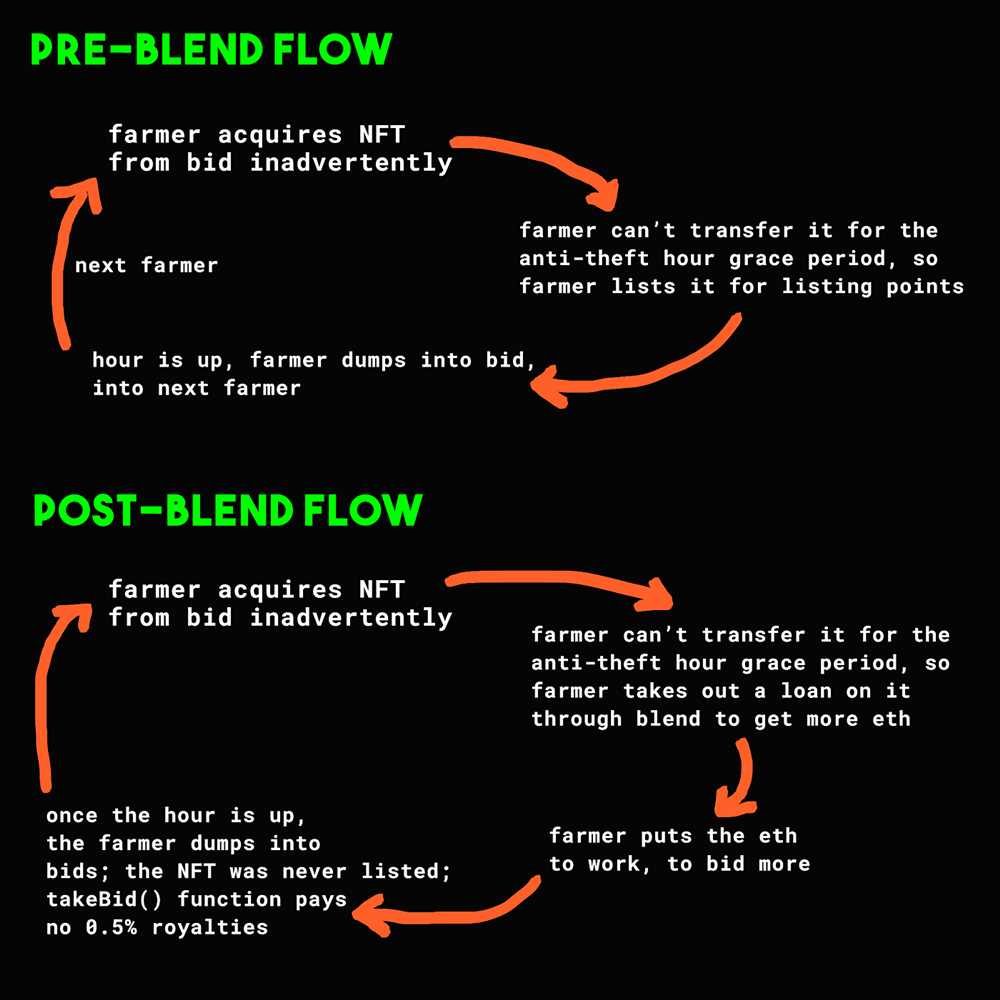

As the blockchain industry continues its rapid growth, farming has emerged as an exciting opportunity in the world of decentralized finance (DeFi). Blur Farming is a revolutionary concept that allows users to earn passive income by staking their cryptocurrency tokens in various liquidity pools.

By leveraging farming pools, Blur provides users with the ability to maximize their farming profits through a diversified strategy. Users can earn rewards in the form of yield on their staked tokens, thus capitalizing on the growth and innovation within the DeFi space.

One of the key advantages of Blur Farming is the ability to compound earnings. With smart contracts and automated strategies in place, users can reinvest their earned rewards back into the farming pools, enabling their investment to work for them and generate even higher returns.

In addition, Blur Farming allows users to hedge their risk by spreading their investment across different pools. By diversifying their token holdings, users can minimize the impact of potential market fluctuations and take advantage of multiple earning opportunities simultaneously.

The Return on Investment (ROI) and Annual Percentage Yield (APY) offered by Blur Farming pools are attractive features that lure users seeking a profitable investment option. The ability to earn consistent and high APY makes Blur Farming an enticing choice for those looking to maximize their farming profits.

| Benefits of Blur Farming: |

|---|

| Farm token liquidity |

| Opportunity to earn passive income |

| Compound rewards for higher returns |

| Diversification of investment |

| Minimized risk with hedging strategies |

| Competitive ROI and APY |

Blur Farming is a game-changing innovation in the DeFi market, providing users with a unique opportunity to earn cryptocurrency through staking and participating in farming pools. With its innovative approach and attractive returns, Blur Farming is reshaping the future of decentralized finance.

Take advantage of Blur Farming today and start maximizing your profits in this exciting and dynamic sector!

Understanding Farming Pools

Farming pools have revolutionized the investment landscape in the world of decentralized finance (DeFi). By leveraging the power of smart contracts and blockchain technology, farming pools offer an innovative way for cryptocurrency holders to maximize their profits through staking and yield farming.

So, what are farming pools? In simple terms, farming pools are a collection of funds and tokens locked in a smart contract, which collectively generate rewards or profits for participants. These rewards are earned through various farming strategies, such as providing liquidity to decentralized exchanges, lending assets, or participating in liquidity mining programs.

One of the key advantages of farming pools is the ability to earn passive income from your cryptocurrency holdings. By depositing your tokens into a farming pool, you can earn a return on investment (ROI) in the form of additional tokens or fees. This can be a highly lucrative opportunity, especially considering the high Annual Percentage Yield (APY) offered by some farming pools.

Moreover, farming pools provide a level of diversification and risk hedging for investors. By pooling their assets with other participants, individuals can reduce the risk associated with individual investments and benefit from the combined growth potential of the pool. This can help mitigate the effects of market volatility and provide a more stable income stream.

Another benefit of farming pools is the ability to compound your earnings. With compounding, you can reinvest your rewards back into the pool, allowing your initial investment to grow exponentially over time. This compounding effect can significantly enhance your overall profits and accelerate your wealth accumulation.

Overall, farming pools offer a unique opportunity for cryptocurrency holders to maximize their profits in the rapidly evolving world of DeFi. By leveraging the power of smart contracts, blockchain technology, and innovative farming strategies, individuals can earn passive income, diversify their portfolio, and compound their earnings. Whether you are an experienced investor or a newcomer to the world of cryptocurrency, farming pools present a compelling option for earning and growing your wealth.

| Key Benefits of Farming Pools: |

| – Passive income through staking and yield farming |

| – High Annual Percentage Yield (APY) |

| – Risk diversification and hedging |

| – Compounding profits |

| – Access to innovative farming strategies |

| – Opportunities for maximizing profits and ROI |

Benefits of Investing in Farming Pools

Investing in farming pools can provide a number of benefits for individuals looking to maximize their blur farming profits:

- Maximize Earning Potential: Farming pools offer a unique opportunity to leverage the power of compound interest to earn higher APY (annual percentage yield) compared to traditional investment opportunities.

- Diversification and Risk Mitigation: By investing in different farming pools, individuals can spread their risk across various tokens and strategies. This helps to minimize the potential impact of market fluctuations and reduce the overall risk of the investment.

- Hedging Against Market Volatility: Farming pools provide a way to hedge against market volatility by earning rewards in the form of liquidity provider (LP) tokens. These tokens can be traded or used as collateral, providing an additional layer of protection against market downturns.

- Opportunity for Passive Income: Investing in farming pools allows individuals to earn passive income through token staking and yield farming. This means that individuals can earn additional tokens without actively participating in the market, creating a steady stream of income.

- Growth Potential: The blur farm and blockchain industry is rapidly growing, and by investing in farming pools, individuals can capitalize on this growth and potentially experience significant returns on their investment.

- Utilizing Smart Contracts: Farming pools are powered by smart contracts, which ensure that transactions are executed automatically and securely. This eliminates the need for intermediaries and provides a transparent and efficient investment process.

Overall, investing in farming pools offers a unique investment strategy that can help individuals maximize their blur farming profits while mitigating risks and taking advantage of the growth potential in the cryptocurrency market.

Strategies for Maximizing Blur Farming Profits

When it comes to maximizing farming profits, it is essential to leverage farming pools effectively. By harnessing the power of compound yields, farmers can maximize their profits and capitalize on the growth opportunities presented in the Blur market.

One important strategy is to diversify your investments across various farming pools. By spreading your tokens across different pools, you can reduce the risk associated with any single pool and ensure a more stable and consistent earning potential. Additionally, pooling your tokens in an aggregator platform can further maximize your profits by optimizing your yield and automatically compounding your rewards.

Another key strategy for maximizing Blur farming profits is to stay informed and updated with the latest innovations and trends in the cryptocurrency market. This includes staying updated with the latest farming APY rates, new farming pools, and emerging tokens. By staying ahead of the curve, farmers can identify new opportunities and make informed investment decisions.

Hedging is another important strategy for maximizing Blur farming profits. By engaging in hedging practices, farmers can protect their investments from potential market downturns or price volatility. This can be done through various techniques, such as staking your tokens in different pools or utilizing smart contracts to lock in profits at desired intervals.

Furthermore, leveraging the power of DeFi (Decentralized Finance) can also play a crucial role in maximizing Blur farming profits. DeFi platforms provide liquidity and enable farmers to earn additional rewards by staking their tokens in different liquidity pools. Additionally, DeFi platforms often come with innovative features and opportunities that can further enhance farming profits.

In conclusion, maximizing Blur farming profits requires a combination of strategies such as diversification, leveraging aggregator platforms, staying updated with market trends, hedging, and utilizing DeFi opportunities. By effectively implementing these strategies, farmers can maximize their profits, mitigate risks, and capitalize on the growth potential offered by blockchain-powered farming.

What is “Leveraging Farming Pools to Maximize Blur Farming Profits”?

“Leveraging Farming Pools to Maximize Blur Farming Profits” is a guide that provides strategies and tips on how to maximize profits in Blur farming through leveraging farming pools.

How can “Leveraging Farming Pools to Maximize Blur Farming Profits” help me increase my Blur farming profits?

“Leveraging Farming Pools to Maximize Blur Farming Profits” offers various techniques and strategies on how to effectively leverage farming pools to maximize your Blur farming profits. It covers topics such as selecting the right farming pools, managing risks, and optimizing yield farming strategies.

+ There are no comments

Add yours