Decentralized marketplaces have revolutionized the way we trade and invest in digital assets, and the emergence of Non-Fungible Tokens (NFTs) has taken the cryptocurrency market by storm. Opensea and Blur are two prominent platforms in this new era of NFT trading, each offering unique features and benefits. In this article, we will analyze the fees and costs associated with trading NFTs on Opensea and Blur, and explore the factors that can affect the profitability of such investments.

Gas fees are a significant aspect of NFT trading, as every transaction on the Ethereum blockchain incurs a certain amount of gas fees. Opensea, being a decentralized marketplace, is subject to these fees, which can vary depending on market trends and congestion. On the other hand, Blur is a relatively newer platform that claims to have lower gas fees due to its optimized smart contract structure. This fee comparison is an essential factor for investors, as high gas fees can eat into the profitability of NFT transactions.

Another critical aspect to consider is the evaluation and costs associated with the NFTs themselves. Opensea provides a wide range of collectibles, including digital artwork and virtual assets, whereas Blur focuses on digital art and limited edition NFTs. Both platforms offer auctions where users can bid on items, and the final price includes platform fees. Opensea has gained popularity due to its extensive marketplace, while Blur has carved a niche by focusing on unique and exclusive artworks.

Furthermore, the comparison between a centralized and decentralized platform plays a crucial role. Opensea, as a decentralized marketplace, is built on the Ethereum blockchain, providing transparency and security through smart contracts. On the other hand, Blur offers a centralized approach, allowing for faster transactions but potentially sacrificing some elements of decentralization. This trade-off of platform structure can significantly impact users’ preferences and their perception of the marketplace.

In conclusion, understanding the fees and costs associated with NFT trading on Opensea and Blur is essential for investors looking to maximize their profitability. Gas fees and evaluation of NFTs play a crucial role in determining the overall costs of a transaction, while the platform structure can impact factors such as security and decentralization. By analyzing these factors, investors can make informed decisions about their NFT investments and navigate the ever-evolving world of digital collectibles.

Overview

Artwork has been a popular form of investment for centuries, but the rise of NFTs (non-fungible tokens) has revolutionized the way art is bought and sold. NFTs are unique digital assets that are stored on the blockchain, using smart contracts to guarantee their authenticity and ownership.

When analyzing the profitability of NFT trading, it is crucial to consider the fees and costs associated with the process. Opensea and Blur are two platforms that facilitate NFT trading, each with its own fee structure and marketplace.

Opensea is a decentralized marketplace built on the Ethereum blockchain. It allows users to buy, sell, and trade NFTs, including digital art, collectibles, and more. Opensea charges gas fees for each transaction, which can fluctuate depending on the current state of the Ethereum network. Additionally, Opensea takes a small percentage of the final sale price as a fee.

Blur, on the other hand, is a centralized platform that aims to simplify the NFT buying and selling process. Blur charges a flat fee for each listing, regardless of the final sale price. This can be more cost-effective for users who are transacting higher-value NFTs, as they will not be subject to higher percentage-based fees.

When comparing Opensea and Blur, it is important to consider market trends and evaluate the potential profitability of different NFTs. The costs associated with each platform, such as gas fees on Opensea or listing fees on Blur, should be factored into the overall investment decision.

Overall, both Opensea and Blur provide opportunities for individuals to participate in the booming NFT market. A thorough analysis of fees and costs, alongside market research and evaluation of individual NFTs, is crucial for making informed trading decisions in this rapidly evolving space.

Understanding NFTs

Blockchain technology has revolutionized the way we think about trading and transactions. One of the most exciting applications of this technology is the creation and trading of non-fungible tokens (NFTs). NFTs are unique digital assets that can represent ownership of various items such as artwork, collectibles, and even virtual real estate.

Opensea and Blur are two popular platforms for evaluating and trading NFTs. Opensea is a decentralized marketplace built on the Ethereum blockchain, while Blur is a centralized platform that offers a more curated selection of NFTs.

One of the key factors to consider when trading NFTs is the transaction costs. This includes gas fees, which are the costs associated with processing transactions on the Ethereum network. Gas fees can vary significantly depending on market trends and the complexity of smart contracts.

Investing in NFTs can be a profitable venture, but it’s important to carefully evaluate the costs involved. This includes not only the initial purchase price of the NFT, but also any additional fees for listing or auctioning the artwork.

Another important aspect of NFT trading is the issue of ownership. NFTs offer a unique way to prove ownership of digital assets, as each token is linked to a specific piece of artwork or collectible. This provides a level of authenticity and verification that is often lacking in the digital world.

When comparing Opensea and Blur, it’s important to consider the advantages and disadvantages of each platform. Opensea offers a larger selection of NFTs and a more decentralized approach, while Blur provides a more curated experience and a higher level of curation.

Overall, NFTs are a fascinating and rapidly evolving market. As with any investment, it’s important to carefully consider the costs and risks involved before diving in. By understanding the fundamentals of NFTs and staying informed about market trends, investors can make informed decisions about their NFT portfolio.

Importance of Fees and Costs

When it comes to cryptocurrency trading, analyzing fees and costs is crucial. This is especially true in the case of NFT trading, where ownership of digital assets is recorded on the blockchain.

Platforms such as Opensea and Blur provide users with the opportunity to buy and sell NFTs through their auction and marketplace systems. However, each platform has its own fee structure and cost breakdown that traders need to consider before making a transaction.

One of the main costs associated with NFT trading is the gas fees required to complete a transaction on the Ethereum blockchain. Gas fees are the charges for executing smart contracts and interacting with the blockchain. They can vary greatly depending on network congestion and market trends.

Opensea, as a centralized marketplace, charges a variety of fees to its users. These include a 2.5% commission fee on primary sales, a gas fee paid by the buyer, and additional fees for featured listings and store creation. Traders must take these fees into account when determining the profitability of their investment.

In contrast, Blur is a decentralized auction platform that aims to reduce transaction costs for NFT traders. It operates on its own token, the BLUR token, which eliminates the need for gas fees. This can significantly reduce costs for buyers and sellers, making Blur an attractive option for those looking to minimize fees.

Aside from the specific fees charged by each platform, traders should also consider the overall costs associated with NFT trading. This includes the initial investment in collectibles, the cost of listing and promoting artwork, and the potential for inflation affecting the value of digital assets. These costs can impact the profitability of NFT trading and should be carefully evaluated.

In conclusion, fees and costs play a vital role in NFT trading. Platforms like Opensea and Blur offer different fee structures and cost breakdowns, allowing traders to choose based on their priorities. However, it is essential to consider not only the platform fees but also the overall costs associated with NFT trading, as they can impact the profitability and success of investments in the digital art market.

| Platform | Fees | Gas Fees | Additional Costs |

|---|---|---|---|

| Opensea | 2.5% commission fee | Paid by buyer | Featured listings, store creation |

| Blur | No gas fees | N/A | BLUR token usage |

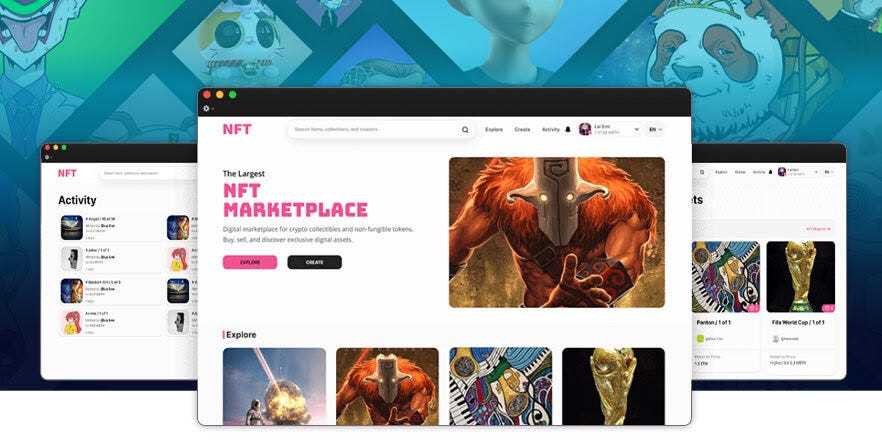

Opensea: The Leading NFT Marketplace

Opensea is widely recognized as one of the leading NFT marketplaces in the cryptocurrency industry. It offers a platform for the trading and selling of digital assets known as non-fungible tokens (NFTs). These tokens are unique digital assets that can represent various types of artwork, collectibles, and other digital items.

Opensea operates on the blockchain technology, specifically utilizing smart contracts, to enable secure and transparent transactions. The platform provides a decentralized marketplace where users can buy, sell, and trade NFTs without the need for intermediaries or centralized authorities.

One of the advantages of Opensea is its wide range of NFTs available for purchase. The marketplace supports various categories, including digital artwork, virtual land, domain names, game items, and more. This diversity allows users to explore different market trends and find investment opportunities that match their interests.

Opensea also provides tools for evaluating the profitability of NFT trading. Users can analyze historical data, transaction history, and ownership records of specific tokens to make informed decisions about their investments. This information is valuable for both buyers and sellers when evaluating the market value of an NFT.

When trading on Opensea, users should be aware of the costs associated with each transaction. These costs include gas fees, which are the fees paid to miners to process and validate transactions on the Ethereum blockchain. Gas fees can vary depending on network congestion and the complexity of the transaction.

In addition to gas fees, Opensea charges a small fee for each transaction that occurs on the platform. This fee is used to support the development and maintenance of the marketplace, ensuring a smooth trading experience for users.

Overall, Opensea offers a robust and reliable platform for NFT trading. It combines the benefits of a decentralized marketplace with the convenience of a centralized platform. With its wide range of NFT categories, analyzing market trends, and evaluating the profitability of investments, Opensea continues to be the go-to marketplace for NFT enthusiasts and collectors.

Transaction Fees on Opensea

One of the key aspects of NFT trading is the evaluation of transaction fees. When participating in the NFT market, users need to consider the costs associated with buying, selling, and transferring ownership of digital collectibles.

Opensea is a popular NFT marketplace built on the Ethereum blockchain. As a decentralized platform, Opensea utilizes smart contracts to facilitate the trading of digital artwork, tokens, and other collectibles.

When conducting transactions on Opensea, users have to pay certain fees. These fees are commonly known as “gas fees” and are required to cover the computational resources needed to execute the transaction on the Ethereum network.

Compared to traditional auction markets, the fees on Opensea can vary depending on the current market trends and the size of the transaction. Gas fees can be influenced by factors such as the demand for NFTs, the number of users on the platform, and the congestion on the Ethereum network.

It is important for users to consider these transaction costs when trading on Opensea, as they can significantly impact the profitability of their investment. High transaction fees may reduce the potential returns on an artwork or collectible, especially if the initial cost of the item is relatively low.

While Opensea provides a wide range of opportunities for NFT trading, users should also be aware of the possible risks and inflationary pressures related to the platform. The popularity of NFTs has led to an influx of new users and increased competition, potentially driving up the costs of transactions and the value of certain assets.

Overall, when analyzing the costs of NFT trading on Opensea, it is crucial to carefully evaluate the transaction fees and consider the potential risks and benefits of participating in this decentralized marketplace.

Listing Fees on Opensea

When it comes to trading NFTs on Opensea, one of the key factors to consider is the listing fees. These fees refer to the cost associated with listing your digital collectibles or artworks on the platform for potential buyers to discover and purchase.

Opensea, being a decentralized marketplace built on the Ethereum blockchain, utilizes smart contracts for trading and ownership verification. This means that each transaction requires a certain amount of gas fees to be paid to miners for processing and validating the transactions on the network.

The listing fees on Opensea are primarily determined by the gas fees required to execute the transaction. Gas fees can fluctuate depending on the network congestion and market trends, resulting in varying costs for listing your NFTs. It’s important to carefully evaluate the current gas fees and consider the potential profitability of your investment before listing your artwork or digital collectibles.

When comparing Opensea to Blur, a centralized platform for NFT trading, one key difference is the listing fees. As Blur operates on a centralized infrastructure, it may charge additional fees for the convenience and services it provides. This factor should be taken into account when choosing between the two platforms.

In addition to listing fees, Opensea also takes a small percentage fee, usually around 2.5% of the final sale price, for each successful auction or direct sale. This fee is designed to support the maintenance and development of the platform, ensuring a seamless trading experience for both buyers and sellers.

Overall, the listing fees on Opensea are dependent on gas fees and should be considered in your evaluation of the costs associated with trading NFTs. Being a decentralized marketplace, Opensea offers a transparent and secure environment for NFT trading, allowing collectors and artists to connect directly without intermediaries. However, it’s essential to stay informed about gas fees and market trends to make informed decisions and optimize your trading strategy on Opensea.

Gas Fees on Opensea

Opensea is a renowned platform in the digital collectibles market, enabling users to trade various types of NFTs (non-fungible tokens). However, one significant factor that traders need to consider before engaging with Opensea is the gas fees.

In Ethereum blockchain, gas fees refer to the transaction costs required to execute operations on the network. Gas fees are paid in ETH, which is the native token of the Ethereum platform. These fees are essential to incentivize miners to process transactions and maintain the network’s security.

Opensea operates on the Ethereum blockchain, which means that users need to pay gas fees for every transaction they make on the platform. Gas fees can vary depending on the market trends, such as network congestion and the complexity of the smart contracts involved in the transaction.

Gas fees can significantly impact the profitability and investment potential of trading NFTs on Opensea. Traders need to carefully analyze the gas fees before making any purchase or sale on the platform. High gas fees can eat into the potential profits or make an investment less lucrative.

A comparison between Opensea and Blur.io can provide insights into the gas fees dynamics. While Opensea is a centralized marketplace, Blur.io is a decentralized trading platform that focuses on reducing gas fees for NFT transactions. At Blur.io, the gas fees are optimized to provide a more cost-effective trading experience for users.

Despite the gas fees associated with Opensea, the platform offers several advantages, such as a larger user base and a wide variety of artwork and collectibles. Traders need to weigh the advantages against the gas fees to determine the overall profitability of their NFT trading on Opensea.

In conclusion, gas fees play a crucial role in the cost of trading NFTs on Opensea. Traders should closely monitor the gas fees and compare them with other platforms like Blur.io to make informed decisions regarding the ownership, auction, and trading of NFTs. Analyzing the fees and costs of gas fees is essential to ensure the sustainability and profitability of NFT investments in a rapidly growing market.

Blur: The New Player in NFT Trading

Blur is a new platform that has entered the NFT trading market, aiming to provide an alternative to the well-established marketplace, Opensea. With the rising popularity of digital collectibles and the surging demand for NFTs, Blur aims to offer a decentralized trading platform that addresses some of the challenges and drawbacks that users face on Opensea.

One of the main concerns when trading NFTs on Opensea is the gas fees associated with each transaction. Gas fees are the costs incurred for executing smart contracts on the Ethereum blockchain. As the popularity of NFTs increases, gas fees have also skyrocketed, making it expensive for users to buy, sell, or list their digital artwork on Opensea.

Blur is evaluating the existing market trends and analyzing the costs and profitability of NFT trading. By introducing their token, Blur aims to create a more cost-effective trading environment, reducing the gas fees and offering competitive fees for users. This can significantly enhance the profitability of owning and trading NFTs on their platform.

Additionally, Blur takes a unique approach to ownership and investment in NFTs. While Opensea operates as a centralized marketplace, Blur aims to create a decentralized platform where the ownership and transaction records are stored on the blockchain. This ensures transparency, security, and eliminates the risk of fraudulent activities that can occur on centralized platforms.

By focusing on the decentralized aspect, Blur aims to attract artists, collectors, and traders who value the integrity and authenticity of the digital art market. They provide artists with the opportunity to auction their artworks directly to collectors, empowering creators to have more control over their work and the value it holds.

Moreover, Blur intends to address the issue of inflation in the NFT market. As NFTs become more popular, the market becomes flooded with various tokens, leading to a potential decrease in the value of collectibles. Blur aims to curate and select high-quality artwork, ensuring that the market remains sustainable and the value of the artwork holds over time.

In conclusion, with the emergence of Blur in the NFT trading market, users now have an alternative platform to consider. By addressing the issues of gas fees, ownership, and market trends, Blur offers a unique and decentralized trading experience for artists, collectors, and traders in the ever-growing world of digital collectibles.

What is Opensea?

Opensea is a popular online marketplace for buying and selling non-fungible tokens (NFTs), which are unique digital assets stored on the blockchain. It offers a wide range of NFTs, including art, gaming items, virtual real estate, and more.

What is Blur Analyzing?

Blur Analyzing is a platform that provides data and analytics on the fees and costs associated with NFT trading. It analyzes various NFT marketplaces, including Opensea, to provide insights into the fees charged by these platforms and the costs associated with selling and buying NFTs.

+ There are no comments

Add yours