Clear receipts are essential for both individuals and businesses when it comes to managing expenses and taxes. Whether you are an individual trying to keep track of your personal expenses or a business owner looking to claim deductions, maintaining clear receipts is crucial. These receipts serve as tangible and official evidence of transactions and can be used to prove the legitimacy of expenses for tax and audit purposes.

When it comes to taxes, clear receipts provide the necessary documentation to support deductions and minimize the risk of an audit. Without clear receipts, it becomes challenging to justify and defend certain expenses. The tax authorities require businesses to keep accurate and detailed records, and clear receipts play a vital role in fulfilling this obligation.

Moreover, clear receipts also help individuals and businesses manage their expenses more effectively. By keeping track of all receipts, you can easily review and categorize your expenses, allowing for better financial planning and budgeting. Clear receipts provide a clear breakdown of the items or services purchased, the date of purchase, and the amount paid, enabling you to identify areas where you can cut costs or optimize spending.

In addition, clear receipts are also important for reimbursement purposes. Many employers or organizations require proper documentation for reimbursement of expenses incurred by their employees. Having clear receipts ensures a smooth and efficient reimbursement process, preventing any misunderstandings or disputes.

In conclusion, clear receipts are not just pieces of paper. They are essential tools for managing expenses, claiming deductions, and maintaining financial records. Whether it is for tax purposes, expense management, or reimbursement, clear receipts play a crucial role in providing accurate and verifiable evidence of transactions. So, make it a habit to keep all your receipts organized and easily accessible to ensure smooth financial operations.

Benefits of clear receipts

Clear receipts are essential for various purposes, including tax and expense tracking. They provide a detailed record of transactions and serve as evidence of purchases made. Here are the key benefits of keeping clear receipts:

| Benefits | Description |

|---|---|

| Accurate Expense Tracking | Clear receipts help individuals and businesses accurately track their expenses. By keeping thorough records of purchases, it becomes easier to categorize and analyze expenses, ensuring that all deductible expenses are accounted for. |

| Tax Deductions | When it comes to filing taxes, clear receipts are invaluable. They provide proof of business expenses and allow individuals and businesses to claim deductions. Without proper documentation, it may be challenging to justify deductions and increase the risk of audits. |

| Business Reimbursements | For employees who need to submit expense reports for reimbursement, clear receipts are a must. Receipts serve as evidence of the expenditure and aid in determining the amount to be reimbursed. |

| Legal Compliance | Clear receipts are crucial for legal compliance purposes. They provide evidence of financial transactions and can be used as proof in case of audits, disputes, or investigations. |

| Budgeting and Financial Planning | Keeping clear receipts helps individuals and businesses better manage their finances. By analyzing spending patterns and identifying areas of expenditure, one can make informed decisions and create effective budgets and financial plans. |

As evident from the above benefits, clear receipts play a vital role in maintaining financial records, ensuring compliance, and maximizing deductions. It is crucial to store receipts in a organized manner, whether in physical form or electronically, to avoid any loss or confusion.

Accurate record keeping

Accurate record keeping is of utmost importance when it comes to tax and expense management. Clear receipts play a crucial role in maintaining accurate records, as they provide documented evidence of transactions and expenses.

By keeping clear and organized receipts, individuals and businesses can easily track and categorize their expenses, making it simpler to report them accurately during tax time. It also helps to avoid any potential disputes with tax authorities by providing transparent and verifiable documentation.

With accurate record keeping, individuals and businesses can ensure that they are claiming all eligible deductions and credits, minimizing their tax liability and potentially maximizing their refunds. Moreover, maintaining clear receipts allows individuals and businesses to keep track of their expenses throughout the year, helping them to budget effectively and identify areas where costs can be reduced.

In addition to tax purposes, accurate record keeping is also crucial for expense management. Clear receipts not only help businesses keep track of their expenses, but they also assist in evaluating the profitability of certain activities or projects. By having detailed records of expenses, businesses can analyze their spending patterns and make more informed decisions about where to allocate their resources.

Overall, accurate record keeping, supported by clear receipts, is essential for both individuals and businesses when it comes to tax and expense management. It helps them maintain transparency, comply with regulations, and make informed financial decisions.

Easy tax filing

Clear and organized receipts are essential for tax filing. Keeping track of your expenses throughout the year is important for several purposes, including tax deductions and reimbursements.

When it comes to tax filing, having clear receipts is crucial. A clear receipt provides proof of your expenses and ensures that you can accurately report them on your tax return. It also helps in case of an audit or if you need to substantiate the expenses in the future.

By keeping your receipts organized, you can easily identify deductible expenses and claim the appropriate deductions. This can help you maximize your tax savings and reduce your overall tax liability.

Furthermore, clear receipts make it easier to reconcile your expenses with your bank statements or credit card statements. This can be especially helpful if you rely on electronic payments for your business or personal expenses.

Overall, the importance of clear receipts for tax purposes cannot be overstated. By maintaining organized records of your expenses and keeping clear receipts, you can streamline your tax filing process and ensure that you are maximizing your tax benefits.

Efficient expense tracking

The importance of clear receipts for tax and expense purposes cannot be overstated.

Tracking expenses efficiently is crucial for both individuals and businesses. Clear receipts serve as documented proof of any transaction, making it easier to organize and categorize expenses.

By keeping track of receipts, individuals can accurately account for their tax deductions and stay on top of their financial responsibilities. In addition, businesses can properly allocate expenses and ensure compliance with tax regulations.

A well-organized system for expense tracking allows individuals and businesses to easily locate and retrieve receipts when needed. Storing receipts electronically or in physical files labeled by category and date can help streamline the process.

Regularly reviewing and reconciling receipts against bank and credit card statements is essential to identify any discrepancies or missing expenses. This ensures accurate financial records and can help prevent potential issues during tax audits or expense reimbursements.

Furthermore, efficient expense tracking can provide valuable insights into spending patterns and help identify areas where cost-saving measures can be implemented.

Overall, clear receipts and efficient expense tracking are crucial for individuals and businesses to maintain accurate financial records, comply with tax regulations, and make informed financial decisions.

Consequences of unclear or missing receipts

Clear and organized receipts are essential for tax and expense purposes. Unclear or missing receipts can have significant consequences and may lead to various issues.

One of the key consequences of unclear receipts is the potential for financial loss. If receipts are not clear or legible, it becomes difficult to accurately allocate expenses and determine the eligibility for tax deductions or reimbursements. Without proper documentation, individuals may lose out on potential savings or face unexpected financial burdens.

Furthermore, unclear receipts can also raise red flags during tax audits. Tax authorities may question the legitimacy of expenses and request additional evidence to support claims. If receipts are missing or unclear, individuals may face challenges in proving the validity of their deductions, leading to potential penalties or increased tax liabilities.

Missing or unclear receipts can also hinder the ability to track expenses and budget effectively. Without clear documentation, it becomes challenging to review spending patterns, identify areas for improvement, and make informed financial decisions. This lack of clarity can lead to financial inefficiencies and missed opportunities for optimization.

In addition to the financial consequences, unclear or missing receipts can also have legal implications. Businesses are often required by law to maintain proper records, and failure to do so can result in penalties and legal actions. Clear receipts serve as evidence for transactions and can help protect individuals and businesses in case of disputes or audits.

Overall, the importance of clear receipts cannot be overstated. They play a crucial role in ensuring financial accuracy, supporting tax deductions, and providing evidence in case of audits or legal matters. By prioritizing clear and organized receipts, individuals and businesses can avoid potential financial and legal consequences, and maintain proper financial management.

Inaccurate financial reporting

Accurate and clear receipts play a crucial role in ensuring precise financial reporting for tax and expense purposes. Inaccurate financial reporting can have serious consequences for individuals and businesses alike.

When receipts are not clear or missing, it becomes challenging to accurately record and categorize expenses. This can lead to errors in reporting, resulting in discrepancies in tax filings. Such inaccuracies can trigger audits, fines, and penalties from tax authorities.

Furthermore, inaccurate financial reporting can also impact the overall financial health and reputation of a business. Investors and stakeholders rely on accurate financial information to make informed decisions. If financial reports are not reliable due to unclear or missing receipts, it can erode trust and confidence in the business.

Additionally, inaccurate reporting can hinder expense control and budgeting efforts. Without clear receipts, it becomes difficult to track spending patterns and identify areas where costs can be reduced. This can significantly impact the financial stability and profitability of both individuals and businesses.

To avoid inaccurate financial reporting, it is essential to prioritize the collection and retention of clear receipts for tax and expense purposes. This means ensuring that all receipts are legible, contain necessary details such as date, vendor name, items purchased, and amounts paid. Implementing efficient systems for receipt organization and storage can help streamline the reporting process and mitigate any potential inaccuracies.

In conclusion, clear receipts are of paramount importance when it comes to accurate financial reporting for tax and expense purposes. Inaccurate reporting can lead to severe consequences, including legal issues, financial penalties, and damage to the reputation of individuals and businesses. By prioritizing clear receipts, organizations can ensure transparency, reliability, and compliance in their financial reporting processes, ultimately fostering trust and financial stability.

Increased risk of audit

Properly documenting and keeping clear receipts for tax and expense purposes is of utmost importance. Failing to provide adequate records can trigger an increased risk of audit from tax authorities.

When tax authorities conduct an audit, they typically scrutinize the documentation provided in order to verify the accuracy of reported expenses and deductions. Clear receipts serve as tangible proof of the legitimacy of these claims. Without them, taxpayers may face difficulties in substantiating their claims and may be subjected to additional scrutiny.

Receipts play a critical role in supporting various tax-related deductions, such as business expenses, charitable contributions, and healthcare costs. In the absence of clear receipts, individuals and businesses may find themselves unable to justify their claims and may face potential tax penalties and interest.

Additionally, keeping clear receipts helps in maintaining accurate expense records. This is particularly important for businesses, as it allows them to track their expenses, manage their finances effectively, and make informed decisions based on their spending patterns. Clear receipts also enable businesses to defend their expense deductions during audits and maintain a good standing with tax authorities.

In conclusion, the importance of clear receipts for tax and expense purposes cannot be overstated. They provide evidence of legitimate claims, reduce the risk of audits, and help individuals and businesses maintain accurate financial records. Therefore, it is crucial to keep track of receipts and ensure their clarity to avoid any potential issues with tax authorities.

Missed tax deductions

Clear receipts are of utmost importance when it comes to tax and expense purposes. Without proper receipts, individuals run the risk of missing out on valuable tax deductions. These deductions can help individuals reduce their taxable income and ultimately lower their tax liability.

For example, if someone owns a small business and fails to keep clear receipts of their business expenses, they may miss out on deducting those expenses from their taxable income. This can result in a larger tax bill and less money in their pocket.

Additionally, without clear receipts, individuals may also miss out on deductions related to specific items or services. For instance, if someone fails to keep track of their medical expenses with clear receipts, they may lose the opportunity to deduct these expenses and save money on their taxes.

It is important to note that the tax authorities require clear receipts as proof of expenses, especially for larger deductions. Without these receipts, it becomes difficult to justify the deductions claimed on the tax return, which can trigger audits and potential penalties.

In conclusion, clear receipts play a crucial role in tax and expense management. They help individuals accurately track their expenses and ensure that they claim all eligible deductions. So, it is essential to keep clear receipts and maintain proper documentation to avoid missed tax deductions and potential consequences.

Why is it important to keep clear receipts for tax and expense purposes?

Keeping clear receipts is crucial for tax and expense purposes because they serve as proof of your financial transactions. They can help you accurately record your income, claim deductions, and comply with tax regulations. In case of an audit, having clear receipts makes it easier to provide evidence of your expenses and support your claims.

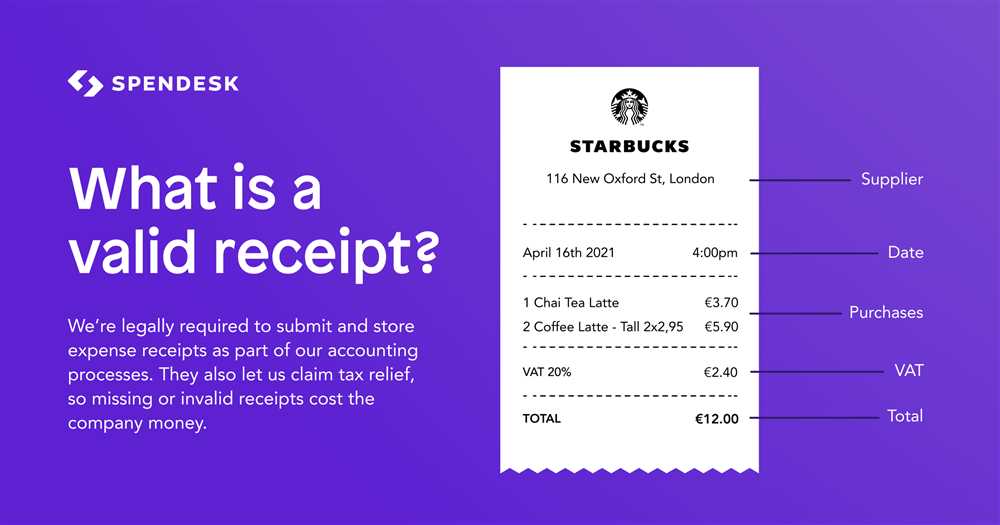

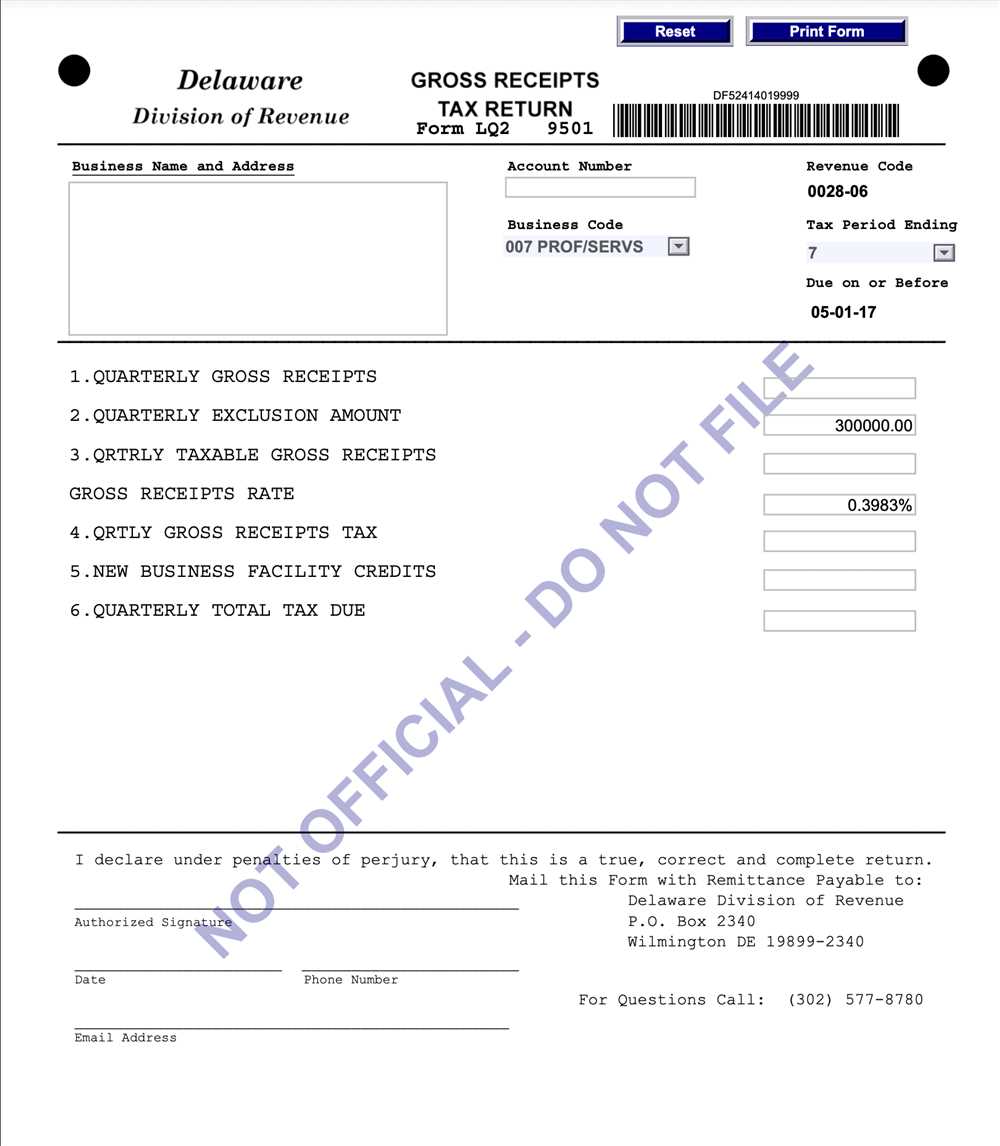

What information should be included on a receipt for tax and expense purposes?

A receipt for tax and expense purposes should include important details such as the date of transaction, the name and address of the seller or service provider, a description of the items or services purchased, the amount paid, and any applicable taxes. It is also helpful to have a receipt number and the payment method mentioned.

How long should I keep my receipts for tax and expense purposes?

It is generally recommended to keep your receipts for tax and expense purposes for a minimum of three to seven years. The specific duration may vary depending on local tax regulations or personal circumstances. By keeping your receipts for the recommended period, you can ensure that you have the necessary documentation in case of an audit or if you need to refer back to your expenses.

Can I use digital receipts for tax and expense purposes?

Yes, you can use digital receipts for tax and expense purposes, provided they contain all the necessary information mentioned earlier. Make sure that the digital receipts are easily accessible, securely stored, and can be printed if needed. Many countries have accepted digital receipts as valid proof for tax purposes, but it is advisable to check the regulations specific to your location.

What are the consequences of not keeping clear receipts for tax and expense purposes?

Not keeping clear receipts for tax and expense purposes can have several negative consequences. Firstly, you may miss out on claiming deductions and benefits that you are entitled to, resulting in a higher tax liability. Additionally, if you are audited and cannot provide proper documentation, you may face penalties, fines, or even legal consequences. By keeping clear receipts, you can mitigate these risks and ensure compliance with tax regulations.

+ There are no comments

Add yours